June 2024 Insight Into ASX Growth Companies With High Insider Ownership

As the ASX200 shows resilience, climbing ahead of the King’s birthday public holiday, investors are taking note of sectors reacting to global economic shifts, such as Consumer Discretionary's rise following international interest rate cuts. In this climate, understanding the significance of high insider ownership can offer insights into companies with potentially strong foundational confidence and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

We're going to check out a few of the best picks from our screener tool.

Emerald Resources

Simply Wall St Growth Rating: ★★★★☆☆

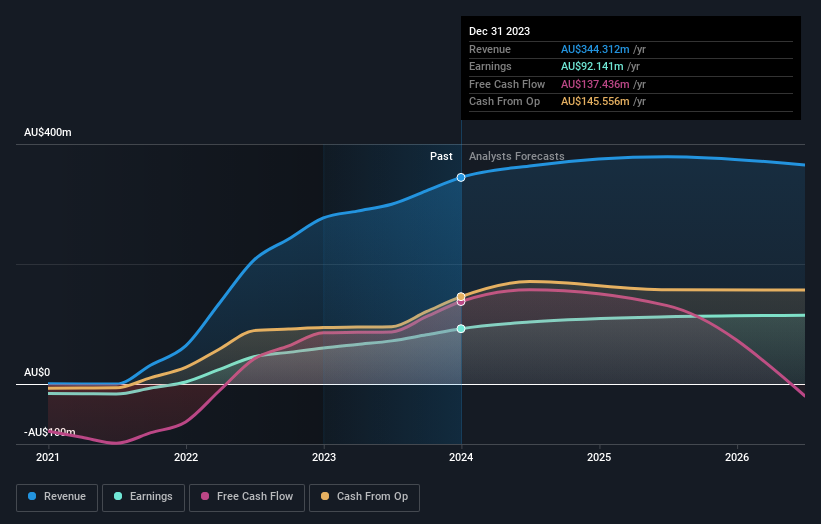

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.50 billion.

Operations: The company generates revenue primarily from mine operations, totaling approximately A$339.32 million.

Insider Ownership: 18.5%

Emerald Resources is positioned for robust growth, with earnings and revenue forecasted to outpace the Australian market at 22.75% and 19.4% per year, respectively. Despite high growth projections, the company's Return on Equity is expected to remain low at 17.8%. Additionally, shareholders have experienced dilution over the past year. There has been no significant insider trading in the past three months, indicating stable insider confidence amidst these financial dynamics.

Dive into the specifics of Emerald Resources here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Emerald Resources' share price might be too optimistic.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

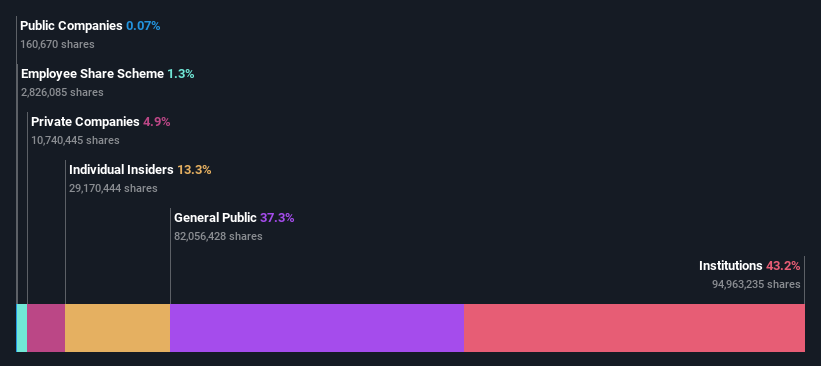

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions globally, with a market capitalization of A$4.26 billion.

Operations: The company generates A$1.28 billion from its leisure segment and A$1.06 billion from its corporate travel services.

Insider Ownership: 13.3%

Flight Centre Travel Group, recently added to the S&P/ASX 100 Index, shows promising financial dynamics with earnings forecasted to grow by 18.98% annually and revenue growth projected at 9.7% per year, outpacing the Australian market's average. Despite trading at a significant discount of 22% below its estimated fair value, its Return on Equity is expected to reach a high of 21.7%. However, this growth is tempered by revenue increases not meeting the high-growth threshold of over 20%.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software company that offers a range of integrated business solutions, primarily in Australia and internationally, with a market capitalization of approximately A$5.94 billion.

Operations: The company generates revenue through three main segments: software sales contributing A$317.24 million, corporate services adding A$83.83 million, and consulting services at A$68.13 million.

Insider Ownership: 12.3%

Technology One, an Australian software company, demonstrates robust financial health with a Return on Equity forecasted at 32.6% in three years. Its earnings have increased by 13.1% over the past year and are expected to grow by 14.34% annually, surpassing the Australian market's average growth rate of 13.9%. However, its revenue growth rate of 11.1% per year, though above the market average of 5.3%, does not reach the high-growth benchmark of over 20%. The company maintains competitive pricing with a Price-To-Earnings ratio below industry average at A$54.20x.

Seize The Opportunity

Discover the full array of 91 Fast Growing ASX Companies With High Insider Ownership right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:FLT and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance