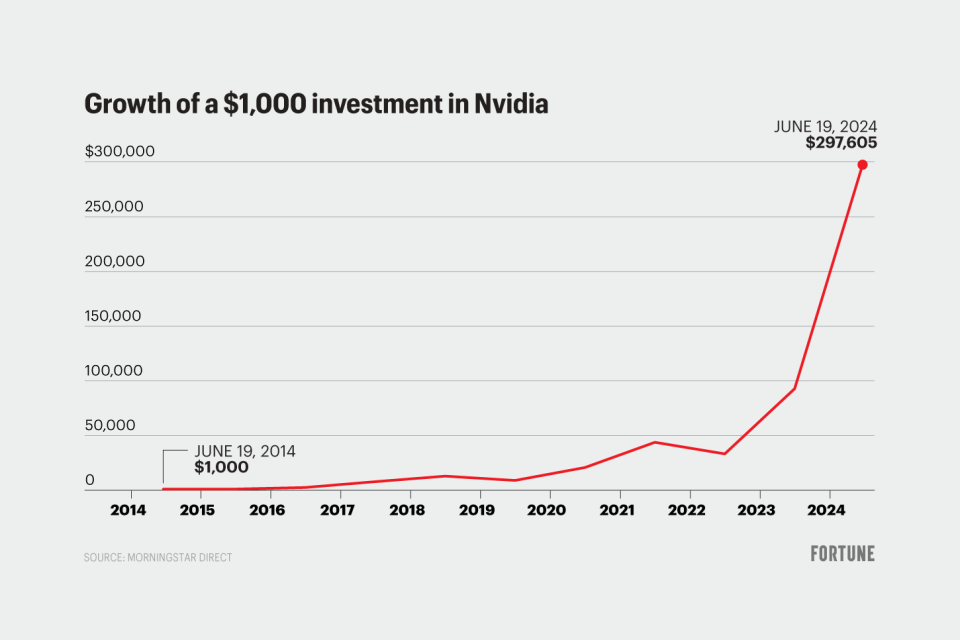

Nvidia stock surge: How much a $1,000 investment 10 years ago would be worth today

Though the average investor may not have even heard of it until recently, Nvidia is the hottest company around, officially becoming the world's most valuable on Tuesday. And for investors who were lucky enough to get in early, the gains are meteoric.

An investment of $1,000 in Nvidia in June 2014 would be worth over $297,600 at Wednesday's close, according to calculations from Morningstar Direct. That's cumulative growth of 29,660%.

Much of that came in the past year, as the chipmaker cemented itself as an artificial intelligence darling: Its graphics processing units, or GPUs, are used to power AI systems. In fact, Nvidia’s stock price has more than doubled this year—after more than tripling in 2023. Its market cap now sits well over $3 trillion, more than Apple's or Microsoft's, and it alone accounts for more than one-third of the S&P 500’s gains so far this year.

Despite a dip in the stock price in 2022—when many big-time investors snapped up shares at a discount—the company has provided a healthy shareholder return for a while, significantly outperforming the broader market. One analyst says the semiconductor giant could see its market value soar to nearly $5 trillion in the coming year.

The question now is whether Nvidia can keep it up. Analysts have been ringing the warning bell on the stock being overpriced for a long time now; with it reaching new heights, those calls are growing louder.

Because the S&P 500 is weighted by market cap, the movements of companies like Nvidia—either up or down—can have an outsize impact on the overall performance of the broader market. Given that retail investors are increasingly buying into these types of index funds, that could spell trouble.

"The bottom line is that the extreme concentration of returns in the S&P 500 makes investors more vulnerable to single headlines impacting the one stock driving index returns," Apollo Global Management chief economist Torsten Sløk wrote in a note last week.

Still, as Morningstar analysts outlined earlier this year, there are reasons to remain optimistic. The biggest tech companies in the world are the ones buying chips from Nvidia, and many other companies are ramping up their AI investments.

"It would not surprise me if a year from now, this is a thousand-dollar stock or more," Morningstar equity strategist Brian Colello said back in February.

This story was originally featured on Fortune.com

Yahoo Finance

Yahoo Finance