Should The Recent String Of F&B Business Closures Like Just Dough, A Mantou Bakery, Worry More Than Just Foodies?

Whether you trawl on popular food sites or stumble upon them randomly in your social media feeds, chances are you’ve read about a food business shutting down in each of the past few months. The latest casualty is a popular mantou (steamed bun) bakery, Just Dough, which has been in operation for the past 7 years, since April 2016.

For foodies, this may come as another dismaying piece of news to digest, but more importantly, it could have implications for not just the F&B industry but for our overall economy as well.

The food services industry, which was particularly hard hit during the COVID-19 pandemic, contributed $4 billion to Singapore’s economy and employed 220,300 workers in 2021. It got a boost on 13 February 2023 as Singapore relaxed its safe management measures, including the group size limits. This contributed to the F&B services industry growing by 15.1% on a year-on-year basis in April 2023 at an estimated sales value of $946 million.

Despite the encouraging numbers and signs of recovery, many global and local issues continue to plague F&B businesses, affecting some more than others. For instance, Just Dough Café mentioned “challenging manpower issues and cost inflation” as reasons for their closure on 1 July 2023.

Cost Inflation Reduced Profit Margins

With inflation staying at an elevated level of 4.7% in May 2023, F&B businesses have to deal with higher costs of production, from raw materials to running expenses like electricity and waste management fees.

The prolonged war between Russia and Ukraine has disrupted supply chains around the world with an increase in the prices of commodities including fertilisers, food products, and oil & gas. This has led to food inflation rising to 6.8% year-on-year.

Despite the higher costs, Just Dough generally maintained the selling price of their mantou buns at under $3, similar to their 2018 pricing. While we may assume a price increase is justified, for some businesses, it may not be straightforward. They may hesitate for fear that any price increase may alienate their long-term customers or push consumers to competitors.

This might have led to a lower profit margin, making the business less competitive and unsustainable amid the elevated cost pressure.

Tight Labour Markets Led To Cuts In Products And Services

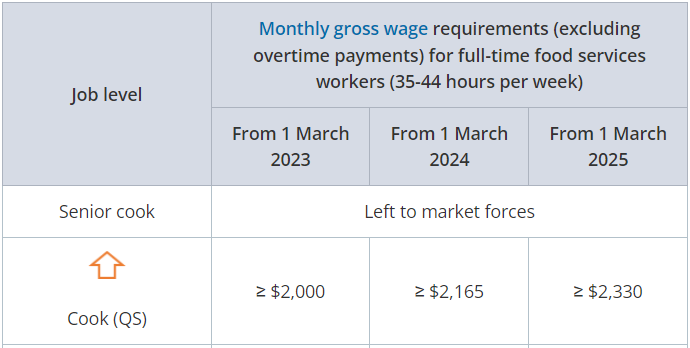

Another reason that Just Dough mentioned for its closure was the challenging manpower issues. The industry as a whole has a high job vacancy rate of 7%, based on the Q12023 Labour Report. The manpower crunch was further exacerbated by the lowering of the foreign worker quota to 35% or less for the services sector in 2021. Furthermore, a minimum wage was also set for local employees under the progressive wage model (PWM) in May 2023, adding to the cost pressures faced by food service businesses.

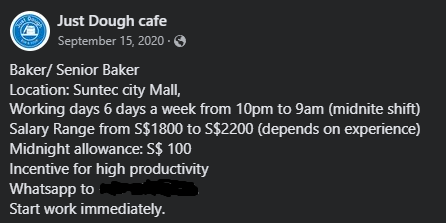

For instance, Just Dough offered between $1,800 and $2,200 for a baker/senior baker position as per their Facebook post below in September 2020. However, under the PWM, companies hiring local food services workers must offer at least $2,000 from 1 March 2023. This represents a wage increase of at least 10%.

As all companies began paying at least the minimum wage, those with urgent manpower needs would need to pay higher to attract and retain local workers amid the tight labour market. This puts further cost pressure on businesses. For Just Dough, the shortage of manpower not only prompted it to cease its delivery services in May 2021 but also limited its mantou offerings due to a lack of bakers in June 2022. This may have had the double effect of increasing costs and lowering revenue, affecting its bottom line.

Read Also: Foreign Worker Quota In Singapore: What Is It And How To Calculate It For Your Business

How Do F&B Business Closures Affect Singapore’s Economy?

Singapore is well known internationally as a gastronomical city due to the availability of a wide array of cuisines, which comes as no surprise for a cosmopolitan and multicultural city. Unlike other nations, our choices of tourist attractions may be limited compared to neighbouring countries, but we punch above our weight in offering a wide selection of food. From the affordable hawkerfare to Michelin-rated restaurants, it is an identity that has been nurtured over time. And it would be a shame to lose our “foodie” nation status if more F&B businesses start closing down due to these structural problems with high costs.

Moreover, while fewer F&B businesses mean we, as consumers, have limited options, it also translates to fewer employment opportunities for local workers. Undoubtedly, the food services industry would shrink and may have a small contribution to our gross domestic product (GDP). This could have a butterfly effect, as food services are an essential sector for feeding our society.

Another consequence of higher operational costs and manpower shortages could be shrinkflation, where we as consumers get less on our plate either for the same price or at a slightly higher price. While businesses are incentivised to experiment with higher productivity and technological innovation to overcome labour challenges and operational efficiency, not all businesses may succeed. Instead, these businesses may decide to sacrifice portion size, quality, or service. When that happens, all parties—not just the consumers but also the food service businesses—will be worse off.

Read Also: 5 Digital Solutions That Every Company Should Adopt Using The Productivity Solutions Grant (PSG)

What’s Next For F&B Businesses?

Since the start of the year to May 2023, there has been a net increase of 500 new F&B businesses, with the highest number of new businesses formed in May at 370 and 222 businesses ceasing operations. While it remains encouraging to note that more F&B businesses spring up to take the spot of those that leave, we should not discount or ignore the challenges faced by the industry and its high failure rate.

For new and existing F&B businesses, it is probably more important now than ever to invest in job transformation to attract local employees. Furthermore, businesses could tap on the IT solutions under the 50% Productivity Solutions Grant (PSG) to digitalise their businesses to improve productivity and stay lean.

There are no easy fixes to the structural problems that F&B businesses are currently facing. Rather, these businesses may need to innovate and transform to stay profitable and relevant in the long-run.

Read Also: [2023 Edition] Price Guide To Hawker Stall Rentals In Singapore

The post Should The Recent String Of F&B Business Closures Like Just Dough, A Mantou Bakery, Worry More Than Just Foodies? appeared first on DollarsAndSense Business.

Yahoo Finance

Yahoo Finance