Bharat Petroleum Leads Three Key Dividend Stocks

The Indian stock market has experienced a period of stability over the past week, maintaining its position after an impressive 44% growth over the past year, with earnings expected to grow by 16% annually. In this dynamic environment, dividend stocks like Bharat Petroleum stand out as potentially attractive options for investors looking for both income and growth opportunities.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.23% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.02% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.26% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.75% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.18% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.64% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.35% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.79% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.44% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.34% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

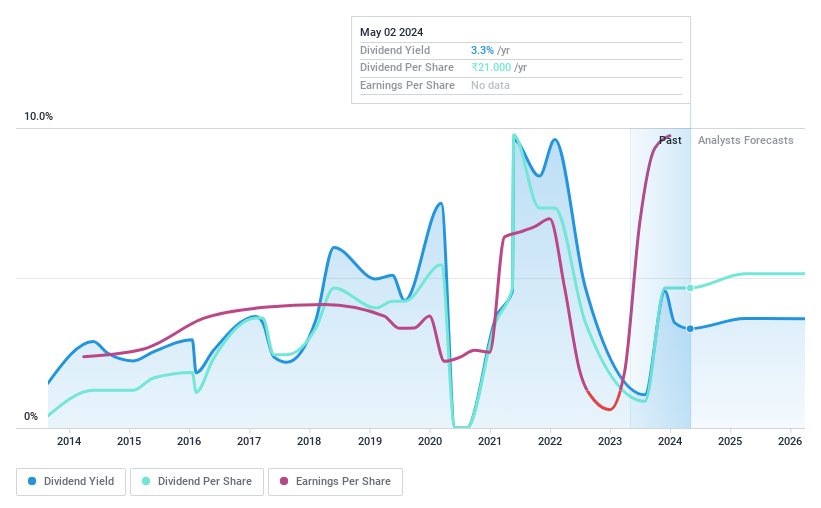

Bharat Petroleum

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited operates primarily in refining crude oil and marketing petroleum products across India, with a market capitalization of approximately ₹1.31 trillion.

Operations: Bharat Petroleum Corporation Limited generates ₹50.68 billion from its Downstream Petroleum operations and ₹1.88 billion from Exploration & Production of Hydrocarbons.

Dividend Yield: 6.9%

Bharat Petroleum Corporation Limited (BPCL) recently proposed a final dividend of INR 21 per share pre-bonus, adjusting to INR 10.5 post-bonus, pending shareholder approval. Despite its volatile dividend history over the past decade, recent financials show robust earnings growth with a significant increase by 1160.4% this past year. However, forecasts predict an average earnings decline of about 35.6% annually over the next three years. BPCL maintains a low payout ratio at 33.3%, suggesting dividends are well-covered by earnings and cash flows (Cash Payout Ratio: 34.6%), yet it carries a high level of debt which may concern dividend sustainability amidst fluctuating market conditions.

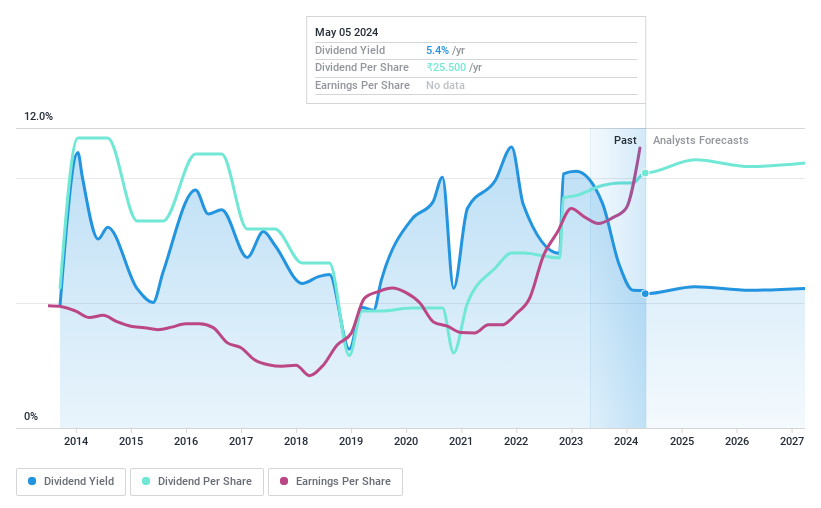

Coal India

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coal India Limited, along with its subsidiaries, engages in the production and marketing of coal and coal products across India, boasting a market capitalization of approximately ₹2.94 trillion.

Operations: Coal India Limited generates revenue primarily from coal mining and services, totaling approximately ₹130.33 billion.

Dividend Yield: 5.4%

Coal India Limited, a major player in the Indian energy sector, has recently ventured into a joint venture focusing on coal gasification, highlighting its strategic diversification. Despite a robust dividend yield of 5.35%, which places it in the top quartile of Indian dividend payers, its dividend sustainability is under scrutiny due to a high cash payout ratio exceeding 1226%. The company's dividends have shown volatility over the past decade and are not adequately covered by cash flows. However, Coal India's earnings have grown significantly by 32.8% over the past year, and it trades at an attractive price-to-earnings ratio of 7.8x compared to its peers.

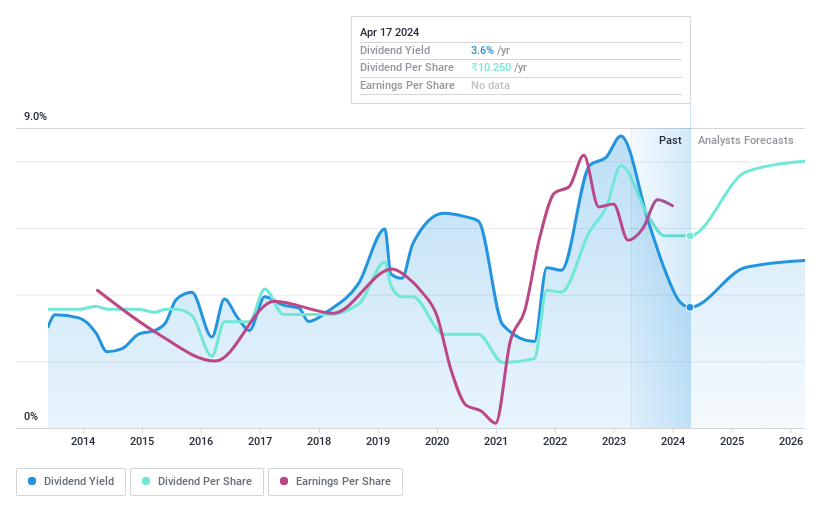

Oil and Natural Gas

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited (NSEI: ONGC) is a company that explores for, develops, and produces crude oil and natural gas both in India and internationally, with a market capitalization of approximately ₹3.26 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through refining and marketing (₹56.75 billion), onshore exploration and production (₹4.39 billion), offshore exploration and production (₹9.43 billion) in India, and international operations (₹95.53 billion).

Dividend Yield: 4.5%

Oil and Natural Gas Corporation Limited (ONGC) has a dividend yield of 4.48%, ranking in the top 25% of Indian dividend payers. Despite a low price-to-earnings ratio of 7x, dividends have shown volatility over the past decade. The company's dividends are supported by earnings with a payout ratio of 31.3% and cash flows with a cash payout ratio of 32.5%. Recent strategic moves include bidding for renewable assets to decarbonize operations, aligning with its goal to reach a renewable capacity of 10 GW by 2030.

Key Takeaways

Delve into our full catalog of 19 Top Dividend Stocks here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCLNSEI:COALINDIA and NSEI:ONGC

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance