High Insider Ownership Marks These US Growth Companies In June 2024

Despite recent fluctuations, with tech stocks experiencing a slump and the broader indices showing mixed results, the U.S. stock market continues to be a hub of activity and opportunity. High insider ownership in growth companies often signals strong confidence from those who know the company best, making such stocks potentially attractive in these volatile market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.5% | 21.5% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Super Micro Computer

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture, serving clients globally with a market cap of approximately $53.87 billion.

Operations: The company generates its revenue primarily from the development and provision of high-performance server solutions, totaling $11.82 billion.

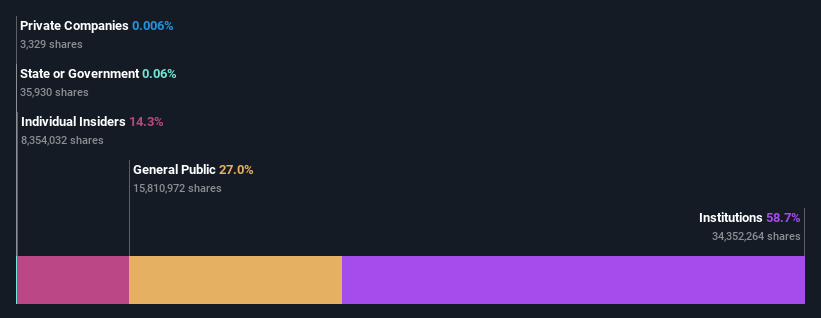

Insider Ownership: 14.3%

Super Micro Computer, a key player in the high-growth tech sector with significant insider ownership, is expanding its Silicon Valley footprint to meet rising demand for AI-capable liquid-cooled data centers. This strategic move aligns with recent product launches like the AMD EPYC 4004 CPU servers, enhancing its competitive edge in dense computing solutions. Despite some volatility and shareholder dilution over the past year, Super Micro's robust revenue and earnings growth projections underscore its potential amidst operational expansions and innovations.

Daqo New Energy

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daqo New Energy Corp., operating in the People’s Republic of China, specializes in manufacturing and selling polysilicon for photovoltaic product manufacturers, with a market capitalization of approximately $1.21 billion.

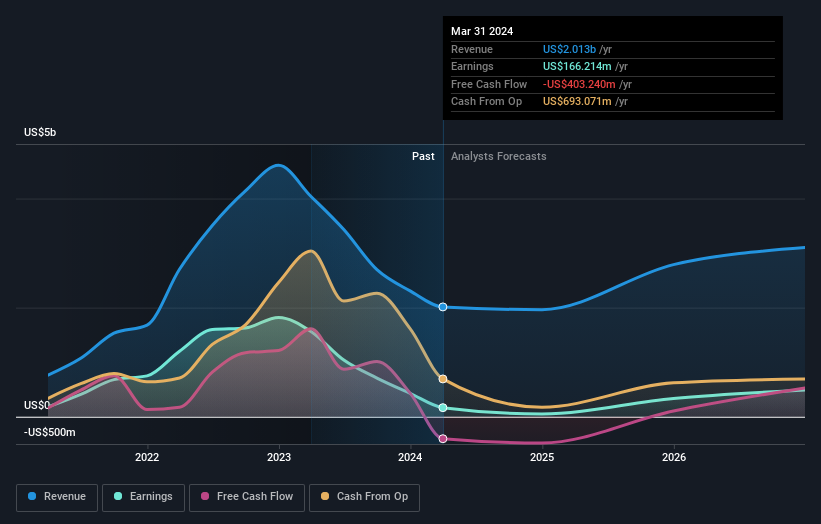

Operations: The company generates its revenue primarily from the sale of polysilicon, amounting to $2.01 billion.

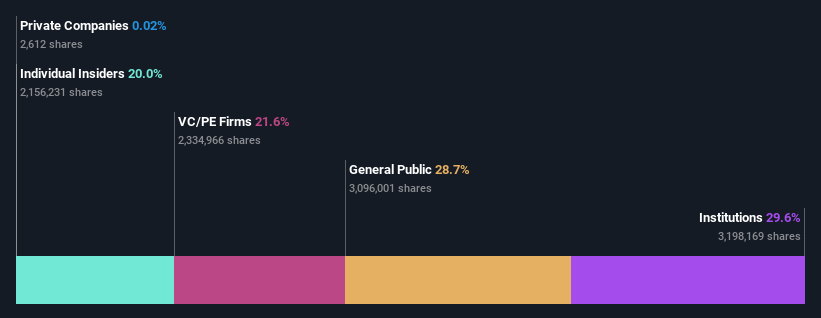

Insider Ownership: 28.7%

Daqo New Energy, amid a backdrop of substantial market shifts, reported a significant decline in quarterly earnings and sales from the previous year, with net income dropping to US$15.47 million from US$278.8 million. Despite this downturn, the company is optimistic about its operational expansions, including the upcoming pilot production at its new Inner Mongolia facility which is expected to enhance polysilicon production volumes by up to 50% compared to 2023. This growth initiative could bolster future performance despite current profitability challenges and a highly volatile share price.

MoneyLion

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MoneyLion Inc. is a financial technology company offering personalized products and financial content to American consumers, with a market capitalization of approximately $849.22 million.

Operations: The company generates revenue primarily through its Data Processing segment, amounting to $450.77 million.

Insider Ownership: 19.7%

MoneyLion, a U.S. fintech company, has demonstrated robust financial recovery and growth prospects. In Q1 2024, it reported a significant revenue increase to US$121.01 million from US$93.67 million the previous year, turning a net loss into a profit of US$7.08 million. Forecasted annual earnings growth is strong at 133.3%, with revenue expected to grow by 19.5% per year, outpacing the U.S market average of 8.7%. Despite this positive trajectory, insider activity has been mixed with more shares sold than bought in recent months, and the company's share price remains highly volatile.

Click to explore a detailed breakdown of our findings in MoneyLion's earnings growth report.

Our valuation report here indicates MoneyLion may be overvalued.

Turning Ideas Into Actions

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 182 companies by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:SMCI NYSE:DQ and NYSE:ML.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance