AstraZeneca's (AZN) Truqap Misses Endpoints in TNBC Study

AstraZeneca AZN announced that a phase III study evaluating its newly approved breast cancer drug, Truqap (capivasertib), for treating advanced or metastatic triple-negative breast cancer (TNBC), has failed to meet its dual primary endpoints.

The CAPItello-290 study investigated the safety and efficacy of Truqap in combination with paclitaxel (chemotherapy) versus placebo in combination with paclitaxel for the first-line treatment of patients with locally advanced (inoperable) or metastatic TNBC.

In the study, the combination of Truqap plus paclitaxel did not meet the dual primary endpoints of improvement in overall survival compared with placebo in combination with paclitaxel, both in the overall study population as well as in a subgroup of patients whose tumors harbor a specific biomarker alteration (PIK3CA, AKT1 or PTEN).

Truqap, in combination with Faslodex (fulvestrant), was approved for HR-positive, HER2-negative locally advanced or metastatic breast cancer in the United States, based on data from the CAPItello-291 phase III study in November 2023.

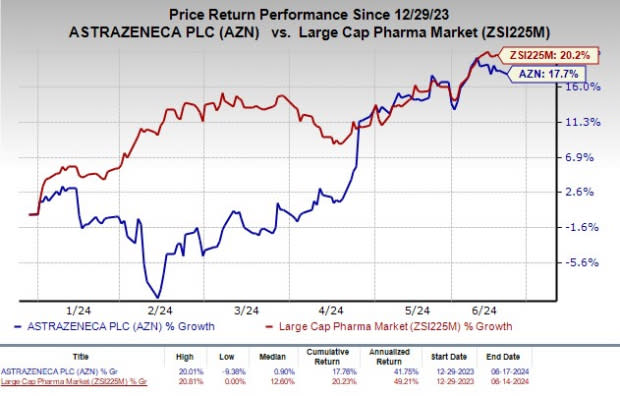

Shares of AstraZeneca have risen 17.7% so far this year compared with the industry’s rally of 20.2%.

Image Source: Zacks Investment Research

In April 2024, the Committee for Medicinal Products for Human Use of the European Medicines Agency rendered a positive opinion, recommending the approval of Truqap in combination with Faslodex, for treating advanced ER-positive breast cancer.

Truqap is also being evaluated in various other late-stage studies for treating breast cancer and in combination with other therapies for treating prostate cancer.

Truqap generated sales of $50 million in the first quarter of 2024 and $6 million in the fourth quarter of 2023.

AstraZeneca is working on strengthening its oncology product portfolio through label expansions of existing products and progressing oncology pipeline candidates. Oncology sales now comprise around 40% of AstraZeneca's total revenues and rose 21% in 2023.

Zacks Rank & Stocks to Consider

AstraZeneca currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Aligos Therapeutics, Inc. ALGS and RAPT Therapeutics, Inc. RAPT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.42 to $2.47. Loss per share estimates for 2025 have narrowed from $3.36 to $2.55. Year to date, shares of ACRV have surged 39.8%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, shares of ALGS have declined 29%.

Aligos Therapeutics’ earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for RAPT Therapeutics’ 2024 loss per share have narrowed from $3.19 to $2.93. Loss per share estimates for 2025 have narrowed from $2.40 to $2.05. Year to date, shares of RAPT have plunged 86.7%.

RAPT’s earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average surprise being 3.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Rapt Therapeutics (RAPT) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance