Project Spotlight: 87% of sellers lost money in this D9 freehold condo

Since launch, Scotts Square has had more unprofitable than profitable transactions.

SINGAPORE (EDGEPROP) - In addition to being the main shopping and hotel belt of Singapore, District 9 is a prime residential area. Hence, many would assume that the profitability of any condo in the district is guaranteed, especially if the condo has a freehold tenure.

EdgeProp Buddy showing the latest unprofitable transactions for Scotts Square

Furthermore, prices for condos in District 9 have stayed resilient during the pandemic. Since 2020, the average price for freehold condos in District 9 grew by 7.3% to $2,444 psf, while their 99-year leasehold counterparts inched down by only 0.9% to $2,258 psf. (see Chart 1).

Source: EdgeProp Market Trends (as at 21 June 2024)

However, Scotts Square may be the exception to the rule, with 62 unprofitable and nine profitable transactions. In this article, we examine the condo to provide possible reasons for its unprofitability.

Read also: FoundOnEdgeProp: Live in a freehold condo in Bukit Timah for under $1,700 psf

Scotts Square is a freehold condo in a prime district

Scotts Square is located along Scotts Road, which is within District 9 and the Orchard Planning Area. Being located in the heart of Orchard Road means that there are numerous high-end malls and luxurious condo developments within walking distance. (see Map 1).

Source: EdgeProp LandLens (as at 21 June 2024)

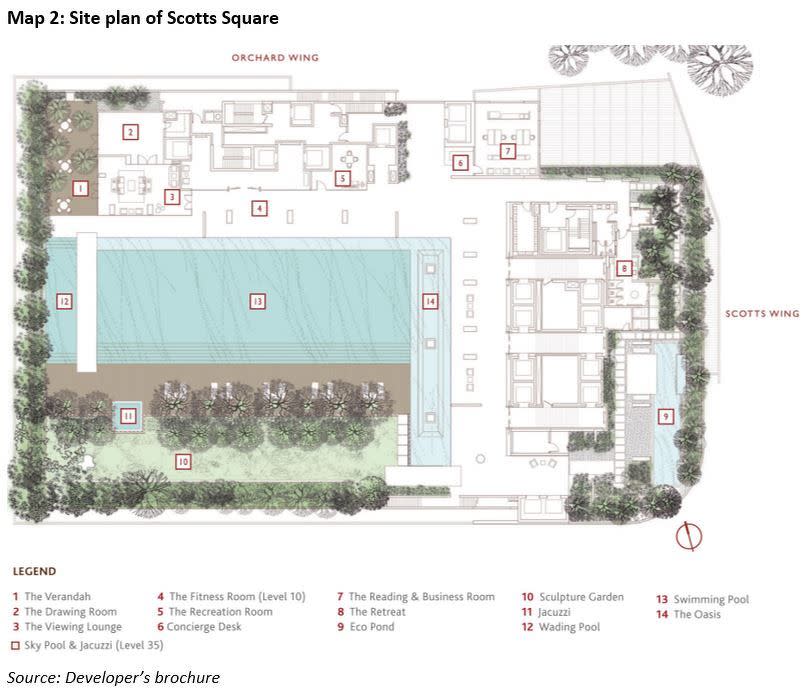

Freehold Scotts Square obtained its temporary occupation permit (TOP) in 2011. The condo features 338 units comprising one- to three-bedroom units that range in size from 624 sq ft to 1,249 sq ft. There are numerous facilities within the development, including a gym, a recreation room, and two pools. (see Map 2).

Scotts Square sits on top of Scotts Square Mall. The four-story retail podium was put up for sale in January with a guide price of $450 million or $3,438 psf (based on gross floor area). At the time of writing, the mall has yet to find a buyer.

More unprofitable transactions than profitable ones

Since its launch in 2007, Scotts Square has had 62 unprofitable and nine profitable transactions. Scotts Square also has the highest number of unprofitable transactions among all condos in the Orchard Planning Area.

Losses for Scotts Square range from approximately $12,000 to $1.56 million, while profits range from approximately $28,000 to $700,000. It is notable that all profits have remained well under $1 million, while losses have surpassed this benchmark. In fact, the top three unprofitable transactions have losses of more than $1 million each. (see Table 1). It is also notable that the three units were bought in 2007 and were sold in either 2017 or 2018.

Furthermore, the top three unprofitable transactions are three-bedroom units that measure 1,249 sq ft. Two of them are for units in stack 1 and thus share the same unit layout (see Floor Plan 1). The layout of the units is unlikely to have contributed to their unprofitability because the units have regularly-shaped rooms without odd corners. The compact units also have an efficient layout with minimal unusable space.

Read also: Is it a Good Deal?: The seller for this condo on Scotts Road lost $1.4 million

Source: EdgeProp Research

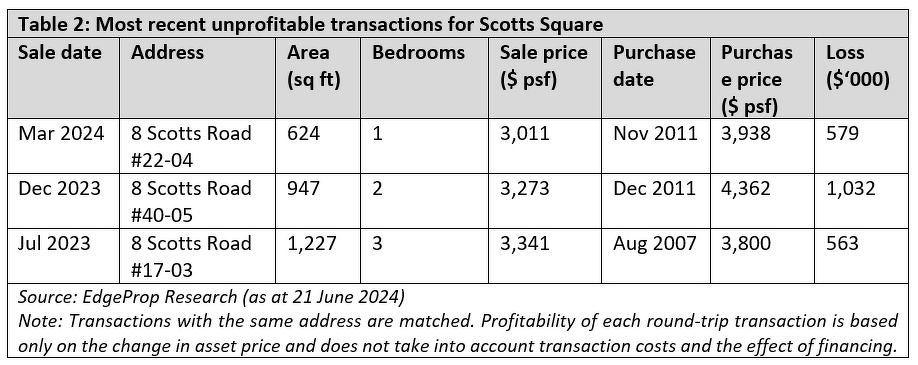

As the top three unprofitable transactions took place several years ago, we examined more recent sales transactions. At the time of writing, five resale transactions have taken place in 2023 and 2024, all of which resulted in a loss for their sellers.

The three most recent unprofitable transactions are for units of various sizes but were all purchased in either 2007 or 2011. Furthermore, two of them generated losses of less than $600,000, which is considerably less than the losses for the top three unprofitable transactions. (see Table 2).

Units that are profitable were previously unprofitable

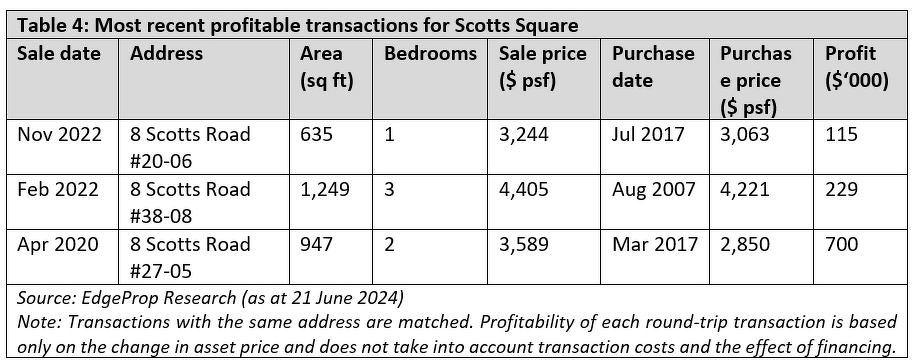

Based on caveats lodged with URA, two units from the top three profitable transactions also generated losses for their previous owners. The first owner of #27-05 bought the unit in August 2007 for $3,994 psf before selling it to the second owner in March 2017 for $2,850 psf, resulting in a loss of approximately $1.08 million. The second owner sold it in April 2020 for a profit of approximately $700,000. (see Table 3).

Likewise, the first owner of #21-03 bought the unit in August 2007 for $3,890 psf and sold it in November 2008 for $3,050 psf, resulting in a loss of approximately $1.03 million. However, the second owner was able to pocket a profit of approximately $296,000 when the unit was sold again in September 2015.

The seller of #37-08 sold the unit only 14 days after purchasing it, resulting in a profit of approximately $631,000. (see Table 3). Readers might want to note that the seller’s stamp duty (SSD) is not applicable because the sale took place in 2007 and SSD for residential properties was introduced in 2010.

In contrast, the owner of the unit one floor above (#38-08) held the property for more than 14 years before selling it for a smaller profit of approximately $229,000. (see Table 4).

Read also: Is it a Good Deal?: This freehold condo in D9 sold for a loss of $163,000

Both units share the same floor layout. (see Floor Plan 2). The units have a private lift lobby and three regularly-shaped bedrooms. As the units face Nutmeg Road, residents are likely to have unblocked views of the landed homes along that road.

Source: EdgeProp Research

As for #20-06, it generated a loss of approximately $525,000 for its first owner, who bought the unit in August 2007 for $3,890 psf before selling it in July 2017. The second owner sold it in November 2022 for a profit of approximately $115,000. (see Table 4).

Bulk sale of 20 units

In June 2017, a foreign buyer purchased 20 one-bedroom units in Scotts Square. As only 39 sale caveats were lodged for Scotts Square in 2017, the bulk sale represented more than half of the sale transactions that took place for the condo that year. Additionally, there are 162 one-bedroom units in Scotts Square, which represent 47.9% of the total number of units in the development. Hence, the bulk purchaser bought 12.3% of the one-bedroom units in Scotts Square or 5.9% of the total number of units in the condo.

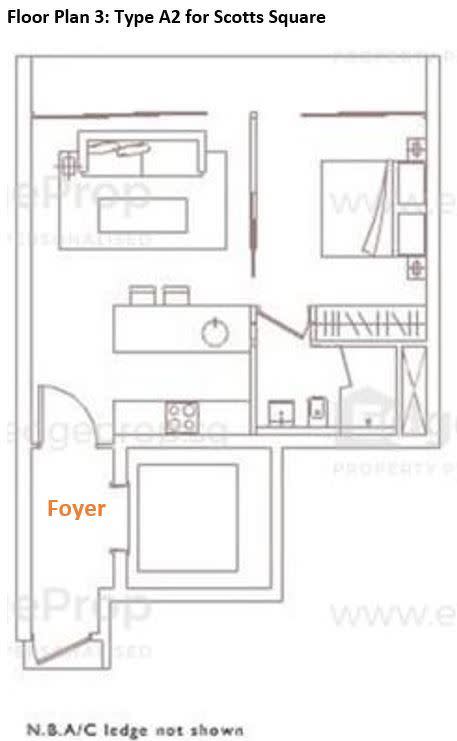

The units in the bulk purchase are one-bedroom units that measure 624 sq ft to 635 sq ft. Six of the units are in stack 7, and five units are in stack 6. Both stacks share the same layout. Stacks 10 and 11 also share the same layout, and the bulk purchaser bought two units from each stack. The remaining five units are in stack 4.

Units in stacks 6 and 7 measure 535 sq ft, which is a generous size for a one-bedroom unit (see Floor Plan 3). The units also have a private lift, which will appeal to those who value exclusivity and privacy. However, some may find the foyer in front of the private lift to be an inefficient use of space. Furthermore, the unit has limited space for a dining area, so the kitchen island doubles up as a dining table, which might make the unit unappealing to those who enjoy hosting large dinner parties.

Source: EdgeProp Research

Based on the caveats lodged with URA, the bulk purchaser paid between $2,821 psf and $3,220 psf, totalling $1.76 million to $2.01 million for each unit. The total price tag was approximately $37.39 million which averaged $2,996 psf. At the time of the bulk purchase, the additional buyer’s stamp duty (ABSD) for foreign buyers was only 15% of the purchase price, which is much lower than the prevailing ABSD rate of 60%.

Another nine one-bedroom units in Scotts Square were sold in the same year as the bulk sale. The units fetched an average price of $3,155 psf, indicating that the bulk purchaser secured a good bargain. The bulk purchase could have contributed to the average price for Scotts Square falling to a then record-low of $3,018 psf in 2017. (see Chart 2).

Source: EdgeProp Market Trends (as at 21 June 2024)

At the time of writing, none of the 20 units from the bulk sale have had another lodged caveat, so it would seem that the purchaser has not sold any of the units. The most recent sale of a one-bedroom unit in Scotts Square was concluded in March for $3,011 psf. It is also the lone sale transaction for the condo that took place this year. Assuming that the bulk purchaser sells all units at $3,011 psf, the 20 units would yield an approximate profit of $15 psf or a total profit of approximately $189,000.

Numerous neighbours but few that are comparable

There are 28 condos with over 2,500 units within walking distance of Scotts Square. However, many of them cannot be considered comparable developments. Among the 28 neighbouring condos, 21 of them are boutique developments with less than 100 units. Of the remaining seven larger developments, Klimt Cairnhill is still under construction while Kim Sia Court (TOP in 1970), Cairnhill Plaza (TOP in 1978), The Claymore (TOP in 1985), Richmond Park (TOP in 1996), and Scotts 28 (TOP in 1998) were completed before 2000. Therefore, The Orchard Residences would be considered the most comparable neighbour despite its 99-year leasehold tenure.

The Orchard Residences obtained its TOP in 2010, making it a year older than Scotts Square. The Orchard Residences features 175 units comprising three and four-bedroom units only. It sits on top of Orchard MRT Station and has a retail component, namely ION Orchard.

Leasehold The Orchard Residences is also performing better than freehold Scotts Square with 45 profitable and 29 unprofitable transactions. Profits range from approximately $7,000 to $2.69 million, while losses range from approximately $20,000 to $3.32 million. The profitability of The Orchard Residences could be due to its excellent location in the heart of Orchard Road and its direct access to an MRT station and a mall.

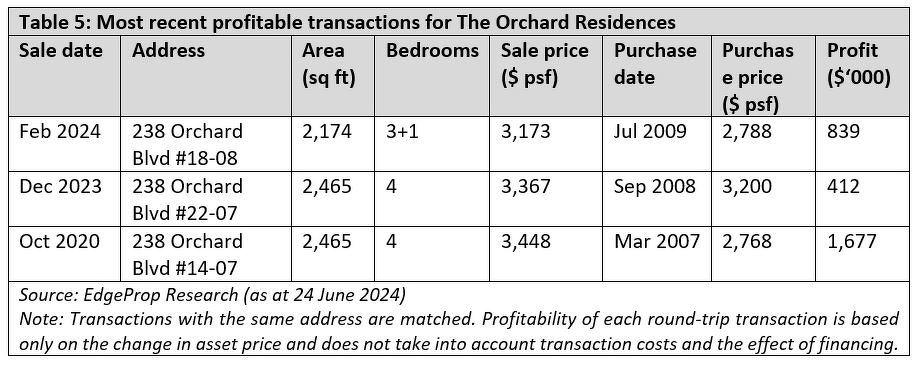

The most recent profitable transaction for The Orchard Residences took place in February, which is also the lone transaction for the development thus far this year. The seller of the 2,174-sq ft unit pocketed a profit of approximately $839,000, which is at the lower end of the profit spectrum for the condo. (see Table 5).

The most recent unprofitable transaction for The Orchard Residences took place last year, and the seller experienced a loss of approximately $1.1 million. (see Table 6). Interestingly, the most unprofitable unit is from the same stack and shares the same unit layout as the most profitable unit, albeit on a higher floor. Both units were sold at similar price points but were purchased at vastly different prices. The profitable unit was purchased in 2009 at $2,788 psf, which is $799 psf cheaper than the unprofitable unit, which was purchased in 2010 at $3,587 psf. This serves as a good indication that timing matters.

More affordable than leasehold neighbour

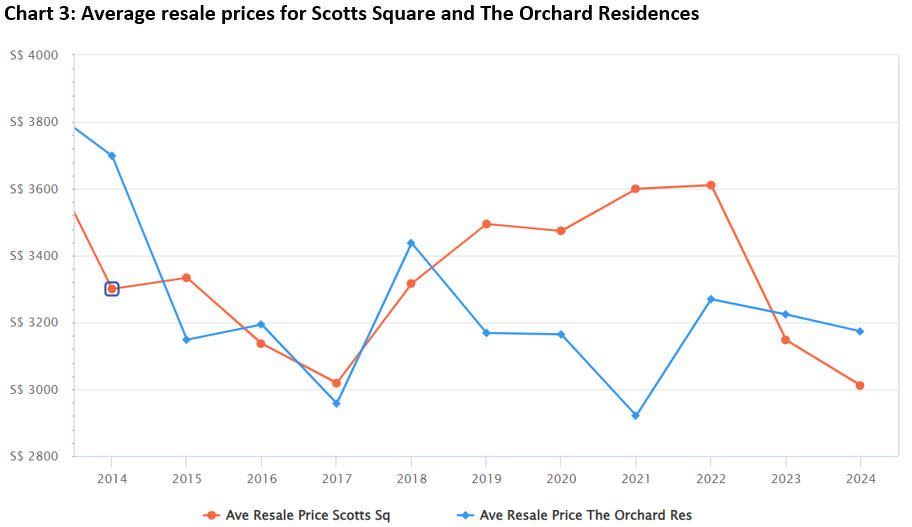

The average resale price for freehold Scotts Square dipped below that of leasehold The Orchard Residences last year. (see Chart 3). The current average resale price for Scotts Square ($3,011 psf) remains below that of The Orchard Residences ($3,173 psf).

Furthermore, the average price for Scotts Square (8.8%) has declined at a slower pace since 2014 compared to The Orchard Residences (14.2%). Much of the price decline for Scotts Square has occurred in recent years. Since 2020, the average resale price for Scotts Square fell by 13.3%, whereas The Orchard Residences experienced a smaller decline of 0.3%.

Source: EdgeProp Market Trends (as at 24 June 2024)

It should also be noted that the average resale price for Scotts Square ($3,011 psf) has consistently trended above that for its freehold counterparts in District 9 ($2,308 psf) and islandwide ($1,826 psf). (see Chart 4). However, freehold condos in District 9 and islandwide have outperformed Scotts Square in terms of price growth. Since 2014, the average prices for freehold condos in District 9 and islandwide has grown by 16.8% and 31.9%, respectively. In contrast, the average price for Scotts Square has fallen by 8.8%.

Source: EdgeProp Market Trends (as at 24 June 2024)

Timing is key to profitability

The top three most unprofitable transactions for Scotts Square were bought in 2007 when a then-record high of $1,050 psf was achieved for condos in Singapore. (see Chart 5). Furthermore, it was the first time that the average price for condos broke through the $1,000 psf benchmark. Additionally, a total of 32,884 condo units were sold that year, which remains a record high sales volume that has not been surpassed.

Of the three most unprofitable transactions, two units were sold in 2018 and one unit was sold in 2017. The average prices for condos in 2017 and 2018 were $1,395 psf and $1,487 psf, respectively, which are higher than the average price in 2007 ($1,050 psf). However, the sales market for condos was less active in 2017 and 2018, with sales volumes of 21,814 units and 19,366 units, respectively.

Source: EdgeProp Market Trends (as at 24 June 2024)

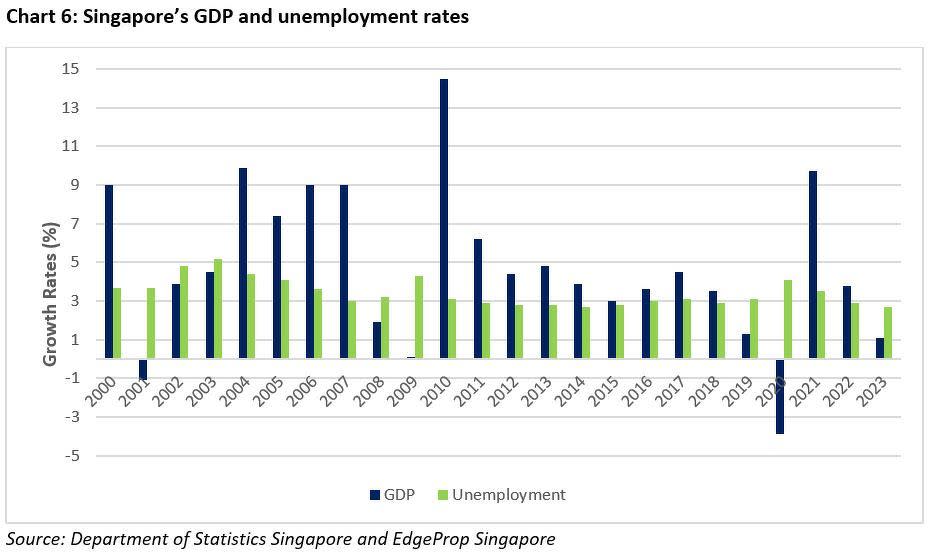

The weaker GDP growth in 2017 and 2018 could have contributed to the less active residential sales market during those years. Singapore's GDP grew by 4.5% y-o-y in 2017 and 3.5% y-o-y in 2018, compared to a growth of 9% y-o-y in 2007. Moreover, the unemployment rate was about 3% for the aforementioned three years. (see Chart 6).

In comparison, the unit that yielded the third highest profit for Scotts Square was purchased a year later in 2008 and sold in 2015. (see Table 3). The average price for condos in 2008 fell by 12% y-o-y to $924 psf on the back of the global financial crisis. Sales volume also dived to 11,085 units. The market had recovered by 2015 when the average price was $1,292 psf, representing a price growth of 39.8% since 2008. Sales volume also increased to 12,764 units.

Singapore’s economy was also in a stronger position in 2015 compared to 2008. GDP grew by 3% y-o-y in 2015 compared to a growth of 1.9% y-o-y in 2008. The unemployment rate was also lower in 2015 (2.8%) compared to 2008 (3.2%).

In a nutshell

The excellent location and freehold tenure of Scotts Square were unable to compensate for the fluctuations of the residential property market in Singapore. At the time of writing, the freehold condo in District 9 had 62 unprofitable transactions and nine profitable transactions. The sellers who experienced losses bought their units when prices reached a peak and sold their units at a less opportune time. In contrast, sellers who pocketed profits bought their units when the property market was weaker.

Furthermore, the average price for Scotts Square has dipped below that of nearby leasehold The Orchard Residences in recent years. This could be due to the price decline of 13.3% since 2020 for Scotts Square. However, owners of units in Scotts Square can take solace in the fact that the average price for the condo has consistently outperformed its freehold counterparts in District 9 and islandwide.

Check out the latest listings for The Orchard Residences, Scotts Square properties

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

FoundOnEdgeProp: Live in a freehold condo in Bukit Timah for under $1,700 psf

Is it a Good Deal?: The seller for this condo on Scotts Road lost $1.4 million

Is it a Good Deal?: This freehold condo in D9 sold for a loss of $163,000

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance