Here's Why We Think Dynacor Group (TSE:DNG) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Dynacor Group (TSE:DNG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Dynacor Group

How Fast Is Dynacor Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Dynacor Group has achieved impressive annual EPS growth of 59%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

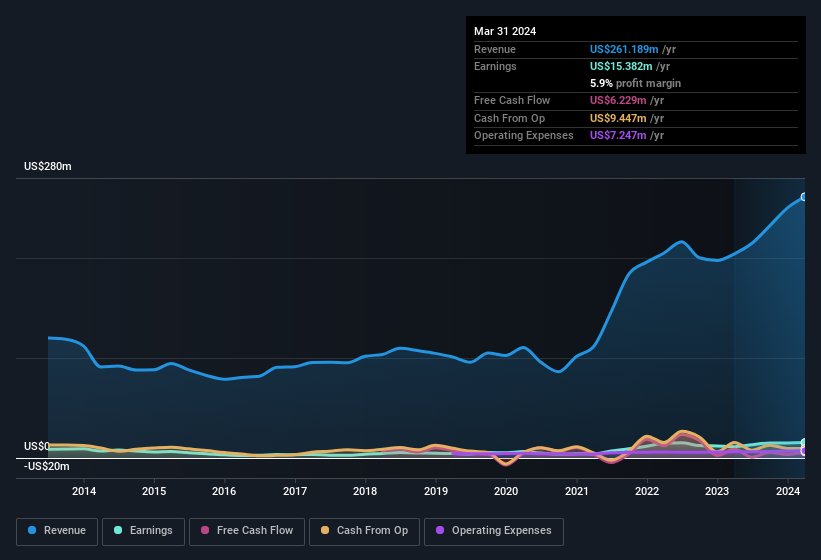

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Dynacor Group maintained stable EBIT margins over the last year, all while growing revenue 28% to US$261m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Dynacor Group is no giant, with a market capitalisation of CA$196m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Dynacor Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders both bought and sold Dynacor Group shares in the last year, but the good news is they spent US$7.9k more buying than they netted selling. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the company insider, Maria del Rodriguez Espinoza, who made the biggest single acquisition, paying CA$67k for shares at about CA$3.97 each.

Does Dynacor Group Deserve A Spot On Your Watchlist?

Dynacor Group's earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over Dynacor Group could be in your best interest. We don't want to rain on the parade too much, but we did also find 1 warning sign for Dynacor Group that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Dynacor Group, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance