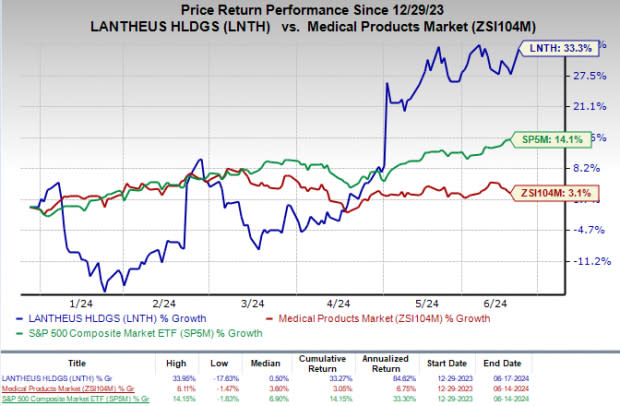

Lantheus (LNTH) Gains 33.3% YTD: What's Driving the Stock?

Lantheus Holdings, Inc. LNTH witnessed strong momentum in the year-to-date period. Shares of the company have rallied 33.3% compared with 3.1% growth of the industry. The S&P 500 Composite has risen 14.1% during the same time frame.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #1 (Strong Buy) company appears to be a solid wealth creator for its investors at the moment.

Lantheus Holdings is a radiopharmaceutical-focused company committed to enabling clinicians to Find, Fight and Follow disease to deliver better patient outcomes. It classifies its products into three categories — Precision Diagnostics, Radiopharmaceutical Oncology, and Strategic Partnerships and Other Revenue.

Lantheus’ leadership in the radiopharmaceuticals market, with PYLARIFY dominating PSMA PET imaging for prostate cancer, looks promising. The company is expanding its pipeline with promising assets like PNT2002, PNT2003, and MK-6240, along with strategic collaborations to enhance its portfolio, including in oncology.

Catalysts Driving Growth

The rally in the company’s share price can be attributed to its market leadership in radiopharmaceuticals and a strong pipeline development. The optimism led by a solid first-quarter fiscal 2024 performance and robust business potential are expected to contribute further.

Lantheus ended the first quarter of 2024 with better-than-expected results. Its robust top-line and bottom-line results and strong performances in the majority of its segments were impressive, which is likely to have aided in the stock’s price growth.

Revenues in the Radiopharmaceutical Oncology segment were up 32.1% year over year. The segment’s performance reflected solid PYLARIFY sales, driven by increasing utilization of PSMA PET with PYLARIFY at existing customers and expansion of the prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging market.

LNTH has raised its revenue and earnings projections for fiscal 2024, which are also likely to have interested investors. For fiscal 2024, Lantheus now expects its revenues in the range of $1.50 -$1.52 billion, up from the previous outlook of $1.41-$1.445 billion. For 2024, adjusted earnings per share (EPS) is now anticipated to be in the range of $7.00-$7.20, up from the previous guidance of $6.50-$6.70.

Lantheus has also been developing its pipeline with promising assets like PNT2002, PNT2003, and MK-6240, which are likely to keep investors interested. The company successfully completed a phase III study evaluating Lu-PNT2002, a PSMA-targeted radioligand therapy (RLT), in patients with mCRPC after progression on an androgen receptor pathway inhibitor.

The company’s regulatory application seeking FDA approval for PNT2003 as a potential treatment for neuroendocrine tumors is under review. The company expects to launch the therapy in 2026, following a potential approval. The MK-6240, LNTH’s F-18-based PET tracer, is under development for the detection of Tau tangles, which has the potential to be an ideal agent for staging and monitoring the progression of Alzheimer’s disease.

The company has also evaluated a number of different opportunities to collaborate, in-license or acquire additional products, product candidates, businesses and technologies to drive its future growth. This has likely proved beneficial in driving the stock price higher.

Lantheus, in February 2024, announced a collaboration agreement with a National Institute on Aging (NIA)-sponsored study to evaluate use of MK-6240 in its investigation of Alzheimer’s disease and related dementias.

In January, Lantheus entered into multiple strategic agreements with Perspective Therapeutics gaining an option to exclusively license Perspective’s Pb212-VMT-α-NET and an option to co-develop certain early-stage therapeutic candidates targeting prostate cancer using Perspective’s innovative lead platform technology, among others..

Image Source: Zacks Investment Research

Risk Factors

Lantheus’ revenues heavily depend on third-party payors like Medicare, Medicaid, and private insurers reimbursing the costs of its products and related services. These payors have significant influence over patient access and are increasingly negotiating lower prices, which could reduce demand for the company’s products.

The ability of Lantheus’ customers to secure sufficient reimbursement impacts their product choices and price willingness. Inadequate reimbursement, coverage denials, or decreased reimbursement levels by third-party payors could lead to reduced prescriptions and purchases of its products.

A Look at Estimates

LNTH’s EPS for fiscal 2024 and 2025 is projected to grow 14.1% and decline 0.7% to $7.11 and $7.06 on a year-over-year basis, respectively. The Zacks Consensus Estimate for EPS for fiscal 2024 and 2025 has remained stable for the past 30 days.

Revenues for fiscal 2024 and 2025 are anticipated to rise 17.2% and 2.4%, respectively, to $1.52 billion and $1.56 billion on a year-over-year basis.

Other Stocks to Consider

Some other top-ranked stocks in the broader medical space that have announced quarterly results are DaVita DVA, Ecolab ECL and Boston Scientific Corporation BSX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. The Zacks Consensus Estimate for EPS for fiscal 2024 and 2025 has been stable for the past 30 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 44% compared with the industry’s 20.4% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. The Zacks Consensus Estimate for EPS for fiscal 2024 and 2025 has been stable for the past 30 days.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. The Zacks Consensus Estimate for EPS for fiscal 2024 and 2025 has been stable for the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance