Rio Tinto (RIO) Renews Agreement for QMM Mine in Madagascar

Rio Tinto plc RIO has renewed its fiscal arrangements pertaining to QIT Madagascar Minerals (QMM) with the government of Madagascar. They have also renewed their long-term partnership for the sustainable operation of the QMM mine.

Rio Tinto has an 80% stake in QIT Madagascar Minerals and the balance 20% is held by the government of Madagascar. The mine, located near Fort Dauphin in the Anosy region of south-eastern Madagascar, produces ilmenite. Ilmenite yields titanium dioxide, an ultra-white pigment used for paints, papers, cosmetics, food, and other products.

Zircon, one of the by-products from the mine, has a significant role in the construction and production of ceramic tiles, television screens, and computer monitors. Monazite, which is originally a waste product, has been repurposed in the process to be used in the creation of camera lenses, smartphones, and EV batteries.

In 1998, Rio Tinto and the government of Madagascar had signed the Framework Agreement. Over the past 25 years, Rio Tinto has invested $1 billion in QMM. While the Framework Agreement remains in place for the total span of QMM’s mining activities, the financial component was subject to renegotiation after 25 years.

As per the terms of the renewed agreement, the royalty rate will henceforth be 2.5%, higher than the previous rate of 2%. QMM will issue its first dividend to the government of Madagascar in 2023. An amount equivalent to the $12 million dividend will be invested by the government in the 109 km rehabilitation project of the National Road 13. Rio Tinto’s contribution toward the road project will run up to $8 million, subject to predefined milestones and deadlines. By facilitating the movement of people and critical supplies to hard-to-access areas, the project is expected to aid the region’s improvement.

Rio Tinto has also agreed to cancel $77 million in advances made to the government of Madagascar to finance the funding of QMM. The state will now hold a 15% free carry ownership of QMM and maintain its 20% voting right, with no obligation to contribute to capital funding or exposure to dilution.

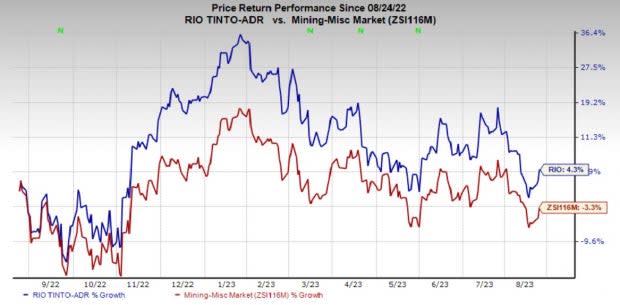

Price Performance

In the past year, shares of Rio Tinto have gained 4.3% against the industry’s 3.3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Rio Tinto currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, PPG Industries, Inc. PPG and L.B. Foster Company FSTR. HWKN sports a Zacks Rank #1 (Strong Buy) at present, and PPG and FSTR carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares have gained 35.7% in the last year.

The Zacks Consensus Estimate for PPG Industries’ fiscal 2023 earnings per share is pegged at $7.47, indicating growth of 23.5% from the prior-year actual. Earnings estimates have moved 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 4.3%. PPG’s shares have gained 9.7% in the past year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares have gained 30.2% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance