It's Probably Less Likely That Fobi AI Inc.'s (CVE:FOBI) CEO Will See A Huge Pay Rise This Year

Key Insights

Fobi AI to hold its Annual General Meeting on 6th of June

Total pay for CEO Rob Anson includes CA$250.0k salary

The overall pay is comparable to the industry average

Fobi AI's three-year loss to shareholders was 95% while its EPS grew by 5.1% over the past three years

Shareholders of Fobi AI Inc. (CVE:FOBI) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 6th of June. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Fobi AI

How Does Total Compensation For Rob Anson Compare With Other Companies In The Industry?

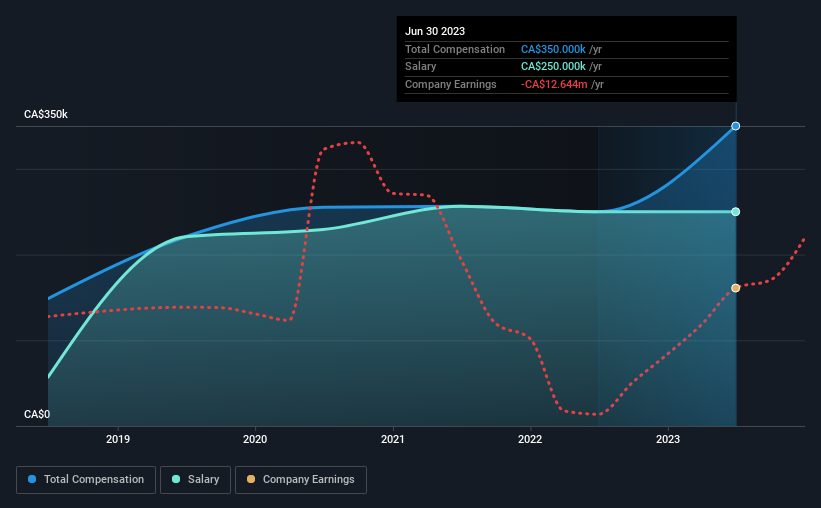

Our data indicates that Fobi AI Inc. has a market capitalization of CA$17m, and total annual CEO compensation was reported as CA$350k for the year to June 2023. That's a notable increase of 40% on last year. Notably, the salary which is CA$250.0k, represents most of the total compensation being paid.

In comparison with other companies in the Canadian Software industry with market capitalizations under CA$273m, the reported median total CEO compensation was CA$323k. This suggests that Fobi AI remunerates its CEO largely in line with the industry average. Furthermore, Rob Anson directly owns CA$571k worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2023 | 2022 | Proportion (2023) |

Salary | CA$250k | CA$250k | 71% |

Other | CA$100k | - | 29% |

Total Compensation | CA$350k | CA$250k | 100% |

Speaking on an industry level, nearly 72% of total compensation represents salary, while the remainder of 28% is other remuneration. Fobi AI is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Fobi AI Inc.'s Growth Numbers

Over the past three years, Fobi AI Inc. has seen its earnings per share (EPS) grow by 5.1% per year. It achieved revenue growth of 60% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Fobi AI Inc. Been A Good Investment?

Few Fobi AI Inc. shareholders would feel satisfied with the return of -95% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Fobi AI (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance