ASX Growth Leaders With High Insider Ownership In June 2024

Recent reports indicate a challenging environment in the Australian market, with inflation unexpectedly climbing to 4%, leading to widespread downturns across most sectors. Amidst these turbulent conditions, companies with high insider ownership may offer a measure of stability and alignment of interests between shareholders and management. In times like these, firms where insiders hold a significant stake could be perceived as having leadership deeply invested in the company's success, potentially providing some resilience against market volatility.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.6% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 62.8% |

DUG Technology (ASX:DUG) | 28.1% | 43.2% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Here's a peek at a few of the choices from the screener.

Botanix Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★★

Overview: Botanix Pharmaceuticals Limited is an Australian company focused on the research and development of dermatology and antimicrobial products, with a market capitalization of approximately A$574.93 million.

Operations: The company generates revenue primarily from its research and development activities in dermatology and antimicrobial products, totaling approximately A$0.44 million.

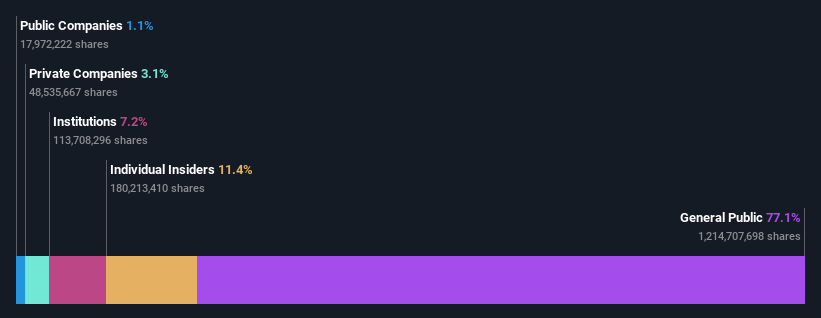

Insider Ownership: 11.4%

Botanix Pharmaceuticals, with less than A$1m in revenue, is on a rapid growth trajectory with earnings forecast to increase by 120.89% annually. Despite recent shareholder dilution and a short cash runway, insider ownership remains high, underscoring commitment as the company nears its commercial launch of SofdraÔ. Expected to turn profitable within three years, Botanix's projected revenue growth rate at 120.4% per year significantly outpaces the Australian market average.

Capricorn Metals

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties, with a market capitalization of approximately A$1.85 billion.

Operations: The company generates revenue primarily from its Karlawinda segment, totaling approximately A$356.94 million.

Insider Ownership: 12.3%

Capricorn Metals, despite not leading in the category of growth companies with high insider ownership in Australia, shows promising financial prospects. The company's earnings are expected to grow by 26.49% annually, outpacing the Australian market forecast of 13.7%. However, recent performance reveals a decline in profit margins from 25.4% to 5.2%. Insider activity has been mixed with more buying than selling over the past three months, indicating some level of confidence among insiders despite one-off items affecting quality earnings.

Temple & Webster Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products across Australia, with a market capitalization of approximately A$1.21 billion.

Operations: The company generates its revenue primarily through the online sales of furniture, homewares, and home improvement items, totaling approximately A$442.25 million.

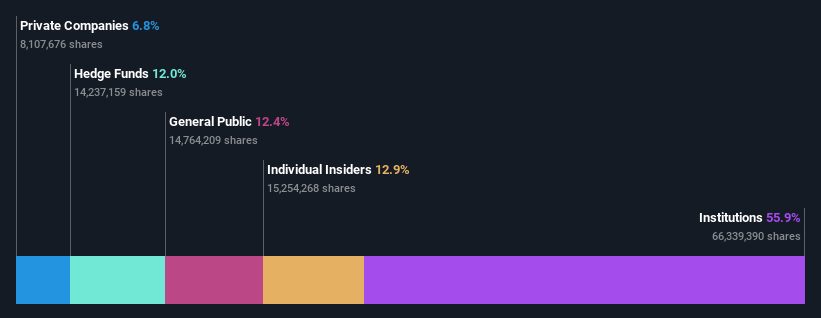

Insider Ownership: 12.9%

Temple & Webster's revenue and earnings are poised for robust growth, with forecasts indicating a 20.9% and 35.1% annual increase respectively, significantly outpacing the Australian market averages of 5.4% and 13.7%. Despite this promising outlook, the company's return on equity is expected to remain low at 19%. Recent strategic moves include a share buyback program aimed at capital management, planning to repurchase shares worth A$30 million by May 2025, enhancing shareholder value but also reflecting cautious insider trading activity over the last three months.

Make It Happen

Dive into all 90 of the Fast Growing ASX Companies With High Insider Ownership we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BOTASX:CMM and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance