BAE Systems (BAESY) Wins $64.8M Deal for Military Radios

BAE Systems plc’s BAESY business unit, BAE Systems Information and Electronic Systems Integration, recently clinched a modification contract to provide spare parts and ancillary training for a series of radios, namely AN/ARC-231, AN/ARC-231A, AN/ARC-164A, MXF-4058, MXF-4059, MXF-4027, MXF-4027 and MXF-4032. Valued at $64.8 million, the contract is projected to be completed by Aug 31, 2028.

The deal has been awarded by the Army Contracting Command, Aberdeen Proving Ground, MD. Work locations will be determined with each order.

What’s Favoring BAE Systems?

Nations are boosting their defense budget considerably. Modernizing and upgrading military radio communication systems constitute a substantial part of defense budgets, leading to the increased procurement of advanced radio systems.

Per the reports from the Markets and Markets research firm, the global military communication market is projected to witness a CAGR of 7.9% during the 2023-2028 period. This stands to benefit BAESY as the company excels in manufacturing a full range of high-quality radio communication systems for the military.

BAE Systems’ airborne radios have evolved into a Software Communications Architecture /Software-Defined radio design. This provides design reserve capacity for the software-only deployment of future operational, mission and end user-focused capabilities.

Backed by such expertise in manufacturing combat radios, the company witnesses multiple order inflows involving the same, like the latest one. This is likely to boost its overall revenue performance.

Peers in Focus

The expanding size of the ammunition market may provide meaningful gains for other defense majors in the industry:

Lockheed Martin’s LMT Universal Communications System business platform (“UCP”) allows the integration of all types of fixed and mobile radio and data-related systems, transforming any radio system into a fully IP-based network. The UCP is vendor and equipment-agnostic and can be used with any existing radio and system.

Lockheed Martin’s long-term earnings growth rate is pegged at 6.5%. The Zacks Consensus Estimate for LMT’s 2023 sales indicates an improvement of 0.8% from the prior-year reported figure.

L3Harris Technologies’ LHX product range includes tactical SATCOM terminals, RO Tactical Radio and the RO-Mobile Awareness program, which offers rapid, global push-to-talk and visual Situational Awareness capabilities for users at remote locations.

L3Harris Technologies’ long-term earnings growth rate is pegged at 2.9%. The Zacks Consensus Estimate for LHX’s 2023 sales calls for growth of 8.9% from the prior-year reported figure.

Northrop Grumman’s NOC Battlefield Airborne Communications Node (“BACN”), combined with Global Hawk, provides warfighters with the essential information to pursue and defeat the enemy. BACN's Airborne Executive Processor enables a persistent gateway in the sky that receives, bridges and distributes communication among all participants in a battle.

Northrop Grumman has a long-term earnings growth rate of 4.1%. The Zacks Consensus Estimate for NOC’s 2023 sales implies a growth rate of 5.6% from the prior-year reported figure.

Price Movement

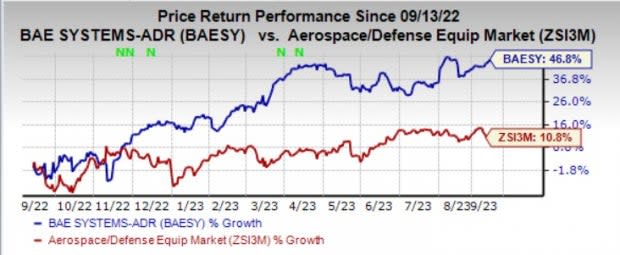

In the past year, shares of BAE Systems have rallied 46.8% compared with the industry’s growth of 10.8%.

Image Source: Zacks Investment Research

Zacks Rank

BAE Systems currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance