Exploring Freehold Royalties And Two More Undervalued Small Caps With Insider Action In Canada

Amidst a backdrop of economic normalization and shifting central bank policies, the Canadian market has shown resilience, with signs of stabilization and potential recovery as commodity prices influence movements. In such an environment, identifying undervalued small-cap stocks with insider action can offer interesting opportunities for investors looking to potentially benefit from market adjustments and economic transitions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Martinrea International | 6.0x | 0.2x | 46.92% | ★★★★★★ |

Dundee Precious Metals | 8.0x | 2.8x | 47.22% | ★★★★★★ |

Calfrac Well Services | 2.2x | 0.2x | 4.12% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.5x | 3.0x | 34.44% | ★★★★★☆ |

Guardian Capital Group | 10.5x | 4.1x | 31.50% | ★★★★☆☆ |

Nexus Industrial REIT | 2.4x | 3.0x | 17.05% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -95.11% | ★★★★☆☆ |

Gear Energy | 19.8x | 1.4x | 28.90% | ★★★☆☆☆ |

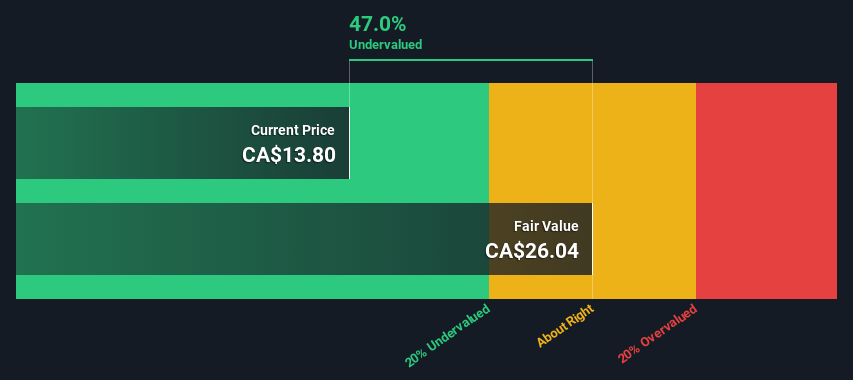

Freehold Royalties | 15.4x | 6.7x | 47.01% | ★★★☆☆☆ |

AutoCanada | 12.0x | 0.1x | -131.37% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Freehold Royalties

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freehold Royalties is a company engaged in oil and gas exploration and production, with a market capitalization of approximately CA$1.53 billion.

Operations: In the exploration and production sector, Oil & Gas generated CA$312.28 million in revenue, with a net income margin of 43.19% and a gross profit margin of 96.74%. Operating expenses amounted to CA$115.67 million for the period ending June 11, 2024.

PE: 15.4x

Recently, Freehold Royalties has shown signs that may interest those looking for underpriced assets in the market. With the recent insider confidence demonstrated through a significant share purchase by David Spyker on May 8, 2024, amounting to CA$276,000, it's clear there is belief in the company’s potential from within. This aligns with their stable production output as reported in Q1 2024 and consistent dividend payments, reaffirming their operational stability. Additionally, leadership changes and confirmed production guidance suggest strategic positioning for sustained performance. These elements collectively hint at a promising horizon for Freehold Royalties amidst its sector peers.

Dive into the specifics of Freehold Royalties here with our thorough valuation report.

Gain insights into Freehold Royalties' past trends and performance with our Past report.

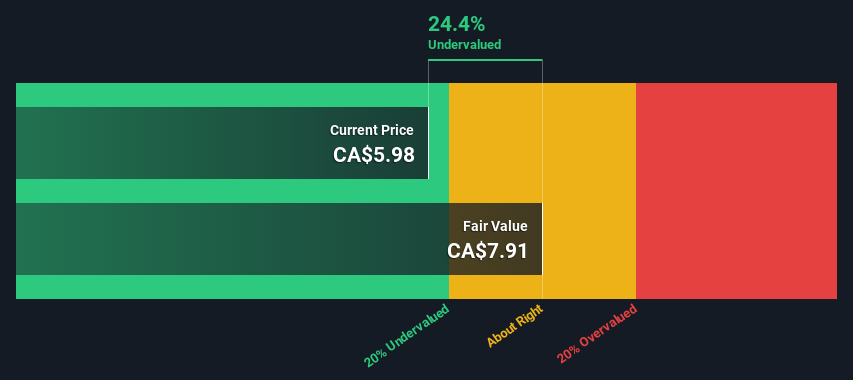

5N Plus

Simply Wall St Value Rating: ★★★★☆☆

Overview: 5N Plus is a company specializing in performance materials and specialty semiconductors, with a market capitalization of approximately CA$184.10 million.

Operations: Performance Materials and Specialty Semiconductors generated revenues of $83.21 million and $168.89 million respectively, highlighting the company's diverse operational focus within these sectors. The gross profit margin observed a notable increase from 7.76% to 24.30% over the examined periods, reflecting significant changes in operational efficiency or market conditions affecting profitability.

PE: 23.5x

Recently, Jean-Marie Bourassa demonstrated insider confidence in 5N Plus by acquiring 60,100 shares, signaling a robust belief in the company's prospects. This move aligns with the firm's positive momentum, highlighted by a significant contract renewal with First Solar to increase supply of semiconductor materials—a key component in cutting-edge photovoltaic modules. Financially, 5N Plus is on an upward trajectory with first-quarter sales rising to US$65 million from US$55 million year-over-year and net income improving to US$2.51 million. These developments suggest that 5N Plus is strategically positioned within high-growth sectors like renewable energy and advanced electronics, marking it as a potentially underestimated entity in its market.

Click here and access our complete valuation analysis report to understand the dynamics of 5N Plus.

Gain insights into 5N Plus' historical performance by reviewing our past performance report.

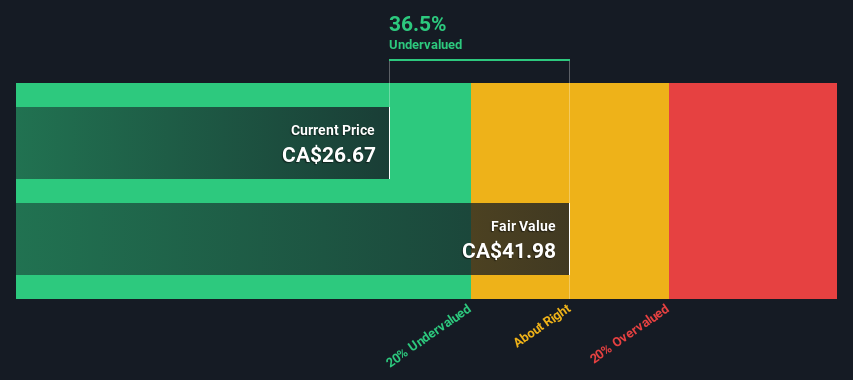

Wajax

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wajax operates as a distributor of industrial machinery and equipment, with a market capitalization of approximately CA$2120.95 million.

Operations: The company generates a substantial portion of its revenue from the wholesale of machinery and industrial equipment, amounting to CA$2.12 billion. It has observed a gross profit margin increase from 20.17% in June 2013 to 21.27% by June 2024, reflecting an enhanced efficiency in managing the cost of goods sold relative to sales over this period.

PE: 7.4x

Recently, Wajax has shown signs of being an appealing pick for those looking at lesser-known Canadian companies with potential. Despite a slight dip in quarterly sales and net income, the firm maintains a steady dividend, signaling financial stability. Noteworthy is Edward Barrett's substantial share purchase, investing nearly CA$294k recently—a robust indicator of insider confidence. With new leadership on board and a solid financial base despite high-risk funding sources, Wajax positions itself as a company to watch for growth opportunities.

Click here to discover the nuances of Wajax with our detailed analytical valuation report.

Examine Wajax's past performance report to understand how it has performed in the past.

Seize The Opportunity

Get an in-depth perspective on all 32 Undervalued TSX Small Caps With Insider Buying by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:FRU TSX:VNP and TSX:WJX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance