Bitcoin ETFs Post $900M in Net Outflows This Week

Spot bitcoin ETFs in the U.S. experienced their fifth consecutive day of outflows on Thursday, totaling over $900 million in losses for the week.

Grayscale's GBTC and Fidelity's FBTC led the outflows, while BlackRock's IBIT was the only ETF to record net inflows.

Spot bitcoin {{BTC}} exchange-traded funds (ETFs) listed in the U.S. recorded their fifth-straight day of outflows on Thursday, losing over $900 million so far this week.

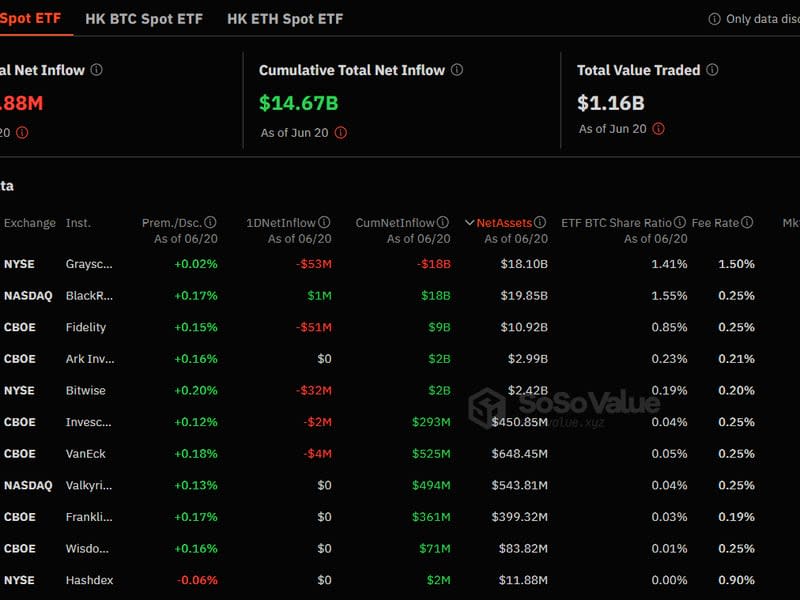

Data tracked by SoSoValue shows that the 11 listed ETFs lost $140 million on Thursday, with $1.1 billion in trading volumes. Grayscale’s GBTC – which has mostly seen outflows since its conversion to an ETF in January – led outflows at $53 million followed by Fidelity’s FBTC at $51 million.

BlackRock’s IBIT, the biggest ETF by assets held, was the only product that recorded net inflows at $1 million. Other products saw zero net inflow or outflow activity.

Such outflow activity is the worst since late April, which saw $1.2 billion in total net outflows in trading sessions from April 24 to May 2. Inflows since picked up and saw the products add more than $4 billion in the next 19 days of trading – before the ongoing outflow deluge started on June 10.

BTC prices have generally suffered in the past few weeks amid $1 billion in sales from large holders, dollar strength and a strong U.S. technology index market.

Yahoo Finance

Yahoo Finance