Euronext Amsterdam Showcases Three Growth Companies With High Insider Ownership

As global markets exhibit mixed signals with some regions showing signs of economic cooling and others gearing up for potential policy easing, the Netherlands market remains a focal point for investors looking for stability and growth opportunities. In this context, companies with high insider ownership can be particularly appealing as they often reflect a commitment by management and major stakeholders to the company’s long-term success.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

Envipco Holding (ENXTAM:ENVI) | 15.6% | 68.9% |

Ebusco Holding (ENXTAM:EBUS) | 34% | 110.7% |

MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

PostNL (ENXTAM:PNL) | 30.8% | 24.2% |

Here we highlight a subset of our preferred stocks from the screener.

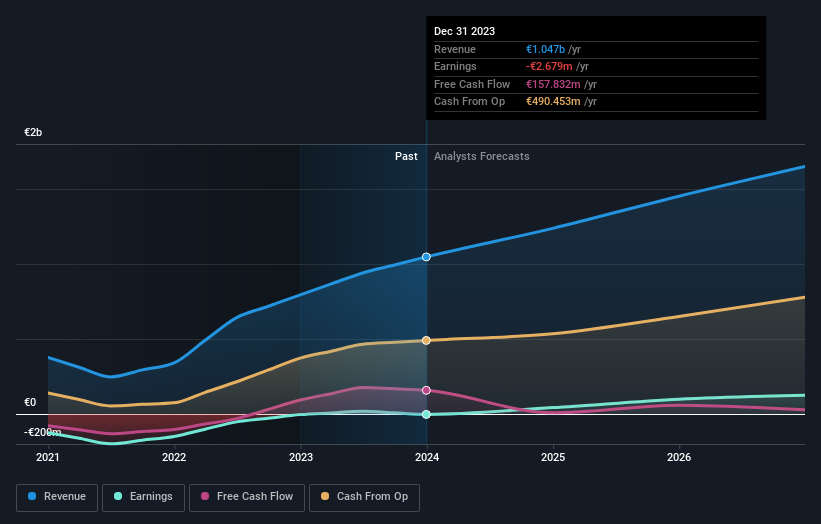

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe, with a market capitalization of approximately €1.36 billion.

Operations: The company generates its revenue primarily from two segments: Benelux, which contributes approximately €479.04 million, and France, Spain & Germany, contributing about €568.21 million.

Insider Ownership: 12%

Earnings Growth Forecast: 66.1% p.a.

Basic-Fit, a growth company in the Netherlands with high insider ownership, shows promising financial prospects. With earnings expected to grow significantly at 66.07% annually and becoming profitable within three years, it stands above average market growth. Despite slower revenue growth forecasts of 14.9% yearly compared to very high benchmarks, insider activities reflect more confidence with recent purchases outweighing sales. Analysts predict a potential stock price increase of 61.2%, underscoring a positive outlook supported by an anticipated strong return on equity of 26.7%.

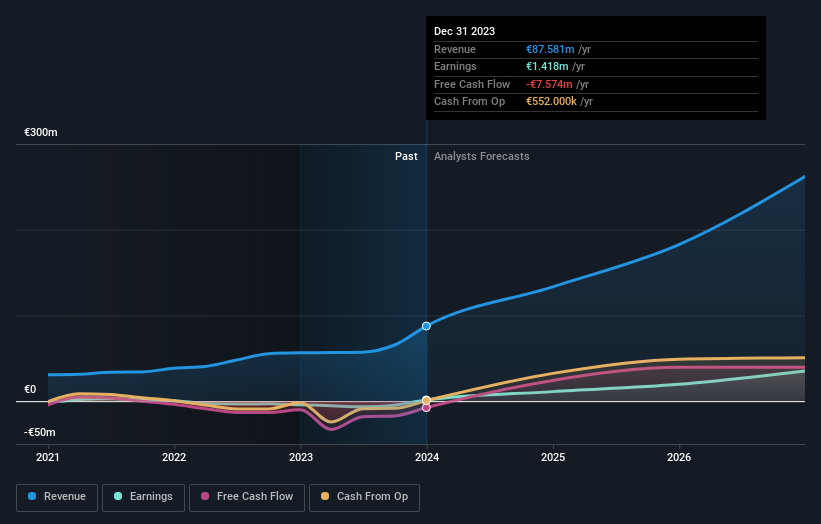

Envipco Holding

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, primarily operating in the Netherlands, North America, and Europe, with a market capitalization of approximately €351.91 million.

Operations: The company generates revenue by designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers across the Netherlands, North America, and Europe.

Insider Ownership: 15.6%

Earnings Growth Forecast: 68.9% p.a.

Envipco Holding N.V., a Dutch growth company with high insider ownership, has shown significant financial improvements. Recently turning profitable, its earnings are expected to rise by 68.9% annually, outpacing the local market's 16.2%. Although shareholder dilution occurred over the past year, revenue growth forecasts remain robust at 33.3% yearly. Despite a highly volatile share price in recent months, the stock trades at 5.8% below estimated fair value, indicating potential undervaluation. Recent earnings reports reflect strong sales growth from €10.41 million to €27.44 million year-over-year.

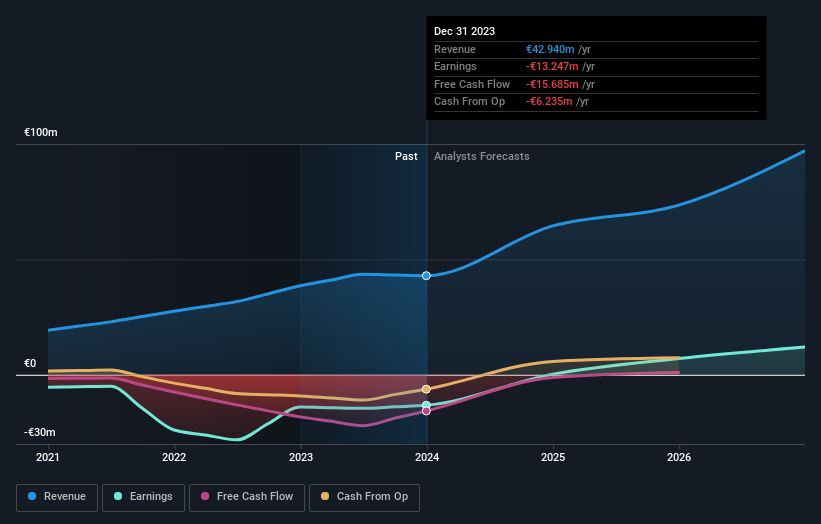

MotorK

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of approximately €273.01 million.

Operations: The company generates its revenue primarily through its software and programming segment, which amounted to €42.94 million.

Insider Ownership: 35.8%

Earnings Growth Forecast: 105.8% p.a.

MotorK, a Dutch growth company with high insider ownership, is on track to profitability within three years, outpacing average market expectations. Despite recent shareholder dilution, MotorK forecasts robust annual revenue growth at 24%, significantly above the Dutch market's 9.4%. However, it remains unprofitable with no expected return on equity in the near term. Recent board changes and a slight dip in quarterly sales to €11.25 million highlight ongoing leadership and financial adjustments.

Delve into the full analysis future growth report here for a deeper understanding of MotorK.

Our valuation report unveils the possibility MotorK's shares may be trading at a premium.

Summing It All Up

Take a closer look at our Fast Growing Euronext Amsterdam Companies With High Insider Ownership list of 6 companies by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:ENVI and ENXTAM:MTRK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance