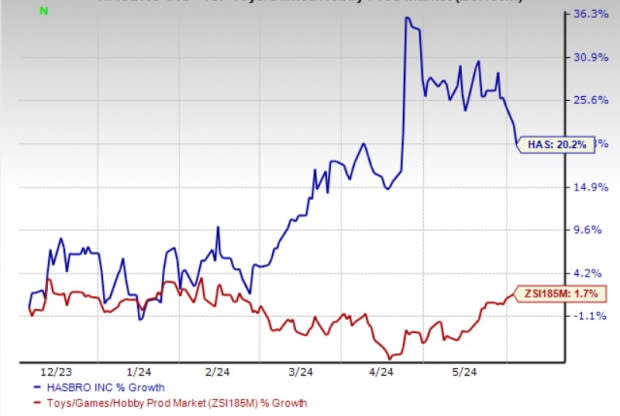

Hasbro (HAS) Up 20% in 6 Months: What's Driving the Stock?

Shares of Hasbro, Inc. HAS had surged 20.2% in the past six months, outpacing the industry's modest 1.7% growth. The company's momentum was fueled by its innovative product and content launches within the Dungeons & Dragons universe. Moreover, its strategic shift toward an asset-light entertainment model, coupled with key partnerships with Playmates, LEGO, Converse and Black Milk Apparel, along with a robust product lineup, contributed positively.

The Zacks Rank #1 (Strong Buy) company’s earnings in 2024 and 2025 are likely to increase 45.8% and 14% year over year, respectively. Long-term projections suggested a solid growth trajectory with an expected earnings increase of 17.1%.

Growth Drivers

Hasbro continues to invest in innovation, focus on strategic partnerships or collaborations and implement other profitable sales-boosting initiatives. It partnered with Paramount to enhance storytelling and content capabilities. Further, the company invested in Boulder Media — the company's animation studio — and increased digital capacities to drive sales. Hasbro continues to release the Transformers Franchise in all forms of entertainment, including movies, television and digital expressions.

Furthermore, the company announced another strategic relationship with Playmates to produce and distribute Power Rangers toys from 2025. Hasbro expressed the importance of its retail and licensing partnerships, which highlighted its collaboration expansion with the Walt Disney Company along with Amazon in March 2024. This collaboration was intended to create a Star Wars experience at its first-ever March to May 4th event. Priorly, HAS partnered with the Walt Disney Company for a multiset Magic and Marvel collaboration.

Coming to the Gaming segment, within the first three months of 2024, Hasbro announced new licensing agreements with Resolution Games, renowned for the VR game Demeo and Game Loft, the makers of Disney Dreamlight Valley. Both partnerships were considered for game development under the Dungeons & Dragons universe. In the first quarter of 2024, the company witnessed the impressive performance of its mobile game MONOPOLY GO! from its partners Scopely, which grossed more than $2 billion in lifetime revenues and witnessed a record-breaking 150 million downloads. Also, the Baldur's Gate 3 video game from Larian Studios, which is based on Dungeons & Dragons' first edition, continues to show momentum into 2024 compared to last year, with even more recognition.

Apart from its toys and gaming business, Hasbro’s entertainment business also bodes well in contributing to its growth trends. Hasbro, in partnership with Paramount, is set to launch the star-studded animated film, Transformers 1, to theaters in September 2024. Also, in the first quarter of 2024, the company announced a deal with Lionsgate and Margot Robbie's production company, Lucky Chap, to produce a live-action Monopoly movie. Deal with the CW was highlighted for the creation of game shows around Trivial Pursuit and Scrabble. HAS is optimistic about its just-announced film and TV projects for Clue in collaboration with Sony.

The company witnessed strong gaming demand. Hasbro has a supreme gaming portfolio, and it is refining gaming experiences across a multitude of platforms like face-to-face gaming, tabletop gaming and digital gaming experiences on mobile. Given a strong product lineup and a greater focus on entertainment-backed products, Hasbro's Entertainment and Licensing segment is poised for growth. The company stated that it is currently investing in longer-term, larger gameplay. The company's gaming category, which includes Magic: The Gathering, NERF, Peppa Pig, My Little Pony, Transformers, Play-Doh and LEGO, as well as Hasbro products for the Marvel portfolio, are performing well.

Image Source: Zacks Investment Research

Other Key Picks

Here are other top-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has risen 49.3% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 58.2% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently sports a Zacks Rank of 1. AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock has increased 45.6% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance