Euronext Paris Showcases Three Prominent Dividend Stocks

Amidst a backdrop of political turbulence and economic uncertainty in Europe, with French markets particularly feeling the impact of recent political shifts, investors are increasingly attentive to stable investment opportunities. Dividend stocks on Euronext Paris stand out as potentially appealing options due to their potential for providing regular income streams during volatile times.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.74% | ★★★★★★ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.12% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.27% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.04% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.75% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 6.27% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.13% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative operates as a cooperative bank in France, offering a range of banking products and services, with a market capitalization of approximately €0.44 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates €253.67 million from Proximity Banking and €92.57 million from Management for Own Account and Miscellaneous activities.

Dividend Yield: 4.6%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a stable dividend yield of 4.57%, supported by a low payout ratio of 17.9%, ensuring dividends are well covered by earnings. Despite trading at 56.1% below its estimated fair value, its dividend yield is modest compared to the top French dividend payers. The company's dividends have shown stability and growth over the past decade, although it lags behind the top 25% of French dividend stocks in terms of yield. Recent earnings grew by 19.5% year-over-year as of April 2024, suggesting solid financial health.

Colas

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colas SA is a global company specializing in the construction and maintenance of transport infrastructure, with a market capitalization of approximately €5.71 billion.

Operations: Colas SA generates revenue primarily through its various regional road construction and maintenance operations, with significant contributions from Roads France-Overseas France/IO (€5.97 billion), Roads EMEA (Europe-Middle East-Africa) at €3.36 billion, Canada Routes contributing €2.38 billion, and Roads United States at €2.24 billion, alongside revenues from Railways and Other Activities amounting to €1.38 billion.

Dividend Yield: 4.2%

Colas SA's dividend yield of 4.2% trails the top quartile of French dividend stocks, yet it has shown growth over the past decade despite historical volatility. The company's dividends are mostly covered by earnings and cash flows, with a payout ratio of 81.3% and a cash payout ratio of 58.9%. Recent financials indicate a positive trend with sales rising to €16.02 billion and net income increasing to €316 million in 2023, although high debt levels and significant one-off items have impacted results.

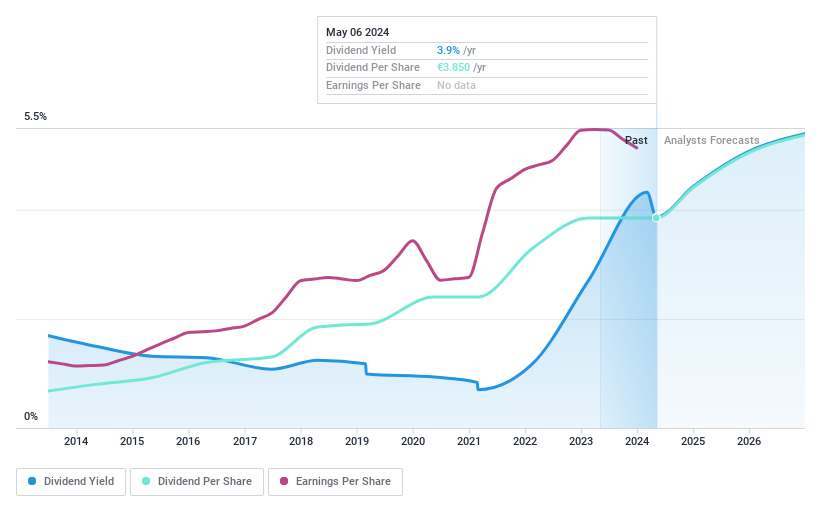

Teleperformance

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE operates globally, providing customer consultancy services, with a market capitalization of approximately €6.12 billion.

Operations: Teleperformance SE generates its revenue from various segments, including Specialized Services at €1.36 billion, Core Services & D.I.B.S across different regions: LATAM at €1.57 billion, North America & Asia-Pacific at €2.53 billion, and Europe, Middle East & Africa (EMEA) at €2.54 billion, along with a smaller contribution from Majorel within the Core Services segment amounting to €0.34 billion.

Dividend Yield: 3.7%

Teleperformance SE offers a modest dividend yield of 3.75%, below the top quartile for French stocks but compensates with a decade-long record of stable, growing payouts. The dividends are well-supported, with a payout ratio of 37.5% and a cash payout ratio of 20.1%, indicating sustainability from both earnings and cash flow perspectives. While the company's debt level is high, its valuation appears attractive, trading at 63.5% below estimated fair value, suggesting potential upside despite lower relative yield.

Summing It All Up

Delve into our full catalog of 31 Top Euronext Paris Dividend Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CRTO ENXTPA:RE and ENXTPA:TEP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance