Ningxia Baofeng Energy Group Leads Three Key Growth Stocks With High Insider Ownership On Chinese Exchange

Amidst a backdrop of fluctuating economic indicators and mixed market signals, the Chinese stock market has witnessed notable shifts, with sectors like real estate experiencing significant downturns while retail sales show signs of resilience. In such a landscape, growth companies with high insider ownership can offer investors potential stability as these insiders may have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningxia Baofeng Energy Group

Simply Wall St Growth Rating: ★★★★★★

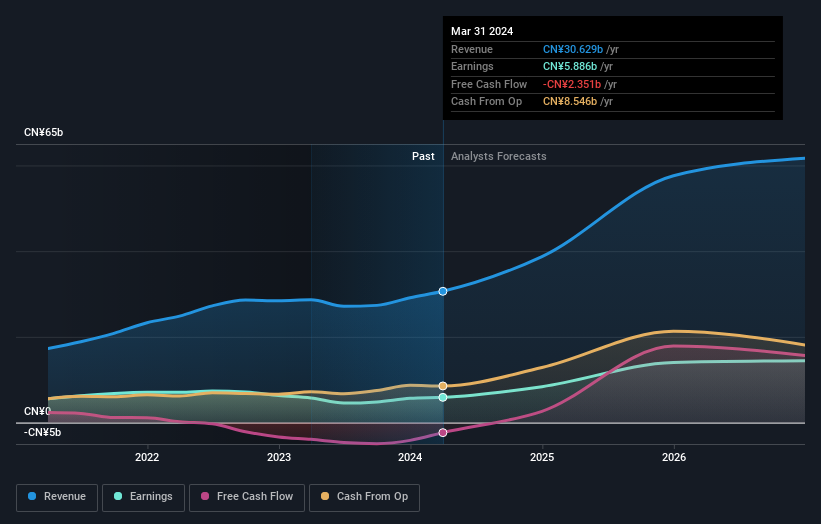

Overview: Ningxia Baofeng Energy Group Co., Ltd. is engaged in the production, processing, and sale of a range of products including coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed methanol, and olefins with a market capitalization of approximately CN¥123.24 billion.

Operations: The company generates revenue from the production and sale of products such as coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed methanol, and olefins.

Insider Ownership: 35.1%

Revenue Growth Forecast: 26.1% p.a.

Ningxia Baofeng Energy Group, a company with high insider ownership, reported a substantial year-over-year increase in Q1 2024 earnings and revenue. Despite its significant debt levels, the firm is trading at a good value relative to peers and shows robust forecasted growth in both revenue (26.1% annually) and earnings (32.6% annually), outpacing broader market expectations. Recent shareholder meetings underscored strategic discussions potentially influencing future operations but no major changes were announced.

Science Environmental Protection

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Science Environmental Protection Co., Ltd. operates in the environmental protection sector and has a market capitalization of approximately CN¥2.70 billion.

Operations: The revenue segments information for the company is not provided in the text.

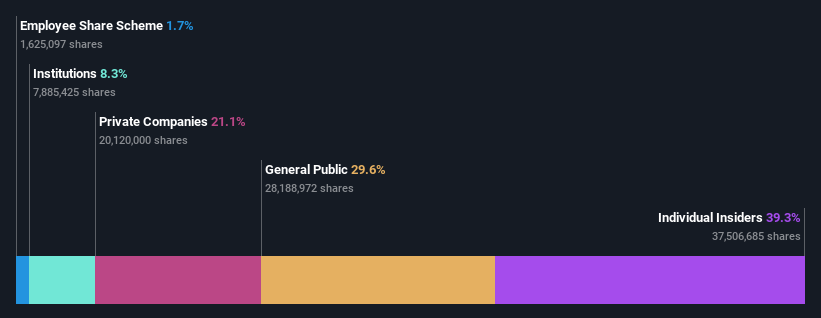

Insider Ownership: 39.3%

Revenue Growth Forecast: 35% p.a.

Science Environmental Protection Co., Ltd. demonstrated a robust financial performance in Q1 2024, with net income soaring to CNY 79.42 million from CNY 13.4 million year-over-year, reflecting a strong growth trajectory. The company's revenue is expected to grow at 35% annually, outperforming the Chinese market forecast of 13.8%. Despite this rapid growth, earnings are projected to expand at a slower pace than the broader market, and its dividend coverage by cash flows remains weak. Trading at a P/E ratio of 17.3x, it offers value compared to industry peers despite concerns about its return on equity and non-cash earnings quality over the next three years.

Dalian Haosen Intelligent Manufacturing

Simply Wall St Growth Rating: ★★★★★☆

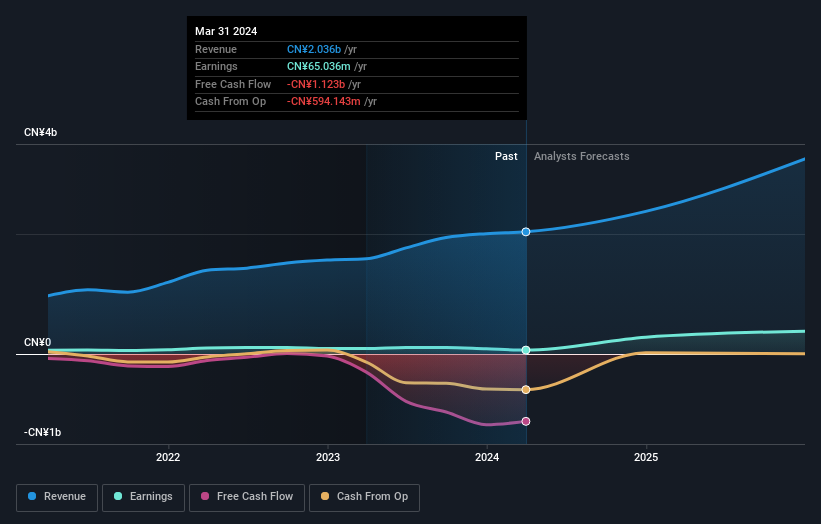

Overview: Dalian Haosen Intelligent Manufacturing Co., Ltd. specializes in equipment manufacturing, with a market capitalization of approximately CN¥2.16 billion.

Operations: The revenue segments data for the company is not provided in the text.

Insider Ownership: 23.8%

Revenue Growth Forecast: 27.5% p.a.

Dalian Haosen Intelligent Manufacturing has experienced a decline in net profit margin from 5.7% to 3.2% over the past year and faces challenges with dividend coverage and interest payments not well covered by earnings. Despite these financial pressures, the company's revenue is expected to grow at 27.5% annually, outpacing the Chinese market forecast of 13.8%. Earnings are also projected to surge by 72.75% per year, significantly above the market average of 22.3%. Recent events include reporting lower Q1 earnings compared to last year but maintaining regular dividends, signaling mixed financial health but potential for growth.

Turning Ideas Into Actions

Dive into all 366 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:600989 SHSE:688480 and SHSE:688529.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance