The best hedge for a President Trump black swan

Black swans – events that are unpredictable and which have an outsized impact – are by definition unpredictable. But that doesn't mean you shouldn't still take steps to protect your portfolio against them.

Black swans aren't usually mentioned in the same breath U.S. Treasuries, which are one of the basic building blocks of modern finance. U.S. government debt is viewed as the one truly "risk-free" asset (although it actually isn't, as we wrote here). The cost of capital for almost every asset in global markets is linked to U.S. Treasuries – making them the oxygen of the global economy.

U.S. President Donald Trump, though, suggested on the campaign trail the idea of reducing government debt by getting creditors to accept less. It's unlikely that President Trump will go down this path, which would unleash a black swan to end all black swans.

(To read our free special report on how to protect your portfolio under a Trump presidency, click here.)

Applying Trump's business approach to government debt

Donald Trump, the businessman, declared bankruptcy four times. In American business, declaring bankruptcy – which often leads to paying creditors only a fraction of what is owed – is widely viewed as just another tool in capitalism's toolbox. Trump appeared to look at debt repayment as optional, and subject to negotiation. And unfortunate creditors paid the price.

So it's not surprising that Trump sent jitters through the financial world when he told CNBC during his campaign in on May 5, 2016:

"I would borrow, knowing that if the economy crashed, you could make a deal." He added, "And if the economy was good, it was good. So, therefore, you can't lose."

As Bloomberg explained, Trump was suggesting that "he might use his business skills to reduce America's debt burden by pushing creditors to accept write-downs on their government holdings."

U.S. debt default would be unprecedented

Countries have been insolvent around 800 times over the centuries. Argentina, Puerto Rico and Greece are some of the many countries currently operating under debt repayment plans that were installed after they were unable to make good on what they owed. The International Monetary Fund (IMF) recommends that if a country can't pay what it owes, that it pay back less.

But the world's economy didn't depend on those countries' debt repayments like it does on U.S. debt today. As the New York Times explained, "Such remarks by a major presidential candidate have no modern precedent. The United States government is able to borrow money at very low interest rates because Treasury securities are regarded as a safe investment, and any cracks in investor confidence have a long history of costing American taxpayers a lot of money."

The prevailing opinion is that since the U.S. government can print more money or raise taxes when needed, the chances of the American government defaulting on its loans is almost nil.

Trump later "clarified" his statement with a suggestion that was no more palatable. When asked if he was talking about renegotiating issued sovereign debt, he said,

"No, I don't want to renegotiate the bonds, but I think you can do discounting. I think depending on where interest rates are, I think you can buy back… at discounts, you can do things at discounts. I'm not even suggesting that we don't borrow money at very low rates long term so we don't have to worry about when they come due."

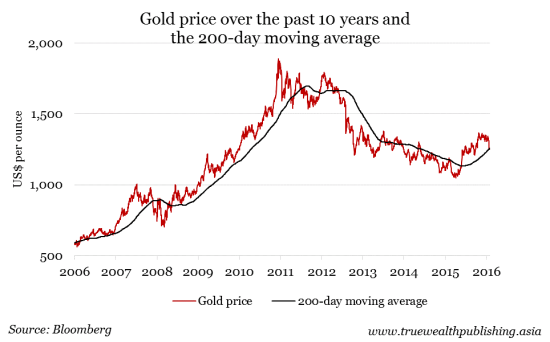

Where investors can find solace Although the U.S. making good on its debt is viewed as sacrosanct, there have been some close calls. In August 2011, partisan infighting in Congress nearly resulted in a default on government debt. During the episode, one-month Treasury bill yields climbed to a 29-month high. Thus, as U.S. government debt was viewed as riskier, investors demanded a higher yield to hold it – and prices of bonds fell. (For bonds, the yield increases when the price falls, and vice-versa.) In times of uncertainty, investors and traders have historically sold their higher-risk assets, and "fled to safety." Usually, this means U.S. Treasuries, as the only "risk-free" asset. But when Treasuries themselves are the subject of uncertainty, there's another asset that has traditionally been a safe haven: Gold. In the summer of 2011, as the political dispute that led to the standoff over government debt simmered, the price of gold soared 25 percent from early July through mid-August. In the following month, the price of gold hit its highest level since 1980.

It wasn't a coincidence that the price of gold spiked as uncertainty over the notion of risk-free became a topic of debate. As we've written before, there are plenty of reasons to own gold… and Donald Trump just happens to be another catalyst to support the argument. With President Trump, there is a greater-than-zero chance that U.S. debt is viewed as subject to a deal. If this were to happen, the price of gold would move up fast. Investors looking to gain exposure to the precious metal can easily do so with the "equity-like" SPDR Gold Trust ETF (ticker: GLD on the New York Stock Exchange; code: O87 on the Singapore stock exchange; and 2840 on the Hong Kong Stock Exchange). For other ways to invest in gold, click here to download our free special report.

Kim Iskyan

Yahoo Finance

Yahoo Finance