DoorDash (DASH) Reports Q3 Loss, Beats Revenue Estimates

DoorDash DASH reported third-quarter 2022 loss of 77 cents per share, wider than the Zacks Consensus Estimate of a loss of 60 cents. In the year-ago period, the company reported a loss of 30 cents.

Revenues of $1.7 billion increased 33% on a year-over-year basis and surpassed the consensus mark by 3.71%. Revenues were driven by 25% year-over-year growth in DoorDash revenues and the addition of the Wolt business. Its revenues were driven by strong growth in total orders and Marketplace gross order volume (GOV).

Quarter in Details

In the third quarter of 2022, total orders increased 27% year over year to $439 million, driven by 16% growth in DoorDash orders and a rise in consumers and average order frequency.

Marketplace GOV increased 30% year over year to $13.5 billion, driven primarily by 21% growth in DoorDash Marketplace GOV and the rest due to the addition of Wolt.

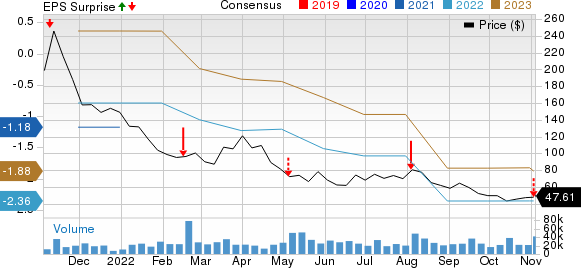

DoorDash, Inc. Price, Consensus and EPS Surprise

DoorDash, Inc. price-consensus-eps-surprise-chart | DoorDash, Inc. Quote

In the quarter, adjusted cost of revenues increased 58% year over year to $895 million, driven by growth in total orders and increased insurance reserves and costs associated with its first-party distribution business. Adjusted gross profit increased 14% to $806 million.

In the quarter under review, adjusted sales & marketing expenses decreased 1000 basis points to $386 million from the year-ago quarter. The decrease in cost was due to a decline in advertising costs, partially offset by growth in headcount and the addition of Wolt.

In the third quarter, adjusted research & development increased drastically by 97% year over year to $122 million, driven by growth in headcount and the addition of Wolt.

Adjusted general & administrative increased a massive 59% from the year-ago quarter to $211 million.

In the quarter under discussion, adjusted EBITDA decreased 1.2% year over year to $87 million.

Balance Sheet and Cash Flow

As of Sep 30, 2022, DoorDash had $2.32 billion in cash and cash equivalents compared with $2.73 billion as of Jun 30, 2022.

Cash flow from operations was $199 million in the third quarter compared with the second-quarter 2022 cashflow of $165 million.

Free cash flow in the third quarter was $99 million against the second-quarter 2022’s outflow of $86 million.

Guidance

For the fourth quarter of 2022, DoorDash anticipates Marketplace GOV in the range of $13.9 billion to $14.2 billion. Adjusted EBITDA is expected to be $85 million to $120 million.

Zacks Rank & Stocks to Consider

DoorDash currently has a Zacks Rank #3 (Hold).

Its shares have tumbled 68% against the Zacks Computer and Technology sector’s decline of 37.7% in the year-to-date period.

Here are some better-ranked stocks worth considering in the broader sector.

Asure Software ASUR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ASUR’s shares have decreased 15.1% in the year-to-date period compared with the Zacks Internet - Delivery Services industry’s decline of 13.5%. ASUR is scheduled to report third-quarter 2022 results on Nov 7.

Tencent Music Entertainment Group TME is also a Zacks Rank #2 stock. The company is set to report third-quarter 2022 earnings on Nov 15.

TME shares have lost 44.7% in the year-to-date period compared with the Zacks Internet - Content industry’s decline of 42.1%.

Angi ANGI carries a Zacks Rank #2.

ANGI’s shares have slumped 77.7% in the year-to-date period compared with the Zacks Internet - Content industry’s decline of 42%. ANGI is scheduled to report third-quarter 2022 results on Nov 8.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Angi Inc. (ANGI) : Free Stock Analysis Report

Tencent Music Entertainment Group Sponsored ADR (TME) : Free Stock Analysis Report

DoorDash, Inc. (DASH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance