June 2024 Insight Into Three UK Stocks Possibly Priced Below Their Estimated Value

As the FTSE 100 shows signs of breaking its recent losing streak amidst a broader positive trend in global markets, investors are closely monitoring economic indicators and central bank decisions that could influence market dynamics. In this context, identifying stocks that may be undervalued involves assessing companies with strong fundamentals that appear to be priced below their potential given the current economic environment and market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kier Group (LSE:KIE) | £1.378 | £2.72 | 49.3% |

Morgan Advanced Materials (LSE:MGAM) | £3.085 | £6.08 | 49.2% |

Mercia Asset Management (AIM:MERC) | £0.295 | £0.58 | 49.1% |

LSL Property Services (LSE:LSL) | £3.16 | £6.00 | 47.4% |

WPP (LSE:WPP) | £7.38 | £13.86 | 46.7% |

YouGov (AIM:YOU) | £8.12 | £15.32 | 47% |

Elementis (LSE:ELM) | £1.43 | £2.78 | 48.6% |

Loungers (AIM:LGRS) | £2.83 | £5.35 | 47.1% |

Nexxen International (AIM:NEXN) | £2.51 | £4.91 | 48.9% |

eEnergy Group (AIM:EAAS) | £0.0565 | £0.11 | 48.8% |

We'll examine a selection from our screener results

accesso Technology Group

Overview: Accesso Technology Group plc specializes in developing technology solutions for the attractions and leisure industry across various global regions, with a market capitalization of approximately £295.73 million.

Operations: The company generates revenue through two primary segments: Ticketing, which brought in $104.02 million, and Guest Experience, contributing $45.49 million.

Estimated Discount To Fair Value: 26.8%

Accesso Technology Group, priced at £7.28, is considered undervalued by more than 20% against a fair value of £9.94 based on discounted cash flow analysis. Despite a low forecasted return on equity of 6.4% in three years, the company's earnings are expected to grow significantly at 25.3% annually, outpacing the UK market's growth rate of 13.1%. Recent strategic moves include launching accesso ShoWare in the UK and securing a major contract with Saudi Entertainment Ventures, enhancing its market position and potential for revenue growth.

Bridgepoint Group

Overview: Bridgepoint Group plc operates as a private equity and private credit firm focusing on various investment strategies in the middle market, with a market capitalization of approximately £1.72 billion.

Operations: The company generates revenue through three main segments: Central (£3.80 million), Private Credit (£64.50 million), and Private Equity (£252.30 million).

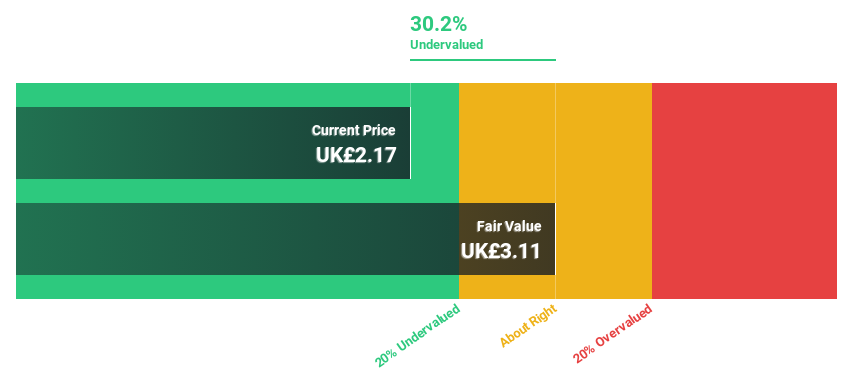

Estimated Discount To Fair Value: 30.2%

Bridgepoint Group, trading at £2.17, is markedly undervalued with a fair value estimate of £3.11, reflecting a significant discount. The company's earnings are projected to grow by 29.5% annually, outstripping the UK market prediction of 13.1%. Despite lower profit margins year-over-year—22% compared to last year’s 39.2%—revenue growth is also robust at 17.9% annually, well above the market average of 3.7%. Recent leadership changes include Tim Score's appointment as Chair effective July 2024, succeeding founder William Jackson.

XPS Pensions Group

Overview: XPS Pensions Group plc operates in the UK, offering employee benefit consultancy and related services, with a market capitalization of approximately £566.57 million.

Operations: The company generates revenue primarily from its Pension and Employee Benefit Solutions segment, totaling £184.11 million.

Estimated Discount To Fair Value: 17.2%

XPS Pensions Group, priced at £2.75, is considered undervalued against a fair value estimate of £3.32, trading 17.2% below its intrinsic value based on discounted cash flows. The company's earnings are anticipated to expand by 27.62% annually over the next three years, significantly outpacing the UK market forecast of 13.1%. However, despite a robust forecasted return on equity of 22.8%, XPS faces challenges with high debt levels and a dividend coverage that is less than ideal.

Seize The Opportunity

Discover the full array of 65 Undervalued UK Stocks Based On Cash Flows right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:ACSOLSE:BPT LSE:XPS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance