Developer sales fall 26.6% m-o-m in May, Lentor Hills Residences tops best-seller list to move 25 units

The best-selling project, in terms of units sold, was the 598-unit Lentor Hills Residences along Lentor Hills Road. The project sold 25 units last month at a median price of $2,164 psf and is about 88% sold to date.

Last month, the number of new private residential units (excluding Executive Condos) sold by developers fell 26.6% m-o-m, with just 221 units sold compared to the 301 units transacted in April. This was also the lowest new home sales figure for May since 2008 when URA records began.

“The sales decline was not unexpected as there were no significant project launches in the suburbs and city fringes,” says Christine Sun, chief researcher and strategist at OrangeTee. Apart from the 190-unit luxury project Skywaters Residences, only two boutique projects were launched for sale last month — the 21-unit Jansen House and the 16-unit Straits at Joo Chiat.

Her sentiment was shared by Mohan Sandrasegeran, head of research & data analytics at SRI, who also attributed the slump in developer sales to the relative scarcity of major new project launches last month.

In total, developers released 248 units onto the primary market in May, a monthly decline of 10.8% compared to the 278 units released for sale in April.

“Some developers have likely opted for a strategic approach by carefully spacing out their new project launches to maximise impact and ensure optimal sales performance. This strategy aims to generate the highest level of interest and demand from prospective home buyers and investors,” says Sandrasegeran.

Leonard Tay, head of research at Knight Frank Singapore, noted that the primary residential market appears to be in a quiet phase, after the completion of almost 20,000 units in 2023 together with interest rates that look to be higher for longer, throughout most of 2024.

“Homebuyers remain more selective, no longer showing the kind of urgency and fear-of-missing-out (Fomo) behaviour at showflats that was a feature of the market from the second half of 2020 to the first half of 2022,” says Tay.

"May 2024 also marks one year since the doubling of Additional Buyer Stamp Duty rate for non-permanent resident (PR) foreign buyers to 60%. Between June 2023 and May 2024, foreign buyers only accounted for an average of 3.1% of total new sale buyers each month. This is significantly lower than the previous 12-month period, where foreign buyers accounted for an average of 11.2% of new sale transactions each month," says Eugene Lim, key executive officer of ERA Singapore.

Lentor Hills Residences leads as May’s best-selling project

The best-selling project, in terms of units sold, was the 598-unit Lentor Hills Residences along Lentor Hills Road. The project sold 25 units last month at a median price of $2,164 psf and is about 88% sold to date.

Read also: GuocoLand’s ‘master developer’ aspirations in Lentor Hills estate

Lentor Hills Residences is jointly developed by Hong Leong Holdings, GuocoLand and TID (a joint venture between Hong Leong Group and Mitsui Fudosan). The 99-year leasehold development was launched for sale last July and saw half of its units snapped up over the launch weekend. At the time, prices averaged $2,080 psf.

So far, the Lentor precinct in District 26 has seen the launch of five new condos. Of the 2,477 units that have been released for sale, almost 75% of the units have been snapped up by buyers, says Lee Sze Teck, senior director of data analytics at Huttons Asia.

Pent-up demand for new private housing in the area, as well as the appeal of living in a new private residential estate, continues to support buying interest for new condos in this neighbourhood, says Lee.

Meanwhile, Hillhaven came in second on the list of best-selling projects last month. The 341-unit development on Hillview Rise sold 23 units at a median price of $2,099 psf and is about 37.5% sold to date.

Hillhaven is a 341-unit residential project in District 23's Hillview area. (Picture: Far East Organization)

The 99-year leasehold project is jointly developed by Far East Organization and Sekisui House. About 59 units were sold when the project launched in January, and the average selling price at the time was $1,903 psf.

Sandrasegeran says that Hillhaven likely benefitted from a spillover effect as the nearby project, The Botany at Dairy Farm, is more than 90% sold. “With The Botany At Dairy Farm selling over 90% of its units, potential home buyers and investors interested in the Hillview area have started to consider Hillhaven as a viable option,” he says.

Read also: Property Unpacked: How to read schematic diagrams

The Botany at Dairy Farm sold 18 units last month at a median price of $1,968 psf. The 386-unit project, on Dairy Farm Walk, launched for sale last month. It sold 187 units (48%) over its opening sales weekend at an average price of $2,070 psf.

Luxury condo sales picking up pace

Three luxury condominiums dominated the list of new condo units that exceeded the $10 million benchmark. The projects were Watten House on Shelford Road, 32 Gilstead on Gilstead Road, and Skywaters Residences on Shenton Way.

Notably, the 180-unit Watten House, which is 80% sold, saw a trio of 3, 412 sq ft units transact for more than $10 million — a unit was sold for $12.2 million ($3,576 psf) in January; another fetched $11.8 million ($3,457 psf) in March, while another was sold for $11.8 million ($3,457 psf) in April.

Meanwhile, 32 Gilstead is a boutique 14-unit project by Kheng Leong Co. The freehold project saw three units transact for more than $14 million in April — a 4,198 sq ft unit was sold for $14.5 million ($3,455 psf), a 4,209 sq ft unit fetched $14.5 million ($3,455 psf), and a 4,198 sq ft unit transacted for $14.4 million ($3,431 psf).

The sale of a 7,761 sq ft unit at Skywaters Residences set a benchmark price of a non-landed, 99-year leasehold new launch project. The unit, on the 57th floor, was sold for $47.3 million or $6,100 psf.

Developers’ sales in the Core Central Region (CCR) fell by 16% m-o-m in May to 27 units. The two best-selling CCR projects in the month, in terms of units sold, were 19 Nassim and Klimt Cairnhill. Each project sold 6 units at median prices of $3,373 psf and $3,317 psf, respectively.

"The punitive ABSD rate continues to keep foreign buyers on the side line, with just one luxury home transaction made by a foreign buyer in May 2024," says ERA's Lim.

‘Tepid’ developer sales to persist

“Developers’ sales will likely remain soft in June 2024 in view of a lack of project launches, as well as the school holidays where there tend to be a lull in transactions as many families travel abroad,” says Wong Siew Ying, head of research and content at PropNex Realty.

She expects new private home sales in 2Q2024 to be lacklustre, possibly falling short of that of 1Q2024 which saw 1,164 units sold, as well as 2Q2023’s sales where 2,127 units were sold,” says

Tricia Song, head of research for Singapore and Southeast Asia at CBRE, echoes a similar outlook, opining: “The market situation appears to have worsened in 2024, with year-to-May sales at 1,686 units, 47.1% lower y-o-y from 3,185 units sold over the correspondingly period in 2023”.

In general, new project launches so far this year have seen generally lower take-up rates, as buyers turn more selective amid a myriad of new launch options, buyer fatigue and increasing resistance to high price points, says Song. “Homebuyers’ current tentative stance is likely to persist until interest rate cuts and an economic rebound catalyses a recovery in sentiment,” she says.

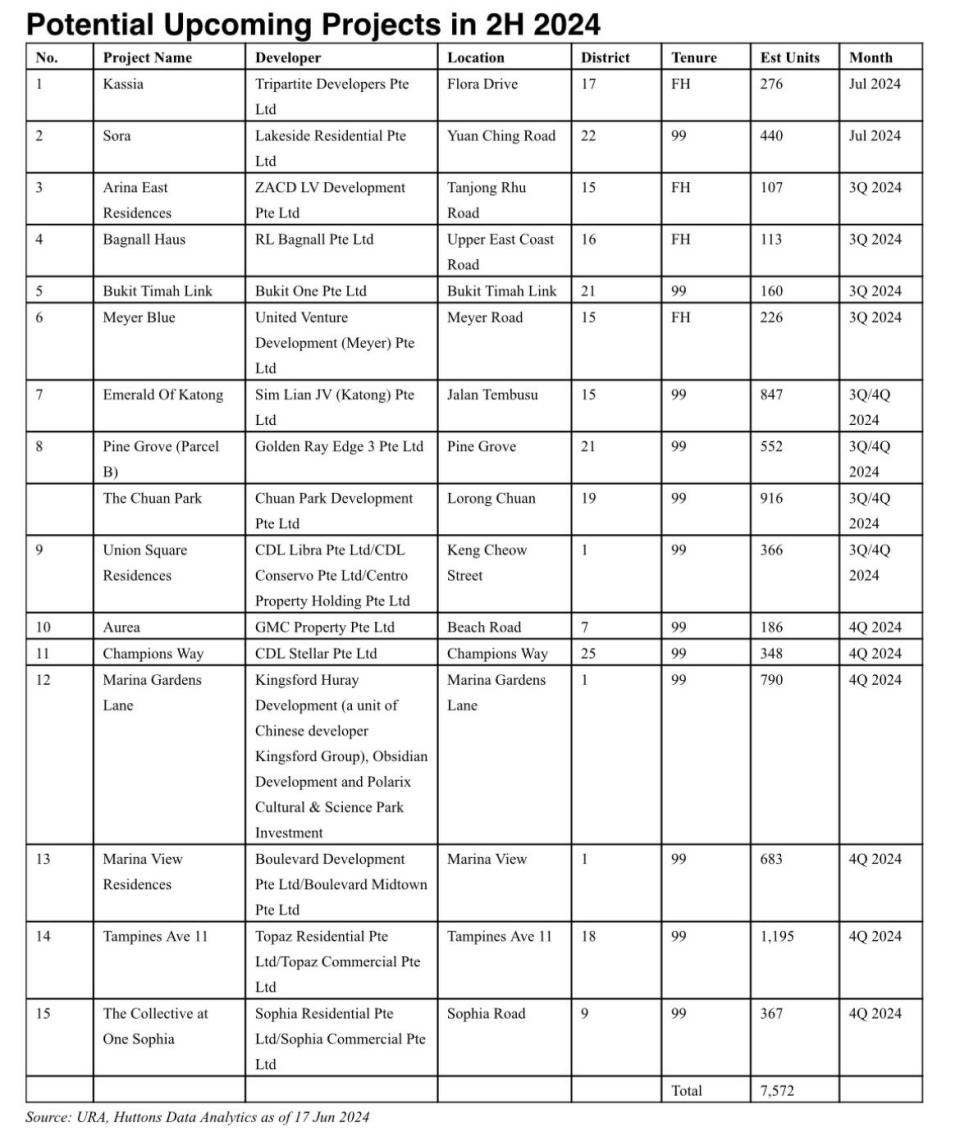

Table: Huttons Asia

Next month will see the launch of anticipated projects – the 440-unit Sora along Yuan Ching Road in Jurong East, the freehold 276-unit Kassia in Flora Drive in the East, the 916-unit The Chuan Park in Lorong Chuan, and the 348-unit Norwood Grand in Champions Way, Woodlands.

“Buyers can look forward to more market activity in the upcoming months because of the prospective launch of several high-profile projects,” says Sun. She adds: “The majority of these developments are situated in the suburban or city fringe areas, making them attractive to HDB upgraders and local investors”.

Given the current “tepid” take-up rate observed in the market over the first five months of this year, Knight Franks is revising its projected sales volume downward, says Tay.

“It is quite likely that the number of new sales might come in under 7,000 units. Sales volume is likely to remain subdued until such time as interest rates are cut, or perhaps if the government were to ease some of the cooling measures,” he says.

Likewise, CBRE is also revising its new home sales forecast to 5,500–6,500 units from 7,000–8,000 units. “With the expectation of a delay in interest rate cuts amid protracted economic uncertainty, the timeline for a recovery in new developer sales is likely to be pushed to 2025,” says Song.

Check out the latest listings for Lentor Hills Residences properties

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

GuocoLand’s ‘master developer’ aspirations in Lentor Hills estate

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance