Government releases 19 sites under 2H2024 GLS Programme

The new mixed-use site on the 2H2024 GLS Confirmed List is at Chencharu Close, a new HDB town in Yishun.

The government has announced the 2H2024 Government Land Sales (GLS) Programme, which comprises 10 sites on the Confirmed List and nine on the Reserve List. Together, these sites could yield about 8,140 private residential units, 1.22 million sq ft of commercial space, and 530 hotel rooms.

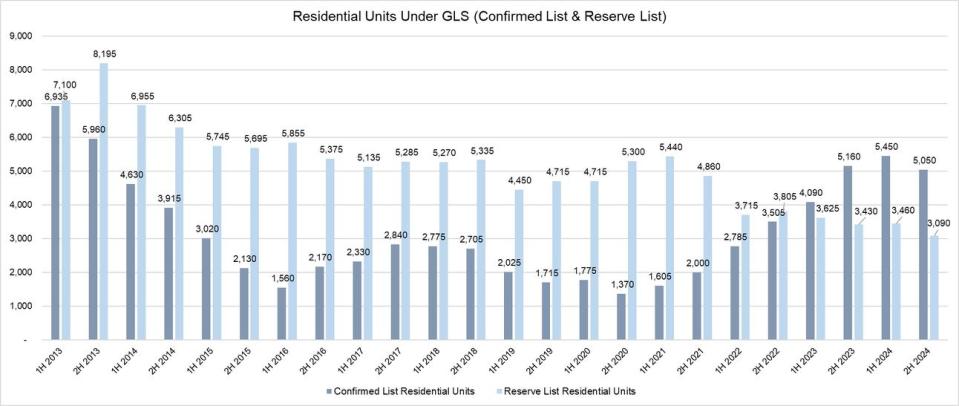

The 10 sites on the Confirmed List comprises eight private residential sites, an executive condo (EC) site, and a mixed-use commercial & residential site for development. In total, these sites could yield up to 5,050 private residential units and commercial gross floor area (GFA) of 153,868 sq ft.

Meanwhile, the Reserve List has three private residential sites, two EC sites, a commercial site, two White sites, and a hotel site that will be available for application. If these sites are launched for tender and awarded, they could yield an additional 3,090 private residential units (including 730 EC units), 1.07 million sq ft of commercial space, and 530 hotel rooms.

Read also: Government launches tender for mixed-use GLS site at Tampines St 94

A noteworthy site on the Reserve List is a 1.73ha White site at Marina Gardens Crescent. In February, the government rejected a $770.46 million bid submitted by a consortium comprising GuocoLand, Hong Leong Holdings, and TID (a joint venture between Hong Leong Holdings and Mitsui Fudosan). The GuocoLand-led consortium was the only party to submit a bid for the white site, but the bid price was assessed as too low by the government. The site is still available for application.

Table: URA

Private housing market stabilising: MND

In the press release on June 25 announcing the latest slate of GLS sites, the Ministry of National Development (MND) says “the private housing market has shown signs of stabilisation”, pointing out that the increase in private property prices moderated from an increase of 8.6% in 2022 to 6.8% in 2023.

MND adds that the market’s positive price momentum has eased with the ramp-up in the supply of private housing as part of the GLS programme over the past two years. The government has steadily increased the supply of private housing on the Confirmed List to 9,250 units in 2023 from 6,290 units in 2022, and from 3,605 units in 2021.

The supply of private residential housing introduced in the 2H2024 Confirmed List (5,050 units) is on a par to the 5,450 units released as part of the 1H2024 Confirmed List, says MND.

This means that 10,500 new private residential units would be injected into the market this year. Taking into account the 610 units from the activated Reserve List site at Zion Road (Parcel B), the total private housing supply of 11,110 units is the highest influx of new private housing supply coming into the market since 2013, says MND.

“In addition, the government will make available a selection of sites on the Reserve List that can yield an additional 3,090 units for developers to initiate for development if they assess that there is demand,” says MND. “The government will continue to release a steady supply of private housing in future GLS programmes to cater to demand, with supply calibrated every six months to account for prevailing economic and property market conditions.”

Read also: Wing Tai Holdings submits top bid of $1,325 psf ppr for residential GLS site at River Valley Green

Chart: PropNex Realty

Cautious bidding by developers

Although the pace of price increase in the private residential market has moderated from the surge in price growth a couple of years ago, market-watchers point out that some recent land tenders have seen relatively poor participation and cautious bidding.

Wong Xian Yang, head of research, Singapore and Southeast Asia, at Cushman & Wakefield, says that the relatively poor participation and cautious bidding from developers come amid heightened development risks and weakening sales volumes. “Against this backdrop, the government has continued to push out substantial new housing supply via the Confirmed List though at a moderate pace,” he says.

This sentiment was echoed by Marcus Chu, CEO of ERA Singapore, who notes that prevailing factors such as the high interest-rate environment, economic uncertainty, and slower new-home sales amidst tighter home buyer affordability may lead to developers becoming more selective and exercising more prudence in their bids.

Potential new launches awarded from sites in the 2H2024 GLS programme would only come to market in 2026 and “would not have an immediate impact on prices”, says Wong. “With more launches coming onstream, buyers would remain selective and quantum-sensitive given still-high interest rates.”

Mohan Sandrasegeran, head of research & data analytics at SRI, says that the supply of new housing in the 2H2024 GLS programme is a more “measured” approach. “This marks a strategic adjustment in response to market conditions” and is a timely adjustment that responds to the current stock of unsold units in the private residential market, he adds.

There have been three consecutive quarters of increases in uncompleted unsold private residential units. There were 19,936 uncompleted and unsold private residential units in 1Q2024, a quarterly increase of 17.8% compared to the 16,929 unsold units in 4Q2023.

Read also: Residential site at Margaret Drive launched for sale

Six new GLS sites introduced

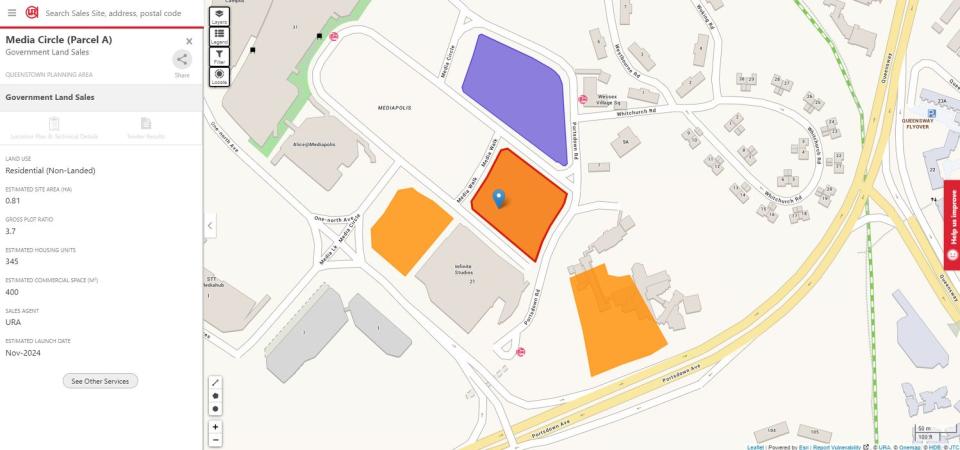

The Confirmed List of the 2H2024 GLS programme introduced six new development sites — Faber Walk, Media Circle (Parcel A), Media Circle (Parcel B), Chuan Grove, Holland Link, and a mixed-use site at Chencharu Close.

The mixed-use site at Chencharu Close is the largest in terms of site area, spanning 2.94 ha with a gross plot ratio (GPR) of 3.2. An estimated 875 private residential units could be developed alongside 139,880 sq ft of commercial space, and the upcoming mixed-use development will have integrated community and bus interchange facilities. The site is expected to be launched in September.

Chencharu is a new housing estate in Yishun, and development plans for this 70ha estate were unveiled in June. It will eventually have 10,000 new homes by 2040, with 80% of the new housing stock set aside for public housing.

The first BTO project in the estate was launched as part of the June 2024 BTO sales exercise. The 1,277-unit Chencharu Hills will consist of two-room flexi, and three- to five-room flats. This project will be built on the site of the former Orto leisure park.

Sandrasegeran says that the Chencharu Close GLS site is “crucial” for developers looking to secure a first-mover advantage by being the first private property development in the area.

The tender for a 2.58ha residential site on Faber Walk will also be launched in September. The site has a GPR of 1.4 and could yield up to 403 units.

The two separate land parcels along Media Circle occupy a total land area of 1.78ha, and collectively they could yield up to 830 residential units. Each site will also accommodate a commercial GFA of up to 4,304 sq ft.

In January, a 114,462 sq ft site on Media Circle was awarded to a joint venture (JV) comprising Qingjian Realty and China Communications Construction Co, also known as Forsea Holdings. The developers submitted the top bid of $395.29 million, which translates to a land rate of $1,191 psf per plot ratio (ppr). The site could be developed into a 355-unit project.

Separately, the government launched the tender for an adjacent 62,046 sq ft, residential site in May. If it is awarded, the future project will accommodate up to 520 long-stay serviced apartment units (SA2), under the new long-term rental housing typology. The tender for this site will close on Sept 19.

The injection of an additional 830 residential units from the two new GLS sites (Media Circle Parcels A and B) is poised to bolster the future housing supply in one-north, says Chu. “This is in line with URA’s plans to enhance the area as a vibrant mixed-use district, while also making shorter office-to-home commutes a reality for residents who are working in the vicinity,” he says.

“Additionally, unlike the Media Circle plot launched in 1H2024, both new sites are not subject to the Serviced Apartments II (SA2) housing typology. Without the mandatory requirement to construct long-stay serviced apartments, developers will likely be more motivated to bid for these parcels in the face of diminished risk,” says Chu.

Meanwhile, the 1.58ha residential site at Chuan Grove has a GPR of 3.0 and could yield up to 550 units. It is expected to be launched in December. This site is close to The Chuan Park, an upcoming 916-unit condo by Kingsford Development and MCC Land. The site is the former Chuan Park which was acquired en bloc for $890 million.

The 1.72ha site at Holland Link is next to a 1.58ha site at Holland Plain that is listed on the newest Reserve List. The Holland Link site could yield up to 242 units, while the Holland Plain site, if triggered, could yield an estimated 275 units.

First GLS site to launch in Bayshore

The 1.05 ha site at Bayshore Road has been moved from the 1H2024 GLS Reserve List and will now be launched for sale in November under the latest Confirmed List. This will be the first private housing sale site in Bayshore, and the site is next to Bayshore MRT Station on the Thomson-East Coast Line, as well as East Coast Park.

Developer interest for this site, as well as interest from buyers for the future new development, is expected to be strong, says Wong of Cushman & Wakefield. “Developers would be looking to get a first-mover advantage in this precinct. However, with about 3,000 private residential units expected to be built in the Bayshore Precinct, future market competition could potentially be stiff,” he adds.

Nevertheless, Chu expects developers participating in this tender to put in competitive bids, as they hope to capitalise on Bayshore’s promising future and the scarcity of newer private residential developments in the area.

Three EC sites available

The second half of the GLs programme includes three EC sites — a site on Tampines Street 95 will be launched for sale in August under the Confirmed List, while one site each at Senja Close and at Woodlands Drive 17 are listed on the Reserve List.

The 2.25ha EC site at Tampines Street 95 has a GPR of 2.5 and could yield up to 560 EC units.The 1.01 ha EC site along Senja Close could be developed into a new EC project with up to 295 units, and the 2.58ha EC site on Woodlands Drive 17 has the potential to be developed into a 435-unit project.

The last EC site sold in Tampines was a 301,392 sq ft plot along Tampines Street 62. It was awarded to Sim Lian Group last October after the developer beat eight other bids with a top bid of $543.28 million. This works out to a record land rate of $721 psf ppr for an EC site to date.

New housing development in this part of Tampines West is ramping up as part of rejuvenation plans. A mixed-use commercial and residential site on Tampines Street 94 was launched as part of the 1H2024 GLS programme, which is set to yield 585 residential units and commercial GFA of 112,980 sq ft. The tender for this site is expected to be launched later this month.

The latest BTO sales launch this month also featured Tampines GreenTopaz, a 550-unit development on Tampines Street 92. Comprising four 12- to 13-storey blocks, the unit mix consists of two-room flexi, four- to five-room flats, and 24 rental flats.

Wong of Cushman & Wakefield says that the EC site on Tampines Street 94 will likely catch the interest of developers, as it is supported by several positive site attributes such as its proximity to Tampines West MRT Station on the Downtown Line and will benefit from the retail options provided in the adjacent retail podium of the adjacent mixed-use GLS site.

“EC sites continue to attract strong interest from developers, and EC projects remain a popular choice for eligible home buyers given their value proposition of relatively lower prices compared to private condos,” says Wong.

He adds that based on URA caveats over the first five months of this year, the median price of EC units between 900 and 1,000 sq ft was about $1,500 psf. In comparison, the median price of suburban 99-year condo units in the same size range was about $2,100 psf.

Upcoming launches for 2024: Buddy can answer any real-estate queries in Singapore

Keeping price growth in check

“The government continues to supply the private residential development market with intentions of keeping price growth in check, even though developers have clearly begun to show diminished appetite for GLS sites at recent land tenders,” says Leonard Tay, head of research at Knight Frank Singapore.

According to research by Knight Frank, GLS sites launched in 2021 attracted an average of seven bids, whereas the GLS tenders launched in the first half of this year attracted an average of just two bids per site.

“Higher-for-longer interest rates, cooling measures as well as the high costs of development that include punitive measures such as sell-out deadlines have combined to take a significant toll on the appetite for new developments,” says Tay.

Overall, the impact of the ample land supply for housing provided by the government over the past two years, coupled with three rounds of property cooling measures since December 2021 and the prevailing cautious market sentiment, will aid in the stabilisation of the private housing market, says Ismail Gafoor, CEO of PropNex Realty.

“We think developers will have ample opportunities to further shore up their land inventory, and prospective home buyers will have plenty to be excited about, in view of several attractive sites to be released,” says Gafoor.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

Wing Tai Holdings submits top bid of $1,325 psf ppr for residential GLS site at River Valley Green

Residential site for long-stay serviced apartments launched at Media Circle

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance