Chifeng Jilong Gold MiningLtd Leads Trio Of High Insider Ownership Growth Stocks On Chinese Exchange

Amid a backdrop of mixed economic signals from China, where industrial production and fixed asset investment show signs of slowing even as retail sales gain momentum, investors are closely scrutinizing market dynamics. In such an environment, growth companies with high insider ownership like Chifeng Jilong Gold Mining Ltd can be particularly compelling, as substantial insider stakes often align management’s interests with those of shareholders, potentially enhancing corporate governance and performance resilience.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Let's uncover some gems from our specialized screener.

Chifeng Jilong Gold MiningLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a company engaged in gold and non-ferrous metal mining, with a market capitalization of approximately CN¥28.03 billion.

Operations: The company generates revenue primarily through gold and non-ferrous metal mining.

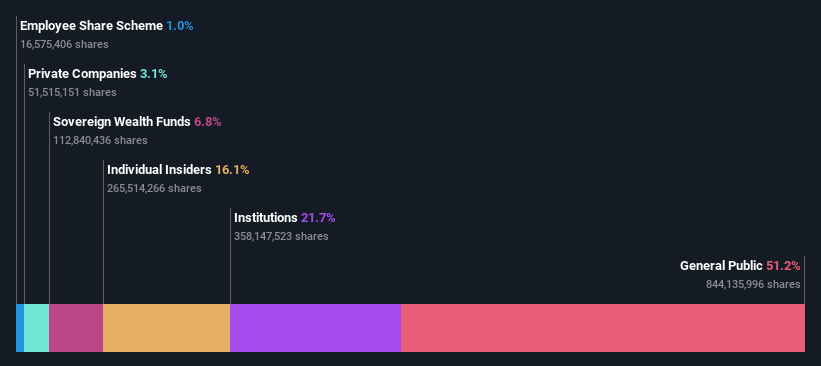

Insider Ownership: 16.1%

Earnings Growth Forecast: 25.2% p.a.

Chifeng Jilong Gold Mining Co., Ltd. has demonstrated robust financial growth with its earnings surging by 163.8% over the past year, and expectations of continued significant growth at an annual rate of 25.17%. Despite trading 57.7% below its estimated fair value, the company's forecasted revenue growth of 15.4% per year is set to outpace the broader Chinese market's 13.9%. However, its projected Return on Equity (ROE) of 18.9% in three years may be considered low compared to benchmarks in the sector.

Hangzhou Jingye Intelligent Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Jingye Intelligent Technology Co., Ltd. operates in the technology sector and has a market cap of approximately CN¥3.38 billion.

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, totaling CN¥226.72 million.

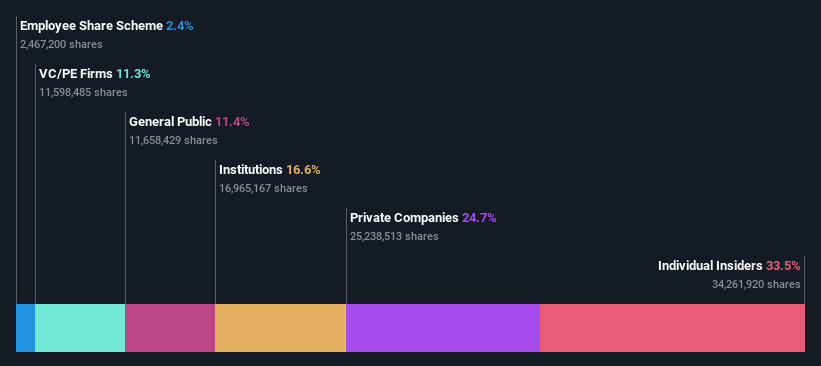

Insider Ownership: 33.5%

Earnings Growth Forecast: 57.9% p.a.

Hangzhou Jingye Intelligent Technology is poised for substantial growth, with earnings expected to increase by 57.9% annually, outpacing the Chinese market's 22.5%. However, recent financial reports indicate a downturn, with a shift from a net income of CNY 5.82 million to a net loss of CNY 11.17 million in Q1 2024. Despite high insider ownership suggesting strong confidence in management, shareholder dilution and declining profit margins highlight significant challenges ahead for the company.

Dioo Microcircuits Jiangsu

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dioo Microcircuits Co., Ltd. Jiangsu specializes in the research, development, design, and manufacture of high-performance analog chips in China, with a market capitalization of approximately CN¥4.99 billion.

Operations: The company generates its revenue primarily through the design and sale of high-performance analog chips.

Insider Ownership: 22.6%

Earnings Growth Forecast: 50.8% p.a.

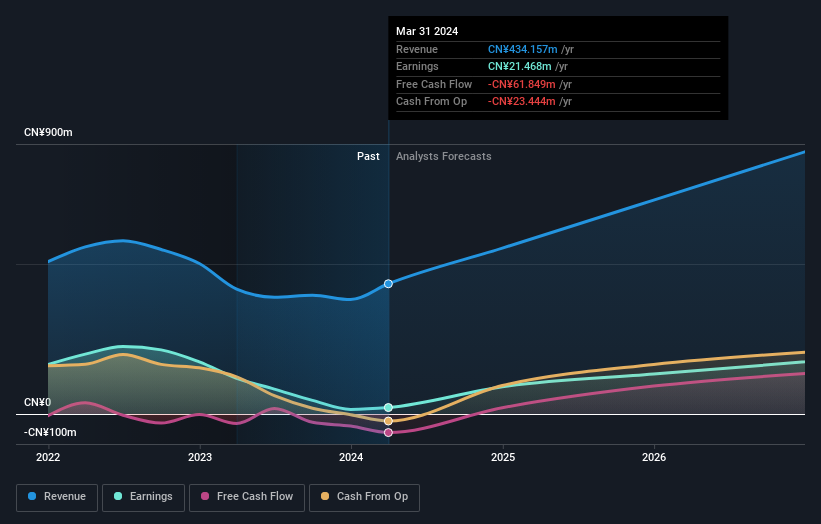

Dioo Microcircuits Jiangsu demonstrates promising growth potential with expected earnings and revenue growth outstripping the Chinese market averages at 50.8% and 24.9% per year, respectively. However, the company faces challenges such as a significant drop in net profit margin from last year and low forecasted return on equity at 4.4%. Recent financial performance shows improvement with first-quarter sales and net income rising to CNY 128.32 million and CNY 16.06 million, respectively, alongside a share buyback completion worth CNY 29.88 million, reflecting strong management confidence despite some financial inconsistencies.

Key Takeaways

Click through to start exploring the rest of the 361 Fast Growing Chinese Companies With High Insider Ownership now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:600988SHSE:688290 and SHSE:688381

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance