LVS or MGM: Which Gaming Stock is Better Placed at the Moment?

The gaming industry is benefiting from improving visitation. Positive trends in Macau's gaming earnings are contributing to the sector's growth. Moreover, robust demand for sports betting is aiding the industry.

The gaming industry in the United States continues to perform better than expected. Per the American Gaming Association data, revenues from gambling hit a record high of $60.42 billion in 2022. In 2022, sports betting increased 72.7% year over year. In the first and second quarter of 2023, the U.S. commercial gaming revenues reached $16.6 and $16.07 billion. This marks the industry’s 10th straight record-breaking quarter. The U.S. gaming industry will continue to improve.

In August, Macau’s gross gaming revenues (GGR) jumped 686.4% year over year to MOP$17.21 billion ($2.12 billion). For the first eight months of 2023, GGR is up 295.1% year over year. Robust investment will continue to aid the gaming industry in Macau. In the next 10 years, six casino companies will invest nearly $15 billion.

In line with the industry’s growth, leading gaming companies — Las Vegas Sands Corp. LVS and MGM Resorts International MGM — are trying out different strategies to generate profits. With both the companies carrying a Zacks Rank #3 (Hold), let’s analyze and find out which is poised better on the basis of different parameters. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

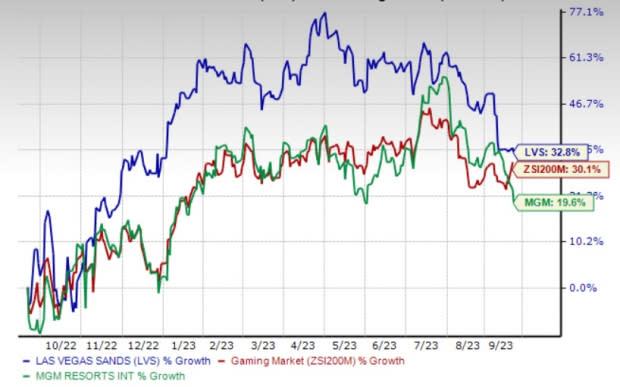

Price Performance and Valuation

Shares of Las Vegas Sands have gained 32.8% in the past year, while the same for MGM Resorts have appreciated 19.6%.

On the basis of the forward 12-month P/E ratio, which is a commonly used multiple for valuing gaming stocks, the industry is currently trading at 10.00X compared with the S&P 500’s 11.07X. MGM Resorts has an edge with a lower forward 12-month P/E ratio of 3.9X compared with Las Vegas Sands’ figure of 10.52X.

Image Source: Zacks Investment Research

Estimated Earnings & Revenues

Arguably, earnings growth is of utmost importance for determining a stock’s potential as surging profit levels indicate strong prospects (and stock price gains).

For the current year, Las Vegas Sands’ earnings per share are expected to increase 255% year over year. Notably, sales for the current year are expected to improve 146.8% year over year. Meanwhile, MGM Resorts’ current-year earnings per share are likely to decline 30.1% year over year. The company’s sales are likely to improve 19.4% year over year. Thus, this round goes to Las Vegas Sands.

Fundamentals

Las Vegas Sands witnessed impressive recovery in Macao in the second quarter of 2023. During the quarter, the company reported significant growth in property visitation, gaming volumes, retail sales and hotel occupancy in the Macao region. Visitation in China (excluding Guangdong province) reached approximately 51% of the 2019 visitation level in the quarter.

LVS also observed splendid travel and tourism recovery in Singapore. Management’s decision to continue investing in the Marina Bay Sands (MBS), Singapore has added to its solid growth. In second-quarter 2023, MBS achieved solid growth in both gaming and non-gaming segments despite the persisting airlift constraints (primarily from China). As per LVS, in the reported quarter, the rolling volumes in Singapore was $6 billion, which is approximately 84% of 2019 levels. Mass gaming win at MBS reached a record value of $580 million (136% of 2019).

On the other hand, MGM Resorts, one of the leading companies in the gaming and lodging industry, is well poised to grow on high brand awareness. The company’s superior business model, extensive non-gaming revenue opportunities, high-quality assets and attractive property locations are the primary growth drivers. In the past few years, the company has taken various initiatives to align every recognized brand into one global entertainment brand.

MGM derives a solid share of its revenues from Macau — the largest gaming destination in the world. It is undertaking initiatives to increase revenues and junket productivity in Macau and anticipates a positive trend, buoyed by upgrades to main gaming floor products and marketing initiatives. During second-quarter 2023, Macau business reported adjusted property EBITDAR of $209 million, up 21% from the second quarter of 2019 with a 28% margin.

Our Take

Fundamentals of both the companies are solid. However, Las Vegas Sands is ahead of MGM Resorts in terms of earnings growth and share price performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance