The future of the petrol kiosk in Singapore with the rise of electric vehicles

EV charging points at Shell petrol station in Sengkang. As part of the Singapore Green Plan 2030, the Land Transport Authority laid out a comprehensive EV push to reduce land transport emissions by 80% by 2050 (Photo: Albert Chua/EdgeProp SIngapore)

As part of the Singapore Green Plan 2030, the Land Transport Authority (LTA) launched a comprehensive electric vehicle (EV) push to reduce land transport emissions by 80% by 2050. Initiatives include establishing 60,000 EV charging points, converting half of the bus and taxi fleets to electric by 2030, and promoting EV adoption so all vehicles run on cleaner energy by 2040.

Still, there is likely to be an overprovision of petrol kiosks in the next 20 to 30 years, with many eventually being phased out as petrol becomes less mainstream for vehicular propulsion. When these stations become obsolete, tiny parcels of land will become available for new uses. What could these plots be repurposed for when that day approaches?

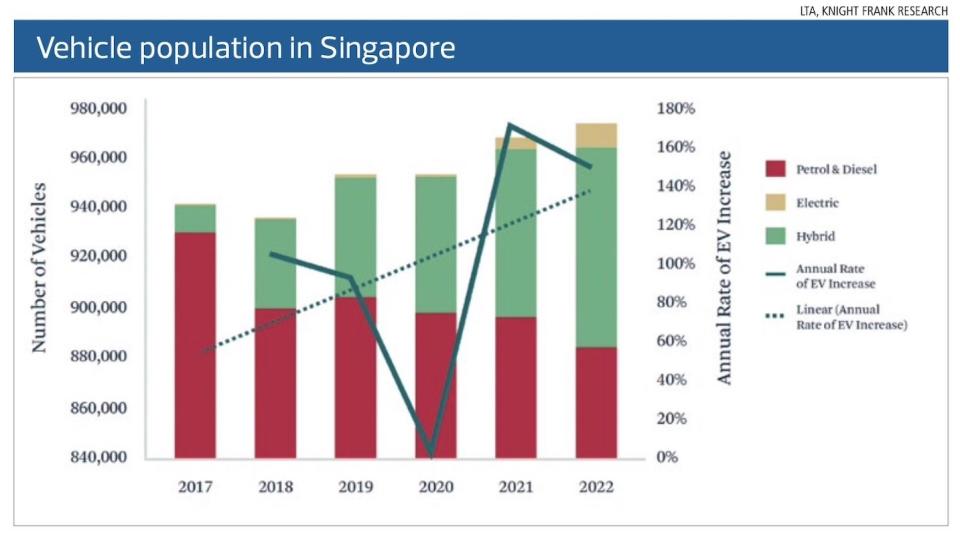

That day might arrive sooner rather than later. All-electric (non-hybrid) vehicles in Singapore comprise less than 1% of the total vehicular population as of 2022. Among the entire car population, EVs make up 1%. However, the EV population’s growth rate in the last five years was exponential, increasing by 103% y-o-y from a mere 349 at the end of 2017 to 707 by end-2018.

In 2019, the growth rate was nearly similar, at 89% y-o-y, before the Covid-19 outbreak in 2020, when adoption faltered to around 5% y-o-y. However, as the pandemic eased, the EV population expanded by 166% in 2021 and 145% in 2022 (see chart titled “Vehicle population in Singapore”).

If the pace of the last five years is maintained, the adoption of EVs will double each year (at a 100% rate of growth) given the support from the government, hindered only by Certificate of Entitlement (COE) quotas in each year. Should this rate continue for the next five years, the number of EVs in Singapore will reach 50% of the total vehicle population by 2030.

As EVs transition to the mainstream, electric carmaker Tesla leased a building at Toa Payoh Lorong 8 to house its showroom, corporate office and service centre. And right in the throes of the pandemic, Hyundai announced the development of an EV manufacturing plant in Singapore, which started operations in the first half of 2023. With a cost of around $400 million, the Hyundai Motor Group Innovation Centre is expected to produce 30,000 vehicles per annum by 2025, with 5,000 to 6,000 of the EVs to be sold locally.

Electric car maker Tesla leased a building at Toa Payoh Lorong 8 to house its showroom, corporate office and service centre (Photo: Albert Chua/EdgeProp Singapore)

Petrol stations in Singapore

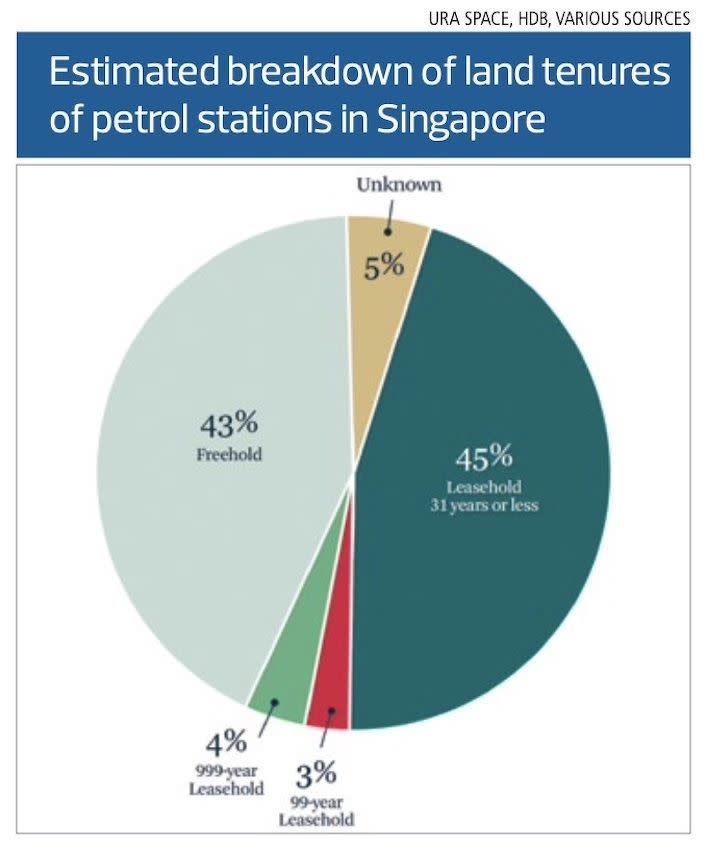

Based on information from Sgcarmart, petrol station websites and other sources, it is estimated that there were just over 180 petrol stations in Singapore in 2022, with about 56% on private land and the other 44% tendered out by various government agencies with lease tenures ranging from 10 to 99 years. Most land awarded by government agencies for petrol station use typically have 30-year leases.

HDB conducted over 50 land tenders for petrol station use from 1992 to 2020. The average size of these sites was 22,000 sq ft. While 22,000 sq ft each is not very substantial, the total, spread over 180 stations across Singapore, represents about four million sq ft of land.

Even if only half of the petrol stations in Singapore become obsolete in the future, this would mean that some two million sq ft of space could potentially be primed for repurposing.

Most petrol stations in Singapore have lease tenures of 31 years or below (45%) or freehold (43%). A few have 99-year or 999-year leases. Around 5% of the petrol stations in Singapore have unknown tenures at the time of writing (see chart titled, “Estimated breakdown of land tenures of petrol stations in Singapore”).

Among the petrol stations on privately held land, the majority (77%), or around 80 petrol stations, are on freehold parcels. Land plot sizes averaging 22,000 sq ft are relatively small, with limited development potential from an economic perspective unless amalgamated with other surrounding plots.

When EVs become the leading mode of transport on Singapore roads, what are the alternative and best uses for these petrol station sites? A Boston Consulting Group study highlighted that up to 80% of petrol stations might be unprofitable in geographies where EVs become the mainstream mode of vehicular transport.

Beyond the traditional assessment of value expressed in financial terms, land owners should now consider social and environmental capital, especially given the current focus on environmental, social and governance.

EV charging, battery swap stations

The most obvious replacement for the petrol stations would be charging stations, where the function remains relatively similar — to fuel motorised vehicles in a purpose-built facility. Depending on factors such as car model and battery capacity, a fast charge would take about 30 minutes, while slow charges can take four hours or more. Public and private car parks possess this potential too, and several are already installing and/or accommodating charging stations.

Therefore, having a purpose-built charging station instead of a traditional petrol station would be impractical given the time needed for charging, even if the facility is equipped with other amenities to occupy users while their vehicles are being charged. It is unlikely that charging stations at petrol stations will be able to compete with HDB carparks, private condo carparks and landed homes, with the latter two affording more convenience when measured against existing charging times.

A better option would be EV battery swapping stations. While not mainstream yet, Chinese electric carmaker Nio has developed Nio Power Swap, where an automated station swaps a used EV battery with a fully charged one in less than five minutes. This would be akin to pumping a full petrol tank in a traditional internal combustion engine car. With this concept, Nio sells the EV while leasing the battery with a subscription.

However, for this to have any chance of widespread adoption, such a system would have to work on almost all EVs with standardised batteries. Currently, EV makers are employing different battery-swapping models.

After all, battery swapping is already being tried on delivery vehicles in Singapore. Cycle & Carriage Singapore is partnering online food delivery service Foodpanda to trial electric motorcycles from Gogoro, a Taiwanese firm that pioneered battery swapping for two-wheelers. These electric scooters have no charging downtime due to removable battery packs that riders can replace in around six seconds.

Shell recharge EV charging stations at Funan Centre. Depending on factors such as car model and battery capacity, a fast charge would take about 30 minutes, while slow charges can take four hours or more (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Amalgamation with surrounding sites

Another option for obsolete petrol stations would be to amalgamate them with surrounding sites. According to the Singapore Land Authority, plots unsuitable for independent development due to small land size or irregular land shape can be sold as remnant land.

Under appropriate circumstances, the government may encourage or require owners/developers to purchase a remnant land parcel, combining it with private land, as the amalgamation can enhance the practical use and economic value of the private land and the neighbourhood. The tenure of the remnant land will then tie in with the adjoining private land.

The parcels that petrol stations typically occupy are relatively small. Hence, they could be gazetted as remnant land once the lease is nearing expiry and when the function as a petrol station becomes obsolete, combined with other adjacent plots and sold off through a tender exercise to interested parties.

For example, the land tenure of the petrol station site located at Ang Mo Kio Avenue 3 expired in May 2023. The government could gazette the petrol station’s site as remnant land and blend it with some of the low-rise factories in the area that may become defunct sometime in the future before listing the amalgamated plot for tender.

With the upcoming Cross Island Line and the nearby Tavistock MRT Station becoming operational in 2030, the amalgamated site could be well utilised, enhancing the economic and human value around the neighbourhood.

Another example could be the petrol station at 355 Commonwealth Avenue, which will expire in 2025. Situated at the junction of Commonwealth Avenue and Stirling Road, the petrol station is in one of the oldest HDB estates in Singapore. It could be merged with older HDB blocks in the immediate vicinity once these become obsolete.

Tesla superchargers at Orchard Central. The EV population’s growth rate in the last five years was exponential, increasing by 103% y-o-y from a mere 349 at the end of 2017 to 707 by end-2018 (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Social value

The above suggestions either attempt to replace the purpose-built petrol station with another that serves the same function catering to EVs or enhance the precinct through conventional repurposing and redevelopment.

However, there are possibilities and opportunities for some sites to be repurposed with uses that might not yield the highest economic value but instead focus on providing social and community value.

These could take the form of seniors’ activity centres, community centres or assistance centres for marginalised groups such as foreign labourers, underprivileged families, and foreign domestic helpers. Alternatively, the sites could be repurposed as public recreational spaces for all residents to enjoy.

Some of these petrol stations might reside on land larger than 22,000 sq ft with more latitude for greater development diversity.

Tesla showroom at Toa Payoh Lorong 8 (Photo: Albert Chua/EdgeProp Singapore)

Flex space: invasion of the pods

Flex space and pods would provide one of the most flexible platforms to harness dynamic repurposing that supplements market imbalances from time to time.

It would not take much to marry the flexibility of the modern technological era with real estate concepts of co-working, co-living and other human activities. Shipping containers, double-decker buses, and other portable structures can be quickly repurposed as pods for various human, commercial and accommodation needs without consuming much more natural material from the environment.

These can be installed on land formerly occupied by petrol stations. Although each parcel will not likely have enough space to generate a critical mass of commercial or human activity, the diverse locations spread throughout Singapore can lead to various uses that proliferate across different neighbourhoods along heavily trafficked main roads.

And there is precedent for this. A high-end boutique hotel called The Garden Pod opened in September 2022 at Gardens by the Bay. It features hotel suites made from shipping containers and equipped with rooftop photovoltaic panels that power up to 80% of the suites’ energy requirements.

Similarly, 20 double-decker buses will be transformed into a resort, tentatively called The Bus Resort, at Changi Village by end-2023. Another example of hospitality use is Tiny Away Escape @ Lazarus Island, run by Sentosa Development Corp. Five tiny houses, between 150 and 170 sq ft, were launched in May 2023 for visitors on Lazarus Island as a low-carbon, low-intensity leisure offering for the growing group of sustainable travellers.

The flexibility of pods can also be applied to office space. An example is the community law centre at Tian De Temple in Hougang, run by Pro Bono SG. This free legal clinic opened in January 2023 and operates from a container office on the temple grounds.

In addition, a site at 30 Cosford Road in Changi will be transformed into an F&B container park spanning 38,000 sq ft, with 13 containers for F&B operators to rent. This $3 million project by developer Tee Tree Investments will have the capacity for 340 people in indoor and outdoor areas and is expected to be ready by the end of 2023.

Other uses include gyms, self-study facilities, possibly self-storage spaces, e-commerce collection points, and even small cafés or pubs. This list is only limited by one’s imagination.

Might these concepts not also be applied on land vacated by petrol stations in the future, especially in locations close to tourist attractions, places of natural beauty, employment centres, and residential precincts? Defunct petrol stations of the future would offer many sites that factor in flexibility as Singapore works towards rethinking, redesigning, reducing, reusing and recycling for a circular economy.

Despite being small in size, the reuse of petrol stations offers Singapore the future proliferation of sites with variety and the promise of creative readaptation. They range from developing charging infrastructure for EVs, amalgamation and reuse, and repurposing for social or human needs or using flexible structures.

As part of readaptation, having a format such as containers or pods — where the real estate can be quickly converted to meet the needs of new human demands with the minimum of material consumption (that typically occurs when the physical property is redeveloped through the construction process) — would be the icing on the cake in the sustainability era.

Leonard Tay, head of research, Knight Frank Singapore (Photo: Knight Frank)

Adapted from the report, “SG Revolution: The future of the petrol kiosk in Singapore with the rise of electric vehicles”, by Knight Frank Singapore head of research Leonard Tay and research analyst Koh Kai Jie

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance