General Dynamics (GD) Wins Deal to Aid Virginia Class Submarines

General Dynamics Corp.’s GD business unit, Electric Boat, recently secured a modification contract involving Virginia Class submarines. The award has been offered by the Naval Sea Systems Command, Washington, D.C.

Details of the Deal

Valued at $10.3 million, the contract is expected to be completed by August 2025. Per the terms of the deal, General Dynamics will provide lead yard support, development studies and design efforts related to Virginia Class submarines.

Work related to this contract will be carried out in the continental United States.

Significance of Virginia-Class Submarines

The Virginia-class submarine is one of the most advanced nuclear-powered multisession stealth submarines suitable for marine warfare. It excels in littoral and open-ocean environments and collects intelligence critical to the full spectrum of warfare. The submarine is also capable of extended submerged operations with superior stealth, endurance, mobility and firepower.

Such enhanced features have made the Virginia-class submarine a top choice for the U.S. Navy. These have also resulted in a steady order inflow for GD from the Pentagon, like the latest one. The submarine’s strong demand can be gauged by General Dynamics’ current backlog strength.

The company is currently working on Blocks IV and V in the program, with 17 Virginia-class submarines in its backlog scheduled for delivery through 2032. The U.S. Navy procures these submarines in multi-boat blocks at a two-per-year rate.

Such strong demand, along with excellence in providing unique capabilities in submarines, should continue to boost GD’s order book in the long run, thereby enhancing its revenue generation prospects.

Growth Prospects & Peer Moves

Efficient submarines, equipped with nuclear weapons, add to military capabilities and deter any potential nuclear attack in sea warfare missions. The advancement in submarine technology and its difficult-to-detect feature further add to its diverse advantages. These have invariably sparked increased spending by nations on military submarines to maintain an edge in undersea warfare.

Looking ahead, per a report by the Mordor Intelligence firm, the submarine market is projected to witness a CAGR of 4% during 2023-2028. This trend should bolster General Dynamics’ Electric Boat segment’s growth as this unit is the prime contractor and lead shipyard on all U.S. Navy nuclear-powered submarine programs.

Other defense majors poised to benefit from the expanding submarine market are BAE Systems BAESY, Northrop Grumman NOC and Huntington Ingalls Industries HII.

BAE Systems’ Astute class submarines, the U.K.’s largest and most powerful attack submarines, can strike targets up to 621 miles from the coast with pinpoint accuracy.

The company boasts a long-term earnings growth rate of 14%. The Zacks Consensus Estimate of BAESY’s 2023 sales indicates an increase of 33.6% from the prior-year reported figure.

Northrop Grumman designs, develops and produces communication systems, sensors, signal processing and electronic warfare systems to counter the increasingly sophisticated sea-based threats. It also provides launch systems for submarines. NOC’s eject launch technology has powered more than 7,000 successful launches.

The company’s long-term earnings growth rate is 2.4%. The Zacks Consensus Estimate of NOC’s 2023 sales implies growth of 6.4% from the prior-year reported figure.

Huntington Ingalls is a co-developer of the Virginia-class fast-attack nuclear submarines, along with Electric Boat. Its Newport News division participates in the design and construction of the Columbia-class (SSBN 826) submarine as a replacement for the current aging Ohio-class nuclear ballistic missile submarines.

HII’s long-term earnings growth rate is 8%. The Zacks Consensus Estimate of 2023 sales implies a year-over-year improvement of 3.8%.

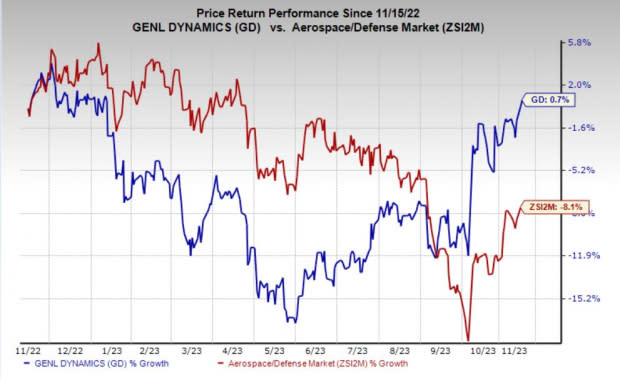

Price Performance

Shares of General Dynamics have risen 0.7% in the past year against the industry’s 8.1% decline.

Image Source: Zacks Investment Research

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance