Orion (ORN) Secures $63M Worth Contracts, Boosts Backlog

Orion Group Holdings, Inc. ORN, a leading specialty construction company, announced three significant contract awards, two in its Concrete segment and one in its Marine segment. These projects, valued at more than $63 million collectively, are slated to commence in the third quarter of 2024 and span nine to 12 months.

Orion’s Concrete segment clinched a contract exceeding $28 million from Costco Wholesale, facilitated through Southeast Industrial Construction. This project involves the construction of the Port Saint Lucie Costco Depot Phase 1 in Southeast Florida, one of the fastest-growing regions in the United States. The facility, one of Costco’s largest distribution centers, will feature a 550,000 square-foot tilt-wall dry/cold storage facility and nearly 3 million square feet of concrete paving. This is Orion’s 16th project with Costco and ranks among the company’s top 10 largest projects in recent years.

In another win for Orion’s Concrete segment, a major hyperscaler awarded a significant data center project in North Texas valued at approximately $15 million. This will be Orion’s 20th data center project, reflecting its strong presence in the mission-critical infrastructure market, particularly as demand surges in the artificial intelligence sector.

Orion’s Marine segment secured a $20 million marine construction project from Port Tampa Bay. The project includes the construction of a 481 ft by 125 ft Berth 218, designed to enhance port operations and support economic growth. This project strengthens Orion’s longstanding relationship with Port Tampa Bay, highlighting the company’s pivotal role in regional infrastructure upgrades.

These strategic projects underscore ORN's robust position in the construction industry and are poised to bolster its financial performance and market presence.

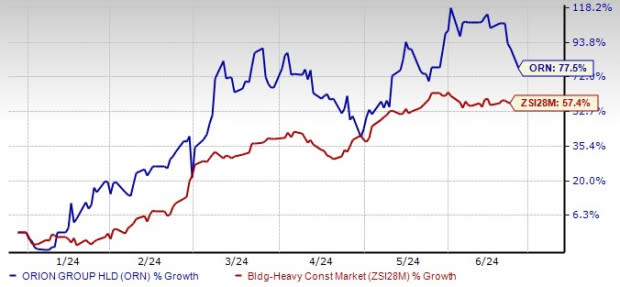

Share Price Performance

Shares of Orion have gained 77.5% so far this year, outperforming the Zacks Building Products - Heavy Construction industry’s 57.4% rise. The Zacks Consensus Estimate for Orion’s 2024 earnings per share (EPS) has been revised upward to 24 cents from 19 cents over the past 60 days. The estimated figure indicates 168.6% year-over-year growth.

Image Source: Zacks Investment Research

Orion's pipeline of opportunities has expanded significantly, now totaling more than $11 billion as of first-quarter 2024, a substantial increase from $3 billion just a year ago. This growth is driven by the critical need to rebuild U.S. infrastructure, especially in heavy civil and marine construction. Orion is actively bidding on numerous marine projects funded by federal, state, municipal, and private sources, including U.S. Navy investments, coastal restoration, LNG terminals, and port infrastructure.

The company is also capitalizing on the booming data center market, fueled by artificial intelligence developments. Orion’s Concrete segment, renowned for handling complex data center projects, is seeing increased activity in the Dallas area.

With a robust backlog and strong pipeline, Orion expects momentum to build throughout 2024, with 2025 poised to fully realize the benefits of their strategic transformation. Investing in Orion offers a promising opportunity, given its strategic positioning in critical infrastructure and data center markets.

With a total backlog of $756.6 million as of Mar 31, 2024, and $101 million in new project awards in April, Orion is poised for significant growth. The company anticipates increased momentum through 2024 and expects 2025 to be a year of substantial harvest from its strategic initiatives. Investing in Orion offers a promising opportunity, given its robust pipeline and strategic positioning in critical infrastructure and data center markets.

Zacks Rank & Key Picks

Orion currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Construction sector.

Owens Corning OC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

OC delivered a trailing four-quarter earnings surprise of 17.4%, on average. The stock has risen 20.2% year to date (YTD). The Zacks Consensus Estimate for OC’s 2024 sales and EPS indicates growth of 16% and 7.4%, respectively, from the prior-year reported levels.

PulteGroup, Inc. PHM currently carries a Zacks Rank of 2 (Buy). It has a trailing four-quarter earnings surprise of 12.5%, on average. PHM shares have gained 9.2% YTD.

The consensus estimate for PHM’s 2024 sales and EPS implies increases of 7.9% and 10%, respectively, from the prior-year reported levels.

Armstrong World Industries, Inc. AWI presently holds a Zacks Rank of 2. AWI delivered a trailing four-quarter earnings surprise of 15.2%, on average. The stock has surged 17% YTD.

The Zacks Consensus Estimate for AWI’s 2024 sales and EPS indicates improvements of 9.3% and 10.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Orion Group Holdings, Inc. (ORN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance