The past three years for Orthocell (ASX:OCC) investors has not been profitable

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Orthocell Limited (ASX:OCC) shareholders have had that experience, with the share price dropping 38% in three years, versus a market return of about 19%.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Orthocell

Orthocell isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

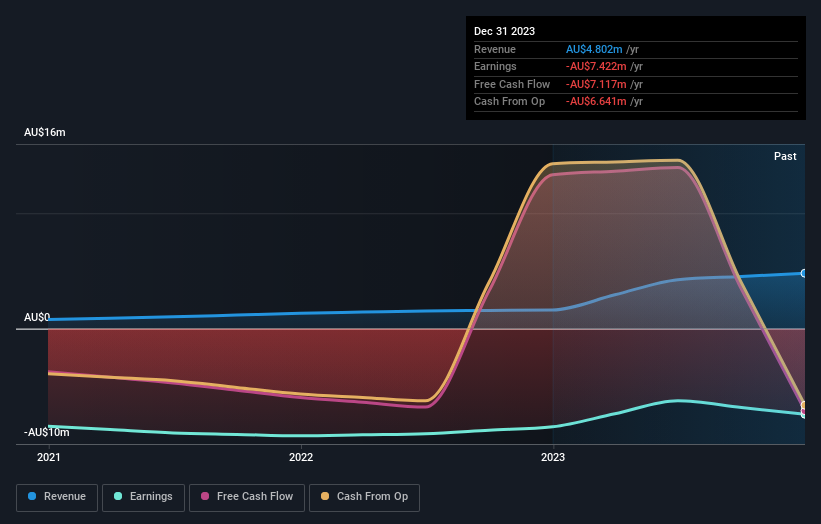

In the last three years, Orthocell saw its revenue grow by 62% per year, compound. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 11% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Orthocell's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Orthocell shareholders are up 7.2% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 5% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Orthocell you should be aware of, and 1 of them is significant.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance