JSE Leads Our Trio Of Top Dividend Stocks

As global markets exhibit a mix of rising indices in the U.S. and political uncertainties in Europe, investors are navigating a complex landscape. Amid these conditions, dividend stocks remain a cornerstone for those seeking potential stability and steady returns. In this environment, understanding the characteristics that define strong dividend stocks—such as robust financial health, consistent dividend history, and resilience in various market conditions—is crucial for investors aiming to enhance their portfolios effectively.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.13% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.62% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.47% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.95% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.48% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.90% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.20% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.38% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

JSE

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JSE Limited is a multi-asset class stock exchange based in South Africa, with a market capitalization of approximately ZAR 9.11 billion.

Operations: JSE Limited generates revenue through various segments including Index Fees (ZAR 80.13 million), Collocation Fees (ZAR 42.61 million), Market Data Fees (ZAR 368.29 million), JSE Clear Revenue (ZAR 111.94 million), Equity Market Fees (ZAR 487.62 million), Primary Market Fees (ZAR 161.33 million), Issuer Services Fees (ZAR 10.82 million), Funds under Management (ZAR 103.71 million), Equity Derivatives Fees (ZAR 116.90 million), Currency Derivatives Fees (ZAR 36.69 million), Interest Rate Market Fees (ZAR 85.44 million), Back-Office Services - BDA - ZAR368,337,000 Commodity Derivatives Fee: ZA79,68500000 JSE Investor Servic Fee: ZA19010400000 JSE Private Placement Fee: ZA1,19400000 Clearing and Settlement Fee: ZA41133100000 Strate AD Valorem-Fee-Bond: A20,955 Bond Electronic Trading Platform ETP): A9,021 Strate AD Valorem-Fee-Cash Equitie : A127477

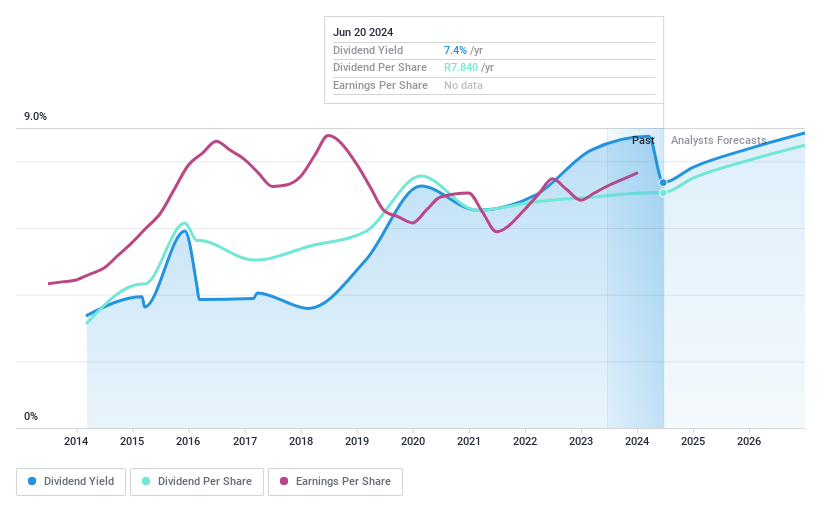

Dividend Yield: 7.4%

JSE's dividend yield of 7.36% trails the top quartile in South Africa, marked at 8.43%. Despite a decade of increasing dividends, JSE's payouts have shown volatility and inconsistency, with significant annual fluctuations over 20%. Financially, the dividends are supported by both earnings and cash flows, with payout ratios of 76.9% and cash payout ratios at 71.1%, respectively. Recent board changes could impact future financial strategies but aren't directly tied to dividend policies as yet.

Spur

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spur Corporation Ltd is a restaurant franchisor operating both in South Africa and internationally, with a market capitalization of approximately ZAR 2.69 billion.

Operations: Spur Corporation Ltd generates revenue through various segments, including ZAR 2.38 billion from Manufacturing and Distribution, ZAR 310.17 million from Franchise Spur, and smaller contributions from Franchise Panarottis (ZAR 40.81 million), Franchise Roco-Mamas (ZAR 46.79 million), and Franchise John Dory's (ZAR 20.06 million) among others in South Africa, with additional international revenues like ZAR 59.81 million from the Rest of Africa and Middle East.

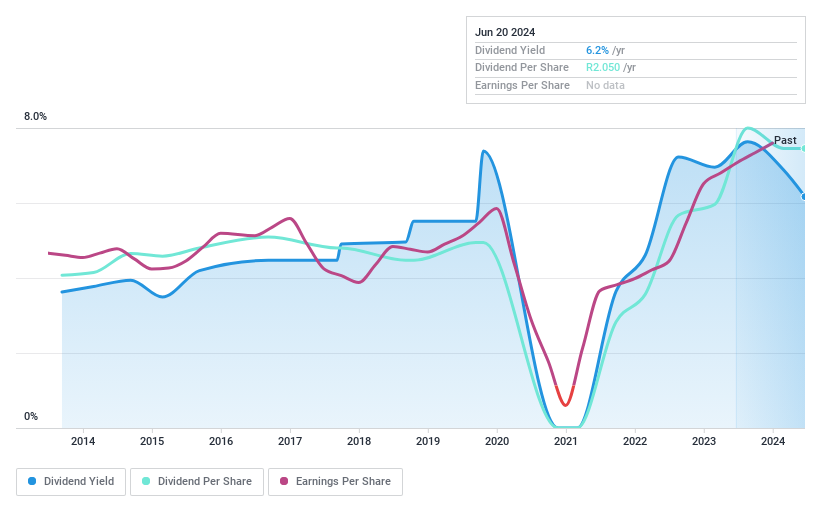

Dividend Yield: 6.2%

Spur has shown a 17.8% earnings growth over the past year, supporting its dividend payments with a payout ratio of 72.6% and a cash payout ratio of 71.9%. Despite this, Spur's dividends have been inconsistent, experiencing significant volatility over the last decade. Moreover, its current dividend yield of 6.17% is below the top quartile average in South Africa's market at 8.43%, indicating potential competitiveness issues within high-yield sectors.

Delve into the full analysis dividend report here for a deeper understanding of Spur.

Our valuation report unveils the possibility Spur's shares may be trading at a premium.

Ruby Tech

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ruby Tech Corporation, based in Taiwan, specializes in manufacturing and selling networking products with a market capitalization of NT$4.07 billion.

Operations: Ruby Tech Corporation generates its revenue primarily from the computer and peripheral equipment segment, totaling NT$1.84 billion.

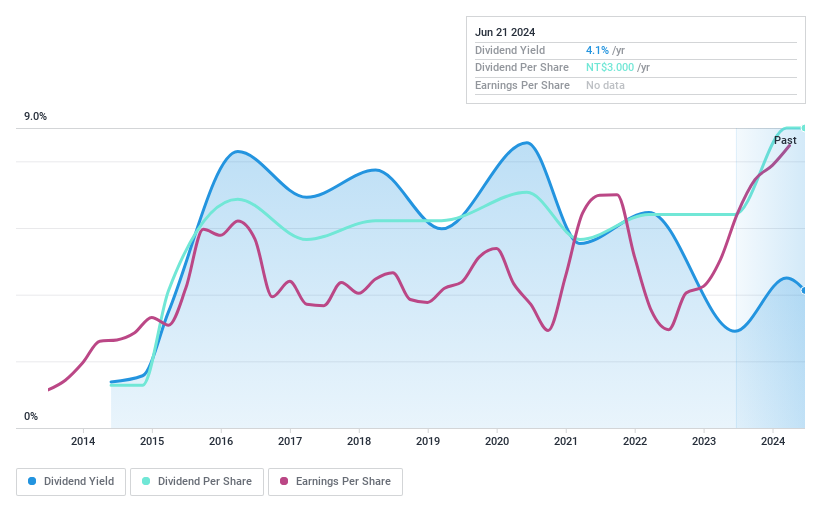

Dividend Yield: 4.1%

Ruby Tech's dividend sustainability is under scrutiny with a 10-year history of volatile payouts, despite a payout ratio of 63.7% and cash payout ratio of 67.7% indicating coverage by earnings and cash flows respectively. Recent financials show robust growth with net income rising to TWD 58.91 million from TWD 40.4 million year-over-year, supporting dividends currently at a yield of 4.13%, slightly below the top quartile in its market at 4.22%.

Summing It All Up

Discover the full array of 1964 Top Dividend Stocks right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include JSE:JSE JSE:SUR and TPEX:8048.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance