Euronext Amsterdam's Top 3 Undervalued Stocks To Watch In June 2024

Amidst a backdrop of political uncertainty and fluctuating market conditions across Europe, the Dutch stock market presents unique opportunities for investors seeking value. As we explore Euronext Amsterdam's top three undervalued stocks to watch in June 2024, understanding the fundamentals and resilience of these companies becomes crucial in navigating current economic challenges.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

Name | Current Price | Fair Value (Est) | Discount (Est) |

Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

PostNL (ENXTAM:PNL) | €1.372 | €2.67 | 48.7% |

Arcadis (ENXTAM:ARCAD) | €59.70 | €114.79 | 48% |

Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

InPost (ENXTAM:INPST) | €16.89 | €31.16 | 45.8% |

Ctac (ENXTAM:CTAC) | €3.12 | €3.83 | 18.6% |

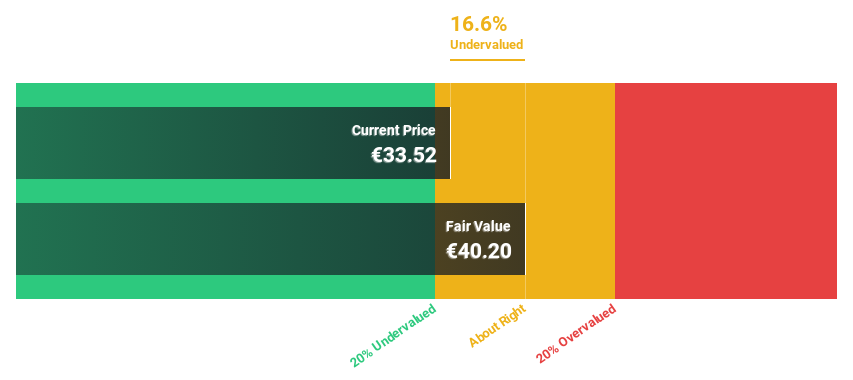

Alfen (ENXTAM:ALFEN) | €33.30 | €40.16 | 17.1% |

Here's a peek at a few of the choices from the screener

Alfen

Overview: Alfen N.V. specializes in smart grids, energy storage systems, and electric vehicle charging equipment, with a market capitalization of approximately €0.72 billion.

Operations: Alfen N.V. generates revenue from three primary segments: Smart Grid Solutions (€188.38 million), EV Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

Estimated Discount To Fair Value: 17.1%

Alfen, trading at €33.3, is perceived as undervalued with a fair value estimate of €40.16 based on discounted cash flow analysis. Despite a highly volatile share price recently, its revenue and earnings growth are forecasted to outpace the Dutch market significantly at 15.5% and 20.13% per year respectively. However, it's worth noting that profit margins have declined from 12.1% to 5.9%. Alfen's Return on Equity is also expected to be robust at 23.2% in three years' time.

Our growth report here indicates Alfen may be poised for an improving outlook.

Get an in-depth perspective on Alfen's balance sheet by reading our health report here.

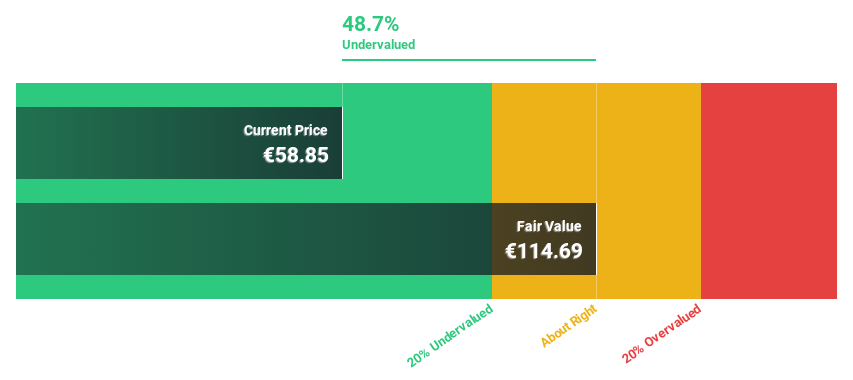

Arcadis

Overview: Arcadis NV provides design, engineering, and consultancy services for natural and built assets across The Americas, Europe, the Middle East, and the Asia Pacific, with a market capitalization of approximately €5.37 billion.

Operations: Arcadis generates revenue through various segments, with €1.95 billion from Resilience, €1.94 billion from Places, €978.80 million from Mobility, and €122.50 million from Intelligence.

Estimated Discount To Fair Value: 48%

Arcadis, priced at €59.7, is significantly below its estimated fair value of €114.79, indicating potential undervaluation based on cash flows. While its revenue growth forecast (1.6% annually) lags behind the market, earnings are expected to increase by 20.72% per year, surpassing the Dutch market's 16.5%. Recent contracts like leading Enterprise Decision Analytics for Henderson highlight expanding capabilities in digital asset management but high debt levels pose financial risks.

The analysis detailed in our Arcadis growth report hints at robust future financial performance.

Dive into the specifics of Arcadis here with our thorough financial health report.

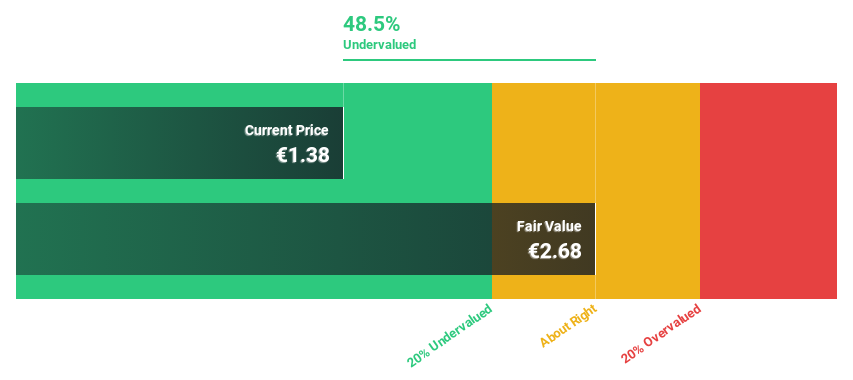

PostNL

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.68 billion.

Operations: The company's revenue is primarily generated from two segments: Packages (€2.25 billion) and Mail in The Netherlands (€1.35 billion).

Estimated Discount To Fair Value: 48.7%

PostNL, currently trading at €1.37, appears undervalued with its price 48.7% below the estimated fair value of €2.67, signaling potential based on discounted cash flow analysis. Despite a challenging first quarter with a net loss of €20 million and sales dropping to €763 million from €780 million year-over-year, the company's earnings are forecasted to grow by 24.23% annually. However, it carries a high level of debt and has experienced significant share price volatility recently. Additionally, PostNL has engaged in sustainable finance activities with recent fixed-income offerings totaling approximately €298.67 million aimed at bolstering its financial structure.

Make It Happen

Click through to start exploring the rest of the 4 Undervalued Euronext Amsterdam Stocks Based On Cash Flows now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ALFEN ENXTAM:ARCAD and ENXTAM:PNL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance