Euronext Paris Dividend Stocks To Watch In June 2024

As the French market shows resilience with a notable 1.67% rise in the CAC 40 Index, investors are keenly observing trends and potential opportunities within Euronext Paris. In this context, dividend stocks remain a focal point for those looking to capitalize on steady income streams amidst broader economic shifts and monetary policy adjustments.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.31% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 7.12% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.00% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.13% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.90% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.14% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.87% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Carrefour

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse range of food and non-food retail stores across multiple formats and channels in Europe, Latin America, the Middle East, Africa, and Asia, with a market capitalization of approximately €9.36 billion.

Operations: Carrefour SA generates €39.02 billion from its operations in France, €24.27 billion from Europe (excluding France), and €22.54 billion in Latin America.

Dividend Yield: 6.3%

Carrefour's dividend yield stands at 6.3%, ranking it in the top 25% of French dividend payers. Despite a history of fluctuating dividends, recent years show improvement with a stable payout ratio of 66.8% and an even more reassuring cash payout ratio at 21.1%. Earnings are expected to grow by 10.9% annually, supporting future dividends, although the company grapples with high debt levels and lower profit margins year-on-year (1.1%, down from last year's 1.7%).

Click here to discover the nuances of Carrefour with our detailed analytical dividend report.

The valuation report we've compiled suggests that Carrefour's current price could be quite moderate.

La Française des Jeux Société anonyme

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: La Française des Jeux Société anonyme operates in the gaming and distribution sector both in France and internationally, with a market capitalization of approximately €6.05 billion.

Operations: La Française des Jeux Société anonyme generates revenue through three primary segments: Lottery, which brings in €1.94 billion, Sport Betting and Online Gaming Open to Competition at €0.52 billion, and Adjacent Activities contributing €0.17 billion.

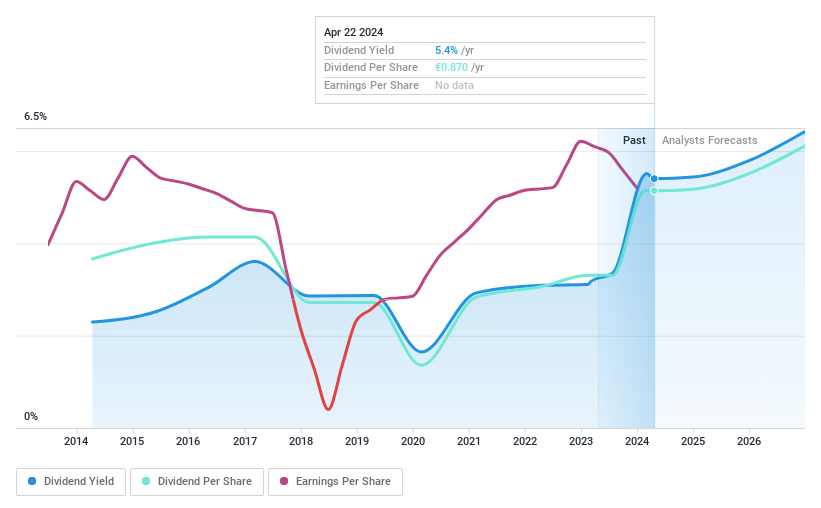

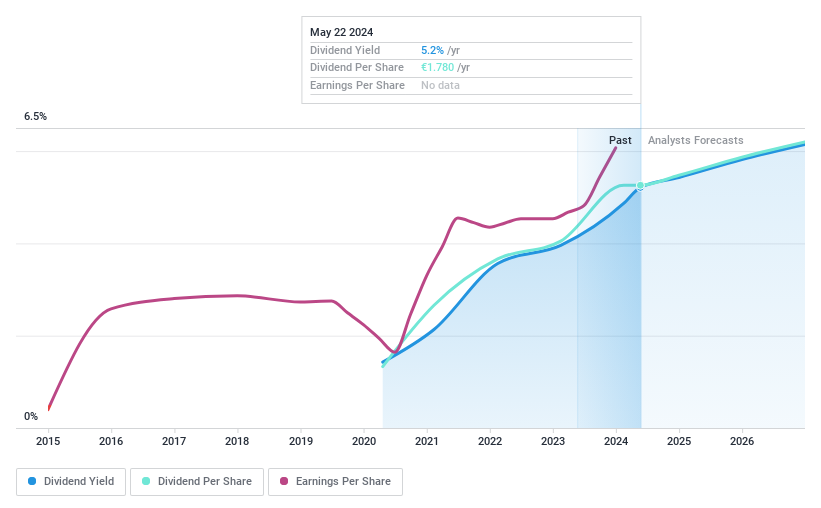

Dividend Yield: 5.4%

La Française des Jeux Société anonyme offers a dividend yield of 5.44%, placing it in the top quartile of French dividend payers. Recent approval at the AGM for a €1.78 per share dividend reflects positive sentiment, supported by a robust earnings growth of 38.1% over the past year and forecasted annual earnings growth of 4.94%. Despite its relatively short dividend history, both earnings and cash flows adequately cover payouts with ratios at 79.9% and 65.3%, respectively, suggesting sustainability amid trading at 24.6% below estimated fair value and anticipated price gains of 21.6%.

Wendel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focused on middle-market and later-stage equity financing through leveraged buyouts and acquisitions, with a market capitalization of approximately €3.70 billion.

Operations: Wendel's revenue is generated through several segments, including CPI (€128 million), ACAMS (€91.60 million), Stahl (€913.50 million), Scalian (€126.80 million), and Bureau Veritas (€5.87 billion).

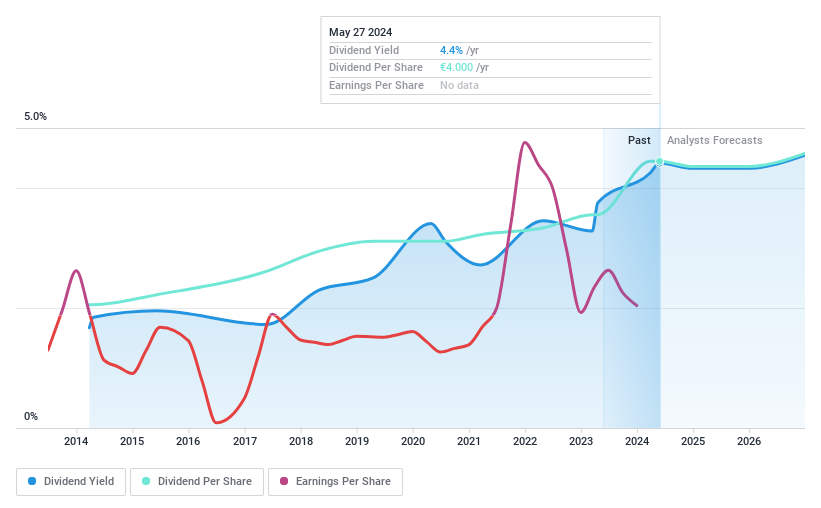

Dividend Yield: 4.7%

Wendel recently increased its dividend to €4.00 per share, marking a 25% rise from the previous year, signaling confidence despite challenges. However, the dividend yield of 4.68% lags behind the top quartile in France at 5.43%. While cash flows support dividends with a low payout ratio of 14.7%, earnings coverage is weak with a high payout ratio of 301.9%. The stock trades at a significant discount of 42.6% below estimated fair value, with analysts expecting a potential price increase of 35.3%.

Dive into the specifics of Wendel here with our thorough dividend report.

Our valuation report unveils the possibility Wendel's shares may be trading at a discount.

Taking Advantage

Access the full spectrum of 33 Top Euronext Paris Dividend Stocks by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CA ENXTPA:FDJ and ENXTPA:MF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance