High Insider Ownership Growth Stocks To Watch In June 2024

As global markets continue to navigate through a mix of economic signals, with the S&P 500 reaching new highs and mixed performance across other major indices, investors are keenly watching for opportunities that align with broader market trends. In this context, growth companies with high insider ownership can be particularly intriguing, as significant insider stakes often signal confidence in the company's future prospects amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34% | 28.7% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Gaming Innovation Group (OB:GIG) | 20.2% | 36.2% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

Here we highlight a subset of our preferred stocks from the screener.

Merdeka Battery Materials

Simply Wall St Growth Rating: ★★★★☆☆

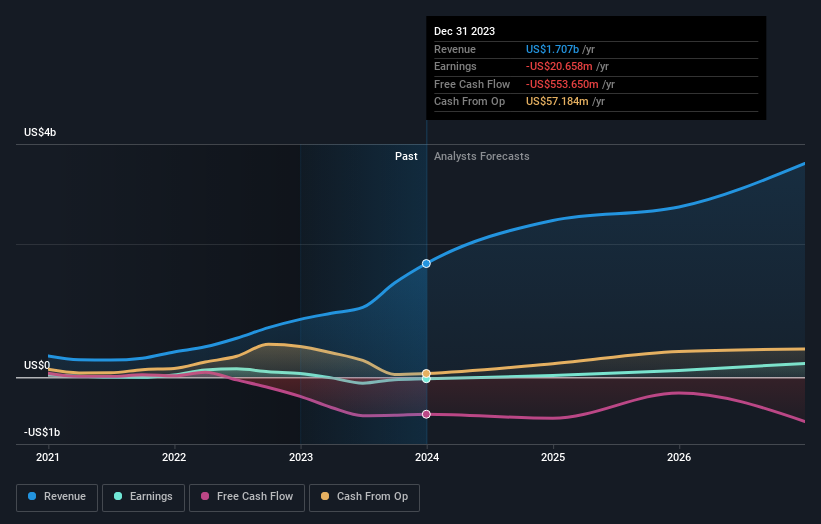

Overview: PT Merdeka Battery Materials Tbk focuses on the mining and processing of nickel, cobalt, and other minerals, with a market capitalization of approximately IDR 59.94 trillion.

Operations: The company generates revenue primarily from its manufacturing segment, totaling approximately $1.61 billion.

Insider Ownership: 16%

Merdeka Battery Materials recently transitioned from a loss to profitability, with its latest quarterly net income reaching US$3.67 million compared to a net loss previously. Analysts expect the company's earnings to grow significantly at 58.5% annually, outpacing the Indonesian market forecast of 30.6%. Despite this robust growth and positive turnaround, MBMA's forecasted return on equity remains modest at 13%, reflecting potential challenges in efficiency or capital allocation. Moreover, the stock is subject to high volatility and has seen substantial fixed-income offerings that could impact its financial structure.

Merdeka Copper Gold

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PT Merdeka Copper Gold Tbk operates in the mining sector within Indonesia, focusing on copper and gold extraction, with a market capitalization of approximately IDR 56.14 billion.

Operations: The firm primarily generates its income from the extraction of copper and gold in Indonesia.

Insider Ownership: 11.1%

PT Merdeka Copper Gold Tbk is navigating a challenging phase with significant recent losses, reporting a net loss of US$15.23 million in Q1 2024 despite a sharp increase in sales to US$541.05 million from US$214.21 million year-over-year. Nonetheless, the company is poised for growth with revenue expected to outpace the Indonesian market and profitability forecasted within three years. This growth trajectory, combined with its recent high-profile presentations at international conferences, underscores its potential amidst current financial volatilities.

Notion VTec Berhad

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Notion VTec Berhad is an investment holding company specializing in the design, manufacture, and sale of precision components and tools, with a market capitalization of approximately MYR 1.24 billion.

Operations: The company specializes in the precision components and tools sector.

Insider Ownership: 35.7%

Notion VTec Berhad has shown a significant turnaround with recent earnings reporting a net income of MYR 14.04 million for Q2 2024, contrasting sharply with a net loss from the previous year. This recovery is underscored by a robust sales increase to MYR 111.6 million from MYR 84.69 million year-over-year for the same quarter. The company's revenue growth is expected to surpass the Malaysian market average, with forecasts suggesting strong annual increases and profitability within three years, aligning well with high insider ownership that could indicate confidence in sustained growth and governance stability.

Summing It All Up

Unlock our comprehensive list of 1447 Fast Growing Companies With High Insider Ownership by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include IDX:MBMAIDX:MDKAKLSE:NOTION and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance