Basler Leads Trio Of Stocks Estimated To Be Trading Below Fair Value On German Exchange

Amidst a challenging week for European markets, characterized by political uncertainties and volatile bond yields, investors are navigating cautiously. In such an environment, identifying stocks that appear undervalued relative to their fundamentals could offer potential opportunities for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €20.24 | €31.45 | 35.6% |

SAP (XTRA:SAP) | €175.76 | €281.90 | 37.7% |

MTU Aero Engines (XTRA:MTX) | €225.00 | €399.53 | 43.7% |

Stratec (XTRA:SBS) | €47.00 | €80.11 | 41.3% |

SBF (DB:CY1K) | €2.76 | €5.25 | 47.4% |

CHAPTERS Group (XTRA:CHG) | €23.80 | €44.35 | 46.3% |

GIEAG Immobilien (MUN:2GI) | €2.30 | €4.44 | 48.2% |

Redcare Pharmacy (XTRA:RDC) | €111.90 | €197.69 | 43.4% |

Your Family Entertainment (DB:RTV) | €2.40 | €4.09 | 41.3% |

Dr. Hönle (XTRA:HNL) | €19.85 | €33.18 | 40.2% |

We'll examine a selection from our screener results

Basler

Overview: Basler Aktiengesellschaft specializes in developing, manufacturing, and selling digital cameras for professional users globally, with a market capitalization of approximately €0.36 billion.

Operations: The company generates €190.30 million from its camera segment.

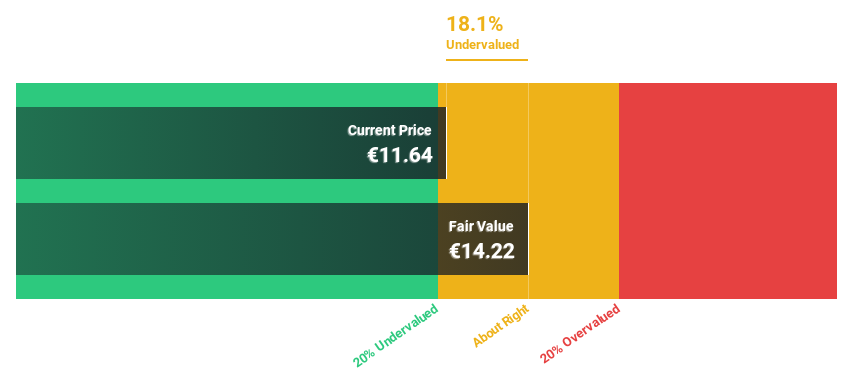

Estimated Discount To Fair Value: 18.1%

Basler, despite recent financial setbacks with a reported significant decline in year-over-year sales and shifting from net income to a net loss, shows potential underpinned by strong future growth expectations. Analysts forecast an 84.03% earnings growth per year, positioning it for profitability within three years. Currently trading at €11.64, below the estimated fair value of €14.22, Basler presents an opportunity as it is undervalued based on cash flow analysis but faces challenges in achieving high return on equity.

Our growth report here indicates Basler may be poised for an improving outlook.

Click here to discover the nuances of Basler with our detailed financial health report.

CHAPTERS Group

Overview: CHAPTERS Group AG operates in the DACH region, offering software solutions through its subsidiaries, with a market capitalization of approximately €0.43 billion.

Operations: The company generates revenue primarily from data processing, contributing €70.77 million.

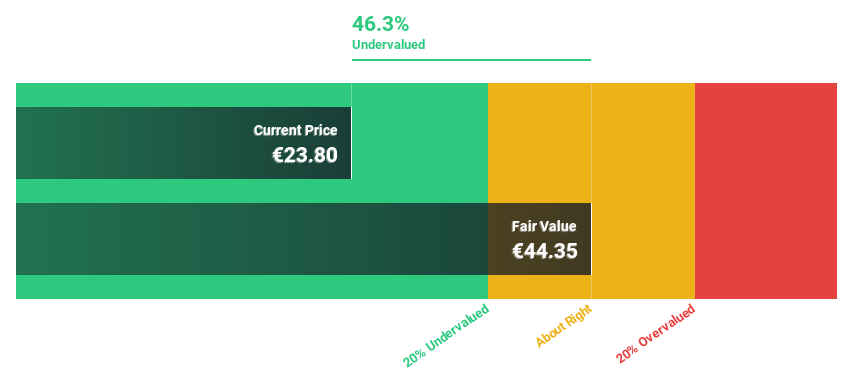

Estimated Discount To Fair Value: 46.3%

CHAPTERS Group AG, with a recent revenue jump from €42.07 million to €70.77 million, shows promising growth, outpacing the German market significantly. Despite a net loss reduction to €4.08 million from €5.89 million, profitability is expected within three years. The stock is currently undervalued by over 20%, trading at €23.8 against a fair value of €44.35, based on DCF analysis. However, shareholder dilution occurred last year and return on equity is projected to be low at 13%.

Stratec

Overview: Stratec SE operates globally, designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences, with a market cap of approximately €0.57 billion.

Operations: The company generates its revenue from designing and manufacturing solutions for diagnostics and life sciences across various global markets.

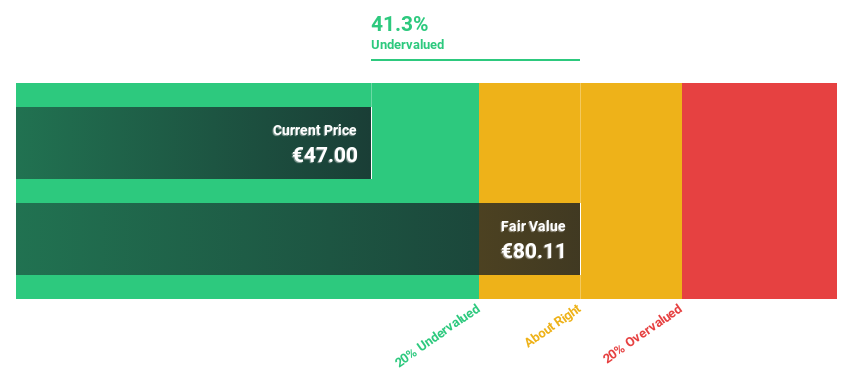

Estimated Discount To Fair Value: 41.3%

Stratec SE, despite a recent downturn in net income and sales, remains a compelling case for undervalued stocks based on cash flows. Currently trading at €47, well below the estimated fair value of €80.11, it offers significant upside potential. The company's earnings are expected to grow by 22% annually over the next three years, outpacing the German market forecast of 18.7%. However, its debt is poorly covered by operating cash flow and return on equity is projected to remain low at 11.1%.

According our earnings growth report, there's an indication that Stratec might be ready to expand.

Navigate through the intricacies of Stratec with our comprehensive financial health report here.

Where To Now?

Dive into all 31 of the Undervalued German Stocks Based On Cash Flows we have identified here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BSL XTRA:CHG and XTRA:SBS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance