Here's Why Commerce Bancshares (CBSH) is Worth Betting On

Commerce Bancshares, Inc. CBSH is well-positioned for growth on the back of decent loan demand, high interest rates and its balance sheet repositioning strategy. Moreover, higher liquidity and non-interest income growth will further aid financials.

Over the past 30 days, the Zacks Consensus Estimate for both 2024 and 2025 earnings has moved marginally upward. CBSH currently carries a Zacks Rank #2 (Buy).

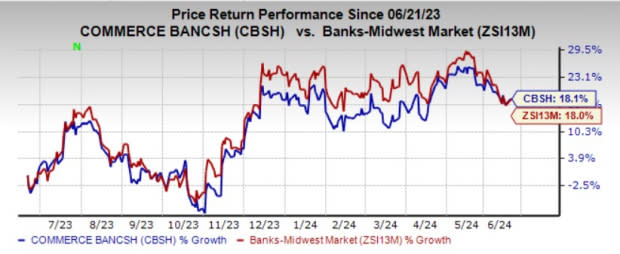

Over the past year, shares of Commerce Bancshares have gained 18.1%, marginally outperforming the industry’s rise of 18%.

Image Source: Zacks Investment Research

Let’s dive deeper into the reasons that make CBSH stock worth betting on now.

Earnings Growth: Commerce Bancshares witnessed earnings growth of 9% over the past three to five years. This was driven by the company’s organic growth strategy, solid customer relationships and strong risk management.

Our projections for earnings indicate a 5.9% decline in 2024, with a subsequent recovery in 2025 and 2026, with year-over-year growth of 1% and 6.9%, respectively.

Revenue Strength: Driven by growth in loan demand and fee income, Commerce Bancshares’ total revenues witnessed a compound annual growth rate of 3.5% over the last five years (2018-2023). The trend continued in the first quarter of 2024 as well. Organic growth measures and a high interest rate scenario are likely to support top-line expansion, though rising funding costs will weigh on it to some extent.

Further, its balance sheet repositioning strategy is likely to boost net interest income through the sale of debt securities and reinvesting the proceeds at higher yields.

Our estimates for total revenues indicate 1.1%, 2.1% and 2.7% growth in 2024, 2025 and 2026, respectively.

Strong Balance Sheet: As of Mar 31, 2024, CBSH’s total cash and cash equivalents (consisting of cash and due from banks and interest-earning deposits with banks) were $1.9 billion. Total debt (comprising other liabilities and other borrowings) was $464.1 million. Hence, a solid liquidity position allows the company to address its near-term obligations.

Impressive Capital Distributions: Commerce Bancshares’ capital distribution activities are encouraging. The company has been paying a 5% stock dividend over the past 25 years, with the most recent one announced in December 2023. Moreover, the company has been consistently paying quarterly cash dividends and has an existing share repurchase plan in place. As of Mar 31, 2024, roughly 1 million shares remained available under the authorization. Additionally, this April, the company announced an incremental authorization of up to 5 million shares.

Given its decent earnings strength and strong liquidity position, the company is expected to continue efficient capital distributions, thus enhancing shareholder value.

Superior Return on Equity (ROE): CBSH’s trailing 12-month ROE reflects its superiority in terms of utilizing shareholders’ funds. The company’s ROE of 16.78% compares favorably with 11.6% of the industry.

Other Bank Stocks to Consider

Some other top-ranked stocks from the banking space worth a look are First Financial Bancorp. FFBC and UMB Financial Corporation UMBF, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FFBC’s current-year earnings has moved 5.2% north over the past 60 days. Shares of the company have lost 10.6% in the past six months.

The Zacks Consensus Estimate for UMBF’s 2024 earnings has moved 14.4% upward in the past two months. Over the past six months, shares of the company have lost 1.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

First Financial Bancorp. (FFBC) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance