Sustainability-aligned investments worth $44 bil, FY2024 emissions below baseline: Temasek’s first sustainability report

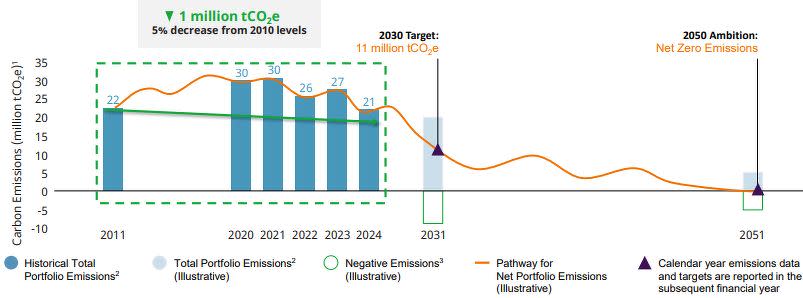

Temasek’s total portfolio emissions fell some 6 million tonnes of carbon dioxide equivalent (tCO2e) to 21 million tCO2e in FY2024.

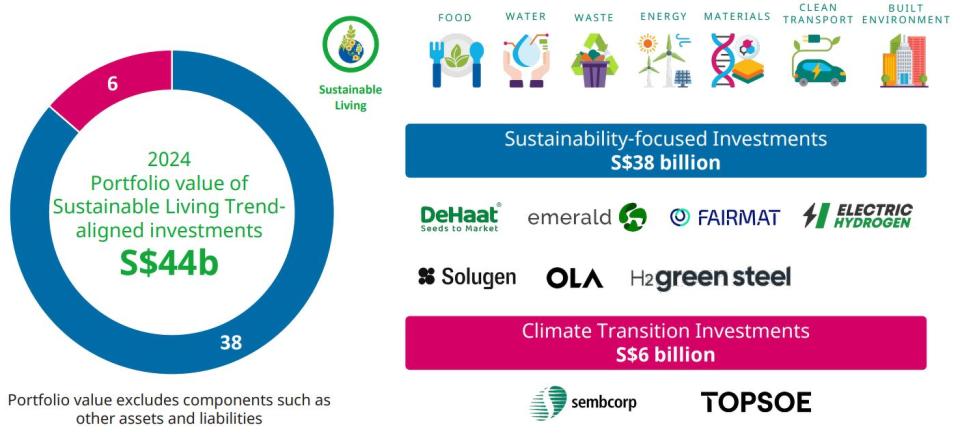

Temasek Holdings’ portfolio value of investments aligned with “sustainable living” reached $44 billion as at March 31 — the first time this figure has been made public.

Of this figure, $38 billion was in “sustainability-focused investments”, like sustainable chemicals company Solugen; and $6 billion was in “climate transition investments”, like Mainboard-listed Sembcorp Industries U96, says the Singapore-headquartered investment firm on July 9.

However, Temasek is unable to state the prior year’s figures, owing to a “reclassification of selected portfolio companies” into the sustainable living trend as at March 31.

Speaking to the media at a briefing on July 5, Temasek International’s chief investment officer Rohit Sipahimalani says investments into sustainable living have been “steadily increasing”. “It used to be the smallest part of our portfolio; but it’s the fastest-growing.”

Sustainable living is one of four structural trends Temasek identified in 2016, alongside digitisation, future of consumption and longer lifespans. Since then, the share of investments aligned with sustainable investing has increased from less than 1% of Temasek’s total portfolio value to 12% as at March 31, owing to the reclassification.

That said, this 12% share of Temasek’s total portfolio is inclusive of institutional assets and liabilities. With Temasek ending the financial year in a net cash position, this figure is higher than the $44 billion portfolio value figure, which is net of those items.

At the launch of Temasek’s report on July 9, Temasek International’s chief financial officer Png Chin Yee says the media “should not worry about the technical definitions”. Following a change in taxonomy, the proportion has increased from 5% in FY2023 to 12% in FY2024.

However, a Temasek spokesperson clarifies that these figures are “not comparable”, again due to the recent reclassification. In the latest financial year, Temasek took into consideration emerging sustainable taxonomies, such as the EU Taxonomy and Singapore-Asia Taxonomy; and climate transition frameworks like the Glasgow Financial Alliance for Net Zero (GFANZ) Net Zero Transition Plan, Asean Transition Finance Guidance and International Capital Market Association (ICMA) Climate Transition Handbook. Temasek says it also benchmarked this against industry peer practices.

Temasek deployed $3 billion into investments aligned to the sustainable living trend in FY2024 ended March 31. These investments include electric vehicle companies Mahindra Electric Automobile in India and BYD in China, sustainable battery solutions provider Ascend Elements in the US and electrolyser manufacturer Electric Hydrogen in the US.

In May, Temasek partnered Canadian alternative investment manager Brookfield to invest in Neoen, a France-based global renewable energy company.

This is the first time Temasek has issued a separate sustainability report alongside its annual report on its performance. For FY2024, Temasek reported a net portfolio value of $389 billion, up $7 billion y-o-y. Temasek’s one-year total shareholder return (TSR) was 1.60%, while the group’s 20-year and 10-year TSRs stood at 7% and 6% as at March 31.

Emissions from Sembcorp, SIA

Over the financial year, Temasek’s total portfolio emissions fell some 6 million tonnes of carbon dioxide equivalent (tCO2e) to 21 million tCO2e as at March 31. This figure reflects Scope 1 and 2 absolute emissions associated with its investment portfolio, and excludes private equity and credit funds.

In another first for Temasek, its total portfolio emissions for a financial year has fallen below the 22 million tCO2e it logged in FY2011, its baseline year. The firm announced in 2019 plans to reach net zero by FY2051, with an interim target to halve emissions from FY2011 to 11 million tCO2e by FY2031.

Temasek attributed the overall decrease in carbon emissions during the financial year to portfolio company Sembcorp Industries’ sale of Sembcorp Energy India Limited (SEIL). Since the sale was completed in January 2023, the proportional emissions of SEIL are accounted for under Sembcorp’s Scope 3 emissions, and are not included in Temasek’s total portfolio emissions.

The transaction has faced greenwashing allegations, as Sembcorp provided as part of the deal a “deferred payment note” to the purchasers, an Oman-led consortium. This essentially eliminated the emissions associated with the coal plant from Sembcorp’s books while it continues to receive interest as a lender.

Sipahimalani notes y-o-y fluctuations in emissions that are charting a decline. “We set our goals in FY2020, when we were at 30 million tCO2e, we’re now at 21 [million tCO2e]. Yes, Sembcorp has contributed to that. But even excluding Sembcorp, the rest of the portfolio has reduced absolute emissions over this period, even as the portfolio has grown significantly.”

Franziska Zimmermann, Temasek International’s director of sustainability and climate change strategy, says Temasek does not control the operational decisions of its portfolio companies, but she also does not think Sembcorp’s financing model will be replicated “across the board”. “It’s the nature of transactions that every transaction will have its own conditionalities, will have its own reflections and considerations. We should also be open-minded about how companies are executing on their strategy and the tools that they use in order to get the job done.”

Park Kyung-Ah, Temasek International’s head of ESG investment management and managing director of sustainability, points to certain conditions set by Sembcorp, such as technical advisory services and a variable interest reduction that is tied to SEIL reducing the emissions intensity of its operations.

“I’ve been pretty much a lifelong sustainability person; I deeply care about this,” says Park, dialling in from the US. “The reality is, it is quite challenging. It’s not quite as plain vanilla [as] to say that we’re just going to pull the plug on a coal facility and shut it down, given that there are significant energy, affordability, accessibility and reliability requirements, particularly when it comes to fast-growing economies and emerging markets like India.”

Apart from Sembcorp, Temasek says its other portfolio companies are cutting emissions through their decarbonisation efforts. However, these decreases were moderated by an increase in emissions from Singapore Airlines C6l (SIA) last year “as global air travel continued to resume post-pandemic”. As at June 5, Temasek holds a 22.1% stake in SIA.

SIA’s Scope 1 and 2 emissions grew 18.1% y-o-y to some 15 million tCO2e for the financial year ended March 31, according to its latest sustainability report. The airline’s emissions have nearly quadrupled since the outbreak of Covid-19 — it reported Scope 1 and 2 emissions of just under 4 million tCO2e for FY2021 ended March 31, 2021. That said, the emissions logged in its latest financial year are still below the pre-pandemic level of 16.3 million tCO2e seen in FY2020 ended March 31, 2020.

Internal carbon price

Temasek also hiked its internal carbon price to US$65/tCO2e ($87.73/tCO2e) on April 1. This is up from US$50/tCO2e in FY2023 and FY2024 and US$42/tCO2e prior. The investment firm “anticipates” that this figure will reach US$100/tCO2e by 2030 “to better assess the potential climate impact” of each investment.

Sipahimalani says Temasek reviews its internal carbon price every two years, and even the 2030 target could be raised or lowered based on “forward-looking estimates”.

The internal carbon price is an “actual cost to us”, he adds — one that is tied to incentive schemes for Temasek’s management and staff.

“What we do every year is that if we have returns [on] our cost of capital, there are incentives that are available to management. From that incentive pool, we will deduct the carbon footprint of our portfolio, multiplied by a carbon price. Only that net amount, or a portion of that, is available for distribution. And whatever is deducted, is then deferred to be distributed only when we achieve our goals for 2030,” says Sipahimalani.

Photos and charts: Temasek

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

96% of S’pore listcos have started climate reporting, up from 65% in FY2022: EY

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance