How inflation took a bite out of workers' wages as they rose over the past decade

There's a stark difference when 32-year-old Olivia Polk compares her life to how her mom's looked at the same age.

In terms of owning a home and a car, or having a family, "I don't have any of those things, and I don't imagine that I will any time soon," she said.

Until recently, Polk worked for a Halifax organization that provides affordable housing, saw herself as middle class and made well above minimum wage.

But despite sharing living expenses with her partner, she said they still live paycheque to paycheque and that her wages haven't kept up with rising prices.

"No matter which way we spin it, it always feels like we're ... just kind of holding on until the next payday," said Polk, who recently lost her job.

When prices rise faster than wages do, workers essentially experience a wage decrease, with their paycheques not going as far as before. Polk is among those in Canada who have experienced this over the last few years.

Analysis of Statistics Canada data by CBC News shows that as inflation rose sharply beginning in 2021, the actual value of hourly wages — what some economists call "real wages" — declined for many people in Canada.

From 2020 to 2022, the median hourly real wage in Canada fell by nearly five per cent.

Pandemic delivered 'shock' to labour market

"Typically in Canada, you would see real wages growing by around one per cent" a year due to improved technology and productivity in the economy, economist Jim Stanford said.

"However, the COVID pandemic created quite a shock in labour markets ... [and the rise in] inflation really disrupted that normal pattern."

Some of the wage decrease in the data reflects the return of low-income jobs, said Stanford, who is director of the labour-focused think-tank Centre for Future Work.

After those jobs were disproportionately lost at the start of the COVID-19 pandemic in 2020, higher-income jobs remained, pushing up the median wage.

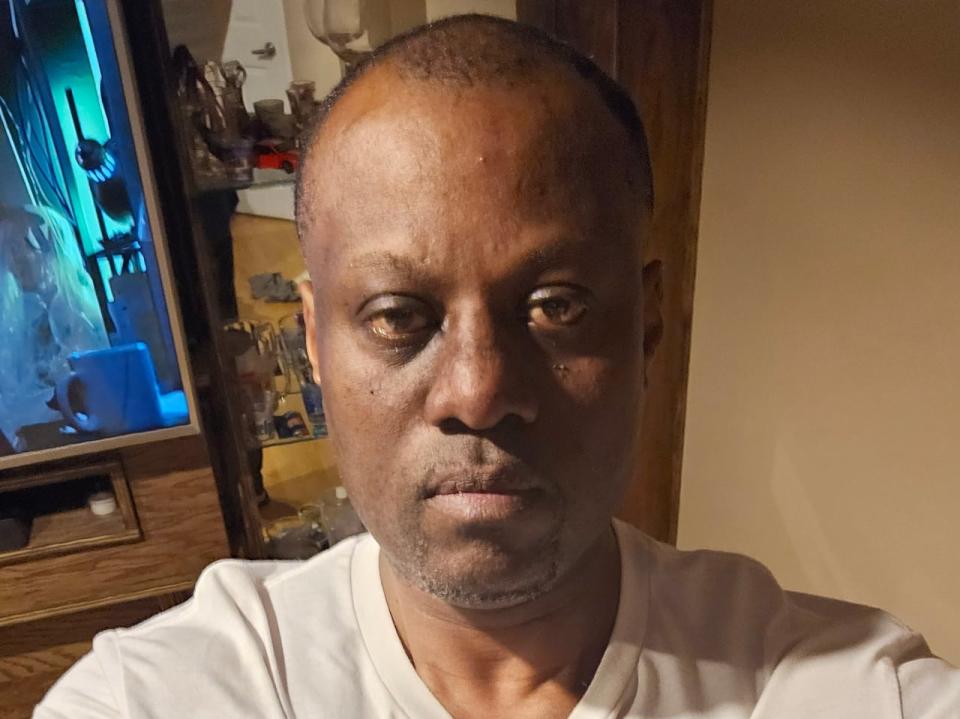

For 52 year-old Paul Anglade, who is a cleaner in Ottawa, it takes two jobs to make ends meet. And he's not the only one among his co-workers who has to take on extra work.

"They all been doing two jobs and it's still tough ... to be surviving," he said. But at the same time, "we have to do what we have to do."

Real wages did show signs of recovery in 2023, rising 2.5 per cent to a median of $28.75 an hour.

Fabian Lange, an economics professor at McGill University in Montreal, attributes this increase to a "tight" labour market, where there was relatively low unemployment and employers were eager to hire.

"People were actually moving up a job ladder," Lange said. "If they were holding jobs, they started to get raises that [were] outpacing inflation." Inflation also slowed in 2023.

Lower unemployment also meant workers were in a position to demand higher wages from employers, Stanford said.

With unions, he said, "we saw some very tough wage bargaining happening in both the public sector and the private sector in all parts of Canada."

Polk, who was working with a Halifax housing support non-profit, had helped unionize her workplace. She said one reason she and her colleagues decided to unionize was to fight for equitable salary increases.

"By coming together as a collective, I think that's one of the only ways we have right now to guarantee any kind of financial future for ourselves."

Those earning less 'pay the highest price'

Inflation also doesn't have equal impacts, said researcher María José Yax-Fraser. "In any moment of inflation, of precarity, it is always those who have less that pay the highest price."

Yax-Fraser recently co-authored a report for the Canadian Centre for Policy Alternatives examining the experiences of immigrant and migrant women in Nova Scotia who were working low-wage, essential jobs during the COVID-19 pandemic.

Those women disproportionately work in home care/long-term care and the food-provision sector — which often pay minimum wage — and will have the most trouble paying today's higher prices, Yax-Fraser said.

Immigrant and migrant women, she said, can be pushed into more precarious jobs because their work experience or credentials from abroad can be seen as less valuable than Canadian experience.

LISTEN | How immigrant and migrant women with low-wage jobs fared during pandemic:

Alberta and Saskatchewan are the only provinces where real wages decreased over the last decade.

In 2023, half the workers in Alberta made $30 an hour or less. Accounting for inflation, this was $1.74 per hour — or 5.5 per cent — less than a decade ago.

One factor driving this in Alberta is that both the proportion and the number of workers in the natural resources sector were lower in 2023 than a decade ago, said Andrew Fields, a Labour Force Survey analyst with Statistics Canada.

Last year, the median wage in that sector was 60 per cent higher than for employees overall in the province, according to the statistics agency.

The year 2013 "was basically a high point for [the natural resources] sector in Alberta," Fields said. Over the next few years, "there were big employment declines," he said, pointing to a major drop in oil prices that began in 2014 as one reason for the loss of jobs.

Overall, people in Canada have higher wages than a decade ago. Since 2013, the median hourly real wage rate has grown by just under one per cent on average each year.

That does not mean wages are sufficient to meet the cost of living, however. In Nova Scotia, for example, half the workers earned $24.62 per hour or less in 2023.

That year, the living wage in the province ranged from $22.85 to $26.50 per hour, according to the Canadian Centre for Policy Alternatives.

After the start of the COVID-19 pandemic, when some people in essential jobs were given temporary pay increases, "we didn't learn ... that the essential workers deserve a living wage," Yax-Fraser said.

They deserve an "income that not only recognizes [them] as essential, but also that recognizes people as human beings."

Yahoo Finance

Yahoo Finance