Here's Why Investors Should Retain Boyd Gaming (BYD) Stock

Boyd Gaming Corporation BYD will likely benefit from the expansion initiatives, Pala Interactive acquisition and interactive gaming platform. This and focus on the Las Vegas market bode well. However, inflationary pressures are a concern.

Let us discuss the factors highlighting why investors should retain the stock for the time being.

Factors Driving Growth

Boyd Gaming focuses on expanding its portfolio by strengthening current operations and growing through capital investment and other strategic measures. The company extensively depends on acquisitions as a strategy to expand its brand presence. In July 2022, the company stated to have initiated work on developing a land-based facility at Treasure Chest. Also, it stated progress with respect to the expansion of the Fremont Hotel and Casino and the Sky River Casino site. The projects include enhancements of gaming and non-gaming amenities, including expanding Casino space and the addition of appealing quick-serve restaurants. Going forward, the company remains optimistic in this regard and anticipates the initiatives to boost its customer base and traffic in the upcoming periods.

Apart from land-based investments, the company is inclined toward the acquisition of Pala Interactive to boost its online gaming strategy. Backed by the latter’s technology (featuring a player account management system and iGaming products) and its operational and marketing expertise, the initiative allows the company to fortify its position in the emerging iGaming opportunity. The company anticipates closing the deal by first-quarter 2023.

Boyd Gaming has been witnessing a solid performance in its interactive gaming platform. Thanks to its strategic partnership with FanDuel, the company is optimistic regarding its future in the iGaming industry. The company emphasized on online gaming prospects in Kansas and Ohio. It anticipates launching FanDuel retail and mobile sportsbooks in the state by 2022-end, subject to regulatory approvals. Given the growth opportunities related to the expansion in new markets and digital opportunities in online casino gaming, the company anticipates EBITDAR (from its online operations) to exceed $30 million in 2022.

Boyd Gaming considers the local market in Las Vegas as a major driver for its portfolios. With restaurants and bars open, frequent visitations by locals are likely to drive growth for the company. During second-quarter 2022, revenues in the Las Vegas Locals segment amounted to $236.5 million compared with $236.1 million reported in the prior-year quarter. Notably, an increase in Hawaiian visitation and return of destination travel added to the upside. Going forward, the company emphasized on streamlining of cost structure to drive growth in the upcoming periods.

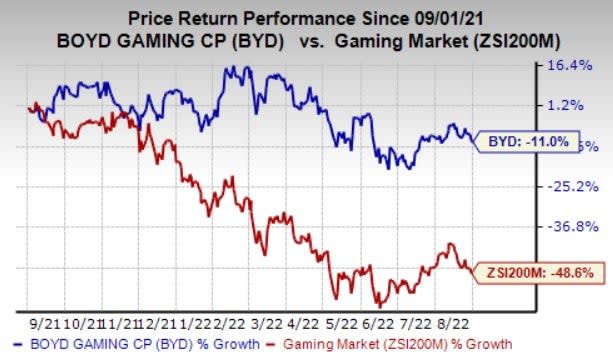

In the past year, shares of Boyd Gaming have declined 11% compared with the industry’s fall of 48.6%.

Image Source: Zacks Investment Research

Concerns

Although most of the properties have reopened, potential resurgences or new variants of the virus might hurt the company in the upcoming periods. Since the pandemic’s severity, duration and impact cannot be ascertained, the possibility of additional business disruptions, lower customer traffic and reduced operations cannot be ruled out.

Boyd Gaming has been grappling with higher expenses across gaming, food and beverage, room, and other offerings. Total operating costs and expenses in second-quarter 2022 increased 3.5% year over year to $649.4 million. The downside was primarily driven by inflationary pressures related to supply chain issues, higher gas prices and utility costs. For 2022, the company anticipates operating expenses to remain elevated owing to a rise in minimum wage rates and utility costs.

Zacks Rank & Key Picks

Boyd Gaming currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Marriott Vacations Worldwide Corporation VAC, Marriott International, Inc. MAR and Choice Hotels International, Inc. CHH.

Marriott Vacations sports a Zacks Rank #1. VAC has a trailing four-quarter earnings surprise of negative 13.9%, on average. The stock has declined 5.5% in the past year.

The Zacks Consensus Estimate for VAC’s current financial year sales and EPS indicates an increase of 19.7% and 131.4%, respectively, from the year-ago period’s reported levels.

Marriott carries a Zacks Rank #2 (Buy). MAR has a trailing four-quarter earnings surprise of 18.6%, on average. The stock has increased 14% in the past year.

The Zacks Consensus Estimate for MAR’s current financial year sales and EPS indicates growth of 46.1% and 102.8%, respectively, from the year-ago period’s reported levels.

Choice Hotels carries a Zacks Rank #2. CHH has a trailing four-quarter earnings surprise of 11.2%, on average. The stock has declined 4.3% in the past year.

The Zacks Consensus Estimate for CHH’s current financial year sales and EPS indicates growth of 219% and 19.6%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance