NIKE (NKE) Sustains Business Momentum: Will Q4 Earnings Beat?

NIKE Inc. NKE is slated to release fourth-quarter fiscal 2024 results on Jun 27. The leading sports apparel retailer is estimated to have witnessed year-over-year growth in the top and bottom lines in the fiscal fourth quarter.

The company has been gaining from its Consumer Direct Acceleration strategy, along with strong demand, compelling products, and robust performances in its digital and DTC businesses. Supply-chain constraints, continued weakness in Greater China, and higher costs have been hurting its bottom-line performance.

The Zacks Consensus Estimate for fiscal fourth-quarter revenues is pegged at $12.9 billion, suggesting 0.7% growth from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for the company’s fiscal fourth-quarter earnings is pegged at 86 cents per share, indicating a rise of 30.3% from the year-ago reported number. Earnings estimates for the fiscal fourth quarter were unchanged in the last 30 days.

In the last reported quarter, the company delivered an earnings surprise of 42%. Its bottom line beat the consensus estimate by 22.6%, on average, over the trailing four quarters.

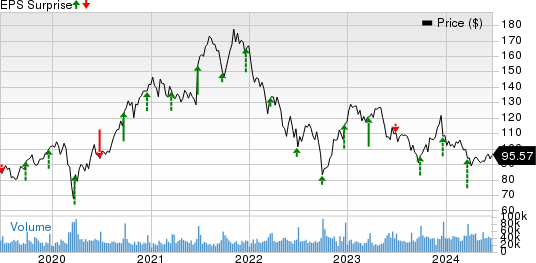

NIKE, Inc. Price and EPS Surprise

NIKE, Inc. price-eps-surprise | NIKE, Inc. Quote

Key Factors to Note

NIKE is expected to have witnessed continued gains from brand strength, robust consumer demand, business strategy and compelling product innovation in the fiscal fourth quarter. Gains from its Consumer Direct Acceleration strategy and digital leadership are expected to have been other tailwinds. Additionally, the company’s proactive efforts to confine inventory supply and prioritize marketplace health, particularly in North America, are expected to have bolstered fourth-quarter fiscal 2024 results.

Continued strength in retail traffic trends at stores and online has been aiding conversion rates, resulting in growth in NIKE Direct revenues. The strong member buying trends are expected to have resulted in a record digital performance in the to-be-reported quarter. Strength in the North America, EMEA and APLA regions, fueled by increasing traffic, higher conversion and growth in average order value, is likely to have aided sales in the to-be-reported quarter.

The NIKE Direct business has been benefiting from robust growth across regions and an efficient digital ecosystem, comprising its online site, and commercial and activity apps. Revenues at NIKE-owned stores are expected to have gained from improved traffic, higher conversion rates and growth in average order value. The NIKE Direct business is likely to have reflected the benefits of growth in North America, EMEA and APLA, offset by continued weakness in Greater China in the to-be-reported quarter.

On the last reported quarter’s earnings call, management expected fourth-quarter fiscal 2024 revenues to rise slightly, reflecting a few shipment timing benefits and lower digital growth due to the franchise lifecycle management. It anticipates strong gross margin execution and disciplined cost management to offset soft second-half revenues and drive earnings growth. It expects the fiscal fourth-quarter gross margin to increase 150-180 bps. This reflects benefits from strategic price increases, lower ocean freight rates, reduced product input costs and supply-chain efficiency. This is expected to be partly offset by elevated markdowns, lower benefits from channel mix due to franchise lifecycle management, and worsening foreign exchange fluctuations.

We expect total NIKE Brand revenues to increase 0.9% year over year to $12.3 billion in the fiscal fourth quarter, driven by a 4.3% rise in the Wholesale business. We anticipate gross profit to increase 4.1% year over year in fourth-quarter fiscal 2024, with a 150-bps expansion in the gross margin to 45.1%.

However, NKE has significant investment outlays toward enhancing brand visibility and improving consumer engagement. For NIKE, these expenses encompass several initiatives, including advertising campaigns, sponsorships, events and digital marketing efforts. Investing in demand creation ensures that the Nike brand remains top-of-mind for consumers.

Consequently, the company has a history of reporting elevated SG&A expenses, comprising demand creation expenses and operating overhead costs.

On the last reported quarter’s earnings call, the company estimated the elevated SG&A expense trend to continue. It predictes SG&A expenses to increase in the low-single digits for fiscal 2024, comprising restructuring charges. For the fiscal fourth quarter, SG&A expenses are expected to decline slightly year over year, including restructuring charges.

We expect demand-creation expenses to increase 0.4% year over year and operating overheads to decline 1.2% year over year in the fiscal fourth quarter, resulting in a 1% decline in SG&A expenses.

Driven by gross margin growth and lower SG&A expenses, our model suggests a 20-bps expansion year over year in the operating margin to 11.6% in the fiscal fourth quarter.

Zacks Model

Our proven model conclusively predicts an earnings beat for NIKE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

NIKE has an Earnings ESP of +0.11% and a Zacks Rank of 3.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies that you may want to consider, as our model shows that these also have the right combination to post an earnings beat.

Carnival Corp. CCL currently has an Earnings ESP of +70.37% and a Zacks Rank of 3. The company is expected to register top-line growth when it reports second-quarter fiscal 2024 results. The Zacks Consensus Estimate for CCL’s quarterly revenues is pegged at $5.7 billion, which suggests a rise of 15.1% from the figure reported in the year-ago quarter. You can see the complete list of today's Zacks #1 Rank stocks here.

The consensus estimate for Carnival’s bottom line was unchanged in the last 30 days at a loss per share of 1 cent. This suggests a significant narrowing from the loss of 31 cents reported in the prior-year quarter. PVH has delivered an earnings surprise of 21.9%, on average, in the trailing four quarters.

Aaron's Inc. AAN currently has an Earnings ESP of +66.7% and a Zacks Rank of 3. The company is anticipated to register top and bottom-line declines when it reports second-quarter 2024 numbers. The Zacks Consensus Estimate for AAN’s quarterly revenues is pegged at $508.4 million, suggesting a decline of 4.1% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Aaron's quarterly earnings moved down by a penny in the last 30 days to 3 cents per share. The consensus mark suggests a 94.9% decline from the year-ago quarter's reported number. AAN delivered a negative earnings surprise of 255.2%, on average, in the trailing four quarters.

Boyd Gaming BYD currently has an Earnings ESP of +1.22% and a Zacks Rank of 3. The company is expected to register top and bottom-line declines when it reports second-quarter 2024 numbers. The Zacks Consensus Estimate for BYD’s quarterly earnings was unchanged in the last 30 days at $1.47 per share, suggesting a decline of 7% from the year-ago quarter's reported number.

The Zacks Consensus Estimate for Boyd Gaming’s quarterly revenues is pegged at $903.2 million, which indicates a decline of 1.5% from the figure reported in the year-ago quarter. BYD delivered an earnings surprise of 2%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carnival Corporation (CCL) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

The Aaron's Company, Inc. (AAN) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance