Examining June 2024's Top Three Dividend Stocks

Amidst a mixed performance in the U.S. stock market, where technological advancements and regulatory challenges shape the landscape, investors continue to seek stable returns through dividend stocks. Understanding what constitutes a resilient dividend stock is crucial in this dynamic environment, emphasizing not just historical payouts but also the company's ability to sustain and grow these dividends against current market volatilities.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.81% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.34% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.41% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.08% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.07% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.98% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.91% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.33% | ★★★★★★ |

West Bancorporation (NasdaqGS:WTBA) | 5.97% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

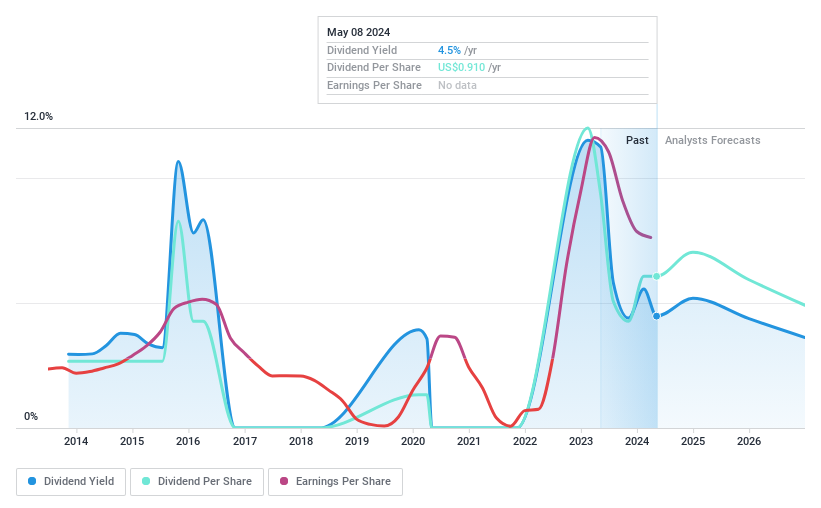

Ardmore Shipping

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardmore Shipping Corporation operates globally, specializing in the seaborne transportation of petroleum products and chemicals, with a market capitalization of approximately $934.32 million.

Operations: Ardmore Shipping Corporation generates $384.05 million in revenue from its core activity of shipping refined petroleum products and chemicals internationally.

Dividend Yield: 4.1%

Ardmore Shipping Corporation recently declared a quarterly dividend of US$0.31 per share, underscoring its commitment to shareholder returns despite a slight decline in Q1 2024 earnings, with sales dropping to US$106.3 million and net income at US$39.24 million from higher figures last year. The company's dividends are well-supported by both earnings and cash flows, with payout ratios at 33.1% and 32% respectively, although its dividend history shows some inconsistency with fluctuations over the past decade.

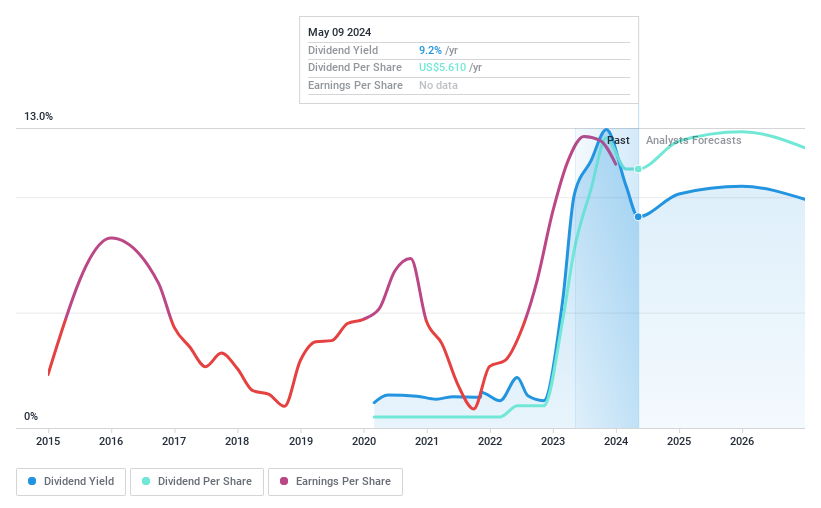

International Seaways

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Seaways, Inc. operates a global fleet of oceangoing vessels that transport crude oil and petroleum products, with a market capitalization of approximately $2.94 billion.

Operations: International Seaways, Inc. generates its revenue primarily through two segments: Crude Tankers, which contributed $518.46 million, and Product Carriers, with $540.58 million in earnings.

Dividend Yield: 9.6%

International Seaways, Inc. recently declared both a regular quarterly dividend of US$0.12 and a special dividend of US$1.63 per share, payable on June 26, 2024. Despite trading at 53.9% below estimated fair value and maintaining a high dividend yield of 9.58%, the company's dividends show instability with an unreliable track record over its short four-year dividend history. Dividends are covered by earnings with a low payout ratio of 4.4% and by cash flows with a cash payout ratio at 61.5%. However, significant insider selling in the past quarter raises concerns about internal confidence in the stock's future performance.

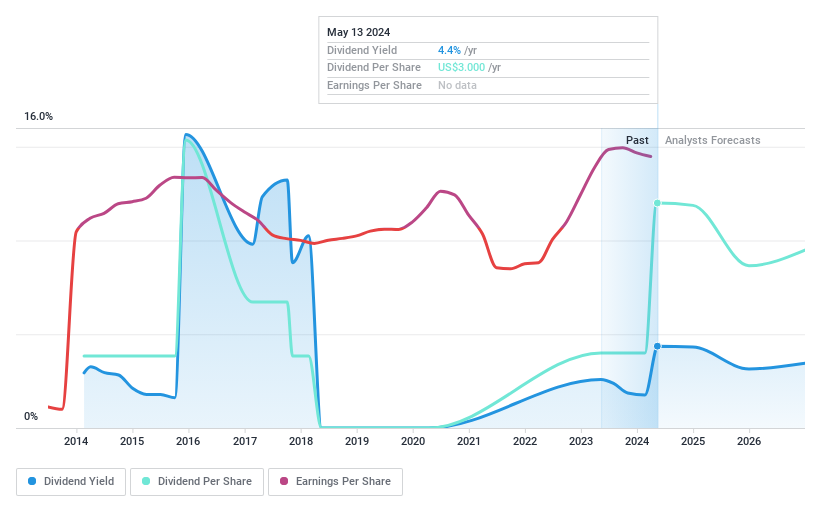

Teekay Tankers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. operates globally, offering crude oil and marine transportation services with a market capitalization of approximately $2.39 billion.

Operations: Teekay Tankers Ltd. generates its revenue primarily from tanker services, amounting to $1.31 billion.

Dividend Yield: 4.3%

Teekay Tankers Ltd. faces a forecasted earnings decline of 7% annually over the next three years, impacting its dividend outlook despite a low payout ratio of 7%. While dividends are well-covered by both earnings and cash flows (cash payout ratio at 17.8%), the company's dividend history has been volatile, with payments fluctuating significantly over the past decade. Recently, Teekay declared both regular and special dividends totaling US$2.25 per share for Q1 2024, reflecting short-term shareholder returns amidst broader financial challenges.

Click here to discover the nuances of Teekay Tankers with our detailed analytical dividend report.

Our valuation report unveils the possibility Teekay Tankers' shares may be trading at a discount.

Next Steps

Delve into our full catalog of 207 Top Dividend Stocks here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:ASC NYSE:INSW and NYSE:TNK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance