Is CrowdStrike (CRWD) Stock Worth Buying Ahead of Q1 Earnings?

CrowdStrike Holdings, Inc. CRWD is scheduled to release first-quarter fiscal 2025 results on Jun 4.

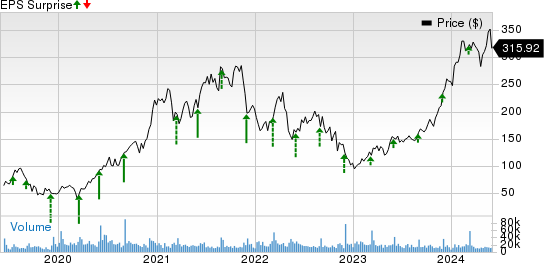

The company has consistently demonstrated impressive financial performance, underpinned by its subscription-based revenue model. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 18.2%.

For the first quarter, CrowdStrike projects total revenues between $902.2 million and $905.8 million. The Zacks Consensus Estimate for revenues is pegged at $904.8 million, which indicates growth of 30.7% from the year-ago quarter's level.

CrowdStrike anticipates non-GAAP earnings between 89 cents and 90 cents per share. The consensus mark for the bottom line has remained unchanged at 89 cents over the past 60 days and indicates a 56.1% year-over-year growth.

CRWD has witnessed a remarkable run with share price soaring 23.7% year to date (YTD) outperforming the Zacks Internet – Software industry’s growth of 10.6%.

As CrowdStrike approaches its first-quarter earnings announcement, let’s see if it is the right time to invest in this stock.

CrowdStrike Price and EPS Surprise

CrowdStrike price-eps-surprise | CrowdStrike Quote

Portfolio Strength Helps Add Users

CrowdStrike is a leader in the endpoint security market, known for its Falcon platform that leverages artificial intelligence and machine learning to detect and prevent threats in real-time. The company’s continuous innovation, including advancements in extended detection and response capabilities, positions it ahead of competitors.

As cybersecurity threats become more sophisticated, CrowdStrike’s ability to adapt and evolve its technology provides a significant competitive advantage. Earlier this month, CRWD announced that it has upgraded the Falcon Next-Gen Security Incident and Event Management (SIEM) solution, which gives it an edge over traditional SIEM products.

CrowdStrike’s portfolio strength, mainly in the Falcon platform’s 10 cloud modules, boosts its competitive edge and helps add users. In the last reported results for fourth-quarter fiscal 2024, the company closed more than 250, 490 and 1,900 deals, valued in excess of $1 million, $500,000 and $100,000, respectively. In fiscal 2024, the company added more than 6,000 subscription customers, reaching total customer count to 29,000.

Rising demand for cyber security, owing to the slew of data breaches, is a positive for CrowdStrike. Enterprises face continued sophisticated cyber threats, making cyber security a mission-critical, high-profile requirement. CrowdStrike’s rich experience in the security space and continued delivery of mission-critical solutions should help it maintain and grow its market share.

Going by a Fortune Business Insights report, the worldwide cybersecurity market is projected to grow from $172.32 billion in 2023 to $424.97 billion in 2030, indicating a CAGR of 13.8% during 2023-2030. This projection reflects strong growth opportunity for for CrowdStrike, which has a diversified product portfolio for large and mid-sized organizations to protect their sensitive data.

Acquisitions, Partnerships Aid Prospects

CrowdStrike’s acquisitions and partnerships play a crucial role in its growth strategy. In March this year, it agreed to acquire Flow Security, the industry's first and only cloud data runtime security solution.

With Flow Security’s acquisition, CrowdStrike aims to enhance its cloud security offerings by providing comprehensive, real-time data protection. This acquisition should allow CrowdStrike to offer a unique platform that secures data both at rest and in motion, covering all aspects of endpoint and cloud environments.

CrowdStrike’s other notable acquisitions over the past couple of years include Bionic, Reposify and SecureCircle. These acquisitions have not only strengthened its data-protection capabilities but also expanded its customer base.

CrowdStrike's strategic partnerships with Amazon’s AMZN cloud division Amazon Web Services (AWS), Alphabet’s GOOGL Google Cloud, and Cloudflare NET have significantly bolstered its growth prospects. The collaboration with Amazon’s AWS allows for seamless deployment of CrowdStrike’s Falcon platform, offering advanced threat detection and response capabilities.

The partnership with Alphabet’s Google Cloud further strengthens CRWD’s reach and effectiveness. Earlier in May 2024, the two companies expanded their partnership to power Mandiant’s Incident Response and Managed Detection and Response services, leveraging the CrowdStrike Falcon and the Google Cloud Security Operations platforms.

Collaboration with Cloudflare brings additional benefits by combining CRWD’s endpoint protection with Cloudflare's network security solutions. This synergy enhances overall cybersecurity measures, providing comprehensive protection against a wide range of cyber threats.

These partnerships enable CrowdStrike to deliver integrated, high-performance security solutions, driving customer adoption and reinforcing its position as a leader in the cybersecurity industry.

Final Thoughts

CrowdStrike’s strong financial performance, robust demand environment, product expansion, growing customer base, and growth initiatives, including acquisitions and partnerships, make it a compelling investment option ahead of its first-quarter fiscal 2025 earnings report. While the cybersecurity landscape is competitive and not without risks, CrowdStrike’s market leadership and continuous innovation position it well for sustained growth.

CrowdStrike carries a Zacks Rank #2 (Buy) and has a Growth Score of A at present. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or 2 and a Growth Score of A or B offer solid investment opportunities. You can see the complete list of today's Zacks #1 Rank stocks here.

Therefore, considering its impressive growth profile and attractive Zacks Style Score, we believe that it is the right time to invest in this stock.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance