Samsara Inc. (IOT) to Report Q1 Earnings: What's in the Cards?

Samsara Inc. IOT is scheduled to report first-quarter fiscal 2025 results on Jun 6.

For the fiscal first quarter, Samsara expects revenues in the range of $271-$273 million, suggesting 33-34% year-over-year growth.

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $272.51 million, indicating a rise of 33.37% from the figure reported in the year-ago quarter.

The consensus estimate for fiscal first-quarter earnings is pegged at 1 cent per share against a loss of 2 cents reported in the year-ago quarter. The consensus estimate for earnings has been stable in the past 30 days.

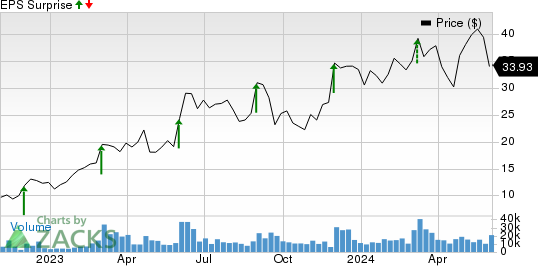

Samsara Inc. Price and EPS Surprise

Samsara Inc. price-eps-surprise | Samsara Inc. Quote

Samsara’s earnings beat the Zacks Consensus Estimate in the last four quarters. The company has a trailing four-quarter earnings surprise of 135.83% on average.

Let’s see how things have shaped up for Samsara prior to this announcement:

Factors to Note

Samsara’s fiscal first quarter is likely to have benefited from the strength of its diversified portfolio offerings and continued expansion of its customer base, particularly large enterprise customers.

With a robust fiscal fourth-quarter performance highlighted by an Annual Recurring Revenue (ARR) of $1.1 billion and 39% year-over-year growth, Samsara is well-positioned to leverage its portfolio strength and a growing customer base, particularly in the large enterprise in the to-be-reported quarter.

The company has been successful in landing new customers and expanding existing customer relationships. Samsara added a quarterly record number of core and large customers in fourth-quarter fiscal 2024, including two $1 million-plus new logos and six $1 million-plus expansion deals.

Samsara’s growing customer momentum, particularly in industries such as transportation, construction and the public sector, is expected to have contributed to its revenue growth in the first quarter.

The introduction of new products like the Connected Forms application, which streamlines workflows through digital forms, is anticipated to showcase the strength of IOT’s portfolio in the first quarter.

Samsara is expected to have witnessed strong growth and adoption of its video-based safety, vehicle telematics, and equipment monitoring products. The company has empowered United Natural Foods UNFI to drive sustainability and safety advancements across its extensive operations like fleet management on the back of these solutions.

In April, Samsara announced that United Natural Foods chose Samsara to drive sustainability and safety progress by adopting its Vehicle Telematics, Asset Gateways, Environmental Monitors and Video-Based Safety solutions.

IOT’s expansion into international markets, with notable success in regions such as Mexico and Europe, is expected to have bolstered its performance during the first quarter.

What Our Model Indicates

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that's not the case here.

Samsara has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Micron Technology MU has an Earnings ESP of +5.22% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology’s shares have increased 46.5% year to date. MU is set to report third-quarter fiscal 2024 results on Jun 26.

Broadcom AVGO has an Earnings ESP of +3.66% and a Zacks Rank #3.

Broadcom’s shares have rallied 19% year to date. AVGO is scheduled to release second-quarter fiscal 2024 results on Jun 12.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Samsara Inc. (IOT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance