Alfen And Two Other Euronext Amsterdam Stocks That May Offer Value Opportunities

Amidst a backdrop of political uncertainties and fluctuating market conditions across Europe, the Dutch stock market presents an interesting landscape for investors seeking value. In this context, identifying undervalued stocks such as Alfen becomes crucial, offering potential opportunities in a market that demands careful analysis and prudent selection.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

Name | Current Price | Fair Value (Est) | Discount (Est) |

Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

PostNL (ENXTAM:PNL) | €1.382 | €2.68 | 48.5% |

Arcadis (ENXTAM:ARCAD) | €60.55 | €114.94 | 47.3% |

Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

InPost (ENXTAM:INPST) | €17.00 | €31.15 | 45.4% |

Ctac (ENXTAM:CTAC) | €3.14 | €3.83 | 18.1% |

Alfen (ENXTAM:ALFEN) | €33.82 | €40.19 | 15.8% |

Let's explore several standout options from the results in the screener

Alfen

Overview: Alfen N.V. specializes in smart grids, energy storage systems, and electric vehicle charging equipment, with a market capitalization of approximately €0.73 billion.

Operations: The company generates revenue from three primary segments: Smart Grid Solutions (€188.38 million), Electric Vehicle Charging Equipment (€153.12 million), and Energy Storage Systems (€162.98 million).

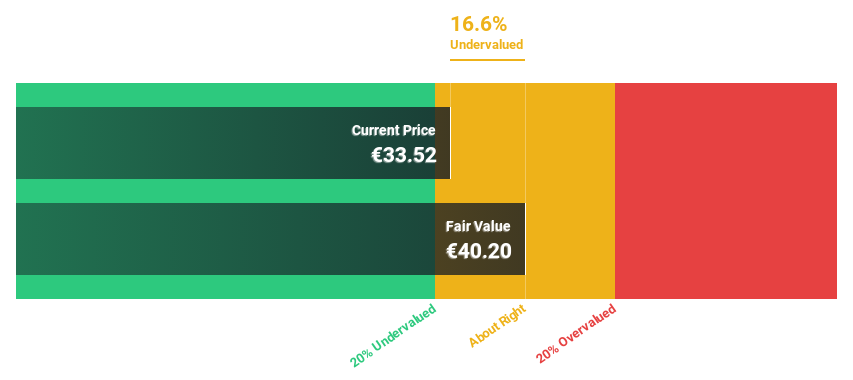

Estimated Discount To Fair Value: 15.8%

Alfen, priced at €33.82, is perceived as undervalued with a fair value estimate of €40.19, reflecting a 15.8% potential upside. Despite a lower profit margin this year at 5.9% compared to last year's 12.1%, its revenue and earnings growth are promising, forecasted at 15.5% and 20.13% per year respectively—both outpacing the Dutch market averages of 9.5% and 16.5%. However, investors should note the stock's high volatility over recent months and significant non-cash earnings contributing to its financials.

Arcadis

Overview: Arcadis NV is a global company providing design, engineering, and consultancy services for natural and built assets, with a market capitalization of approximately €5.45 billion.

Operations: The company generates revenue through its segments in Places (€1.94 billion), Mobility (€0.98 billion), and Resilience (€1.96 billion), with additional contributions from Intelligence (€0.12 billion).

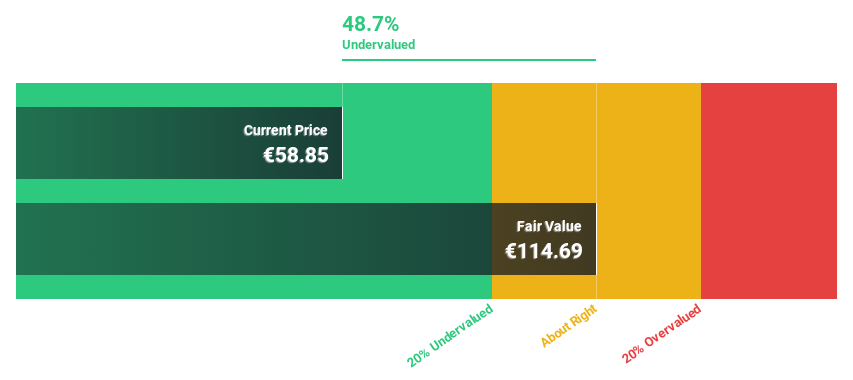

Estimated Discount To Fair Value: 47.3%

Arcadis, trading at €60.55, is significantly undervalued based on a discounted cash flow analysis with an estimated fair value of €114.94. Despite its high level of debt and slower revenue growth forecast at 1.6% annually compared to the Dutch market's 9.5%, Arcadis is poised for robust earnings growth, expected at 20.72% per year. Recent developments include securing a major contract for digital asset management in Henderson, enhancing its North American and public sector portfolio, alongside an increased dividend of €0.85 per share reflecting strong operational income from 2023.

InPost

Overview: InPost S.A., along with its subsidiaries, functions as an out-of-home e-commerce enablement platform offering parcel locker services across Europe, with a market capitalization of approximately €8.50 billion.

Operations: The company generates revenue primarily through its Segment Adjustment and International - Mondial Relay segments, totaling approximately PLN 9.27 billion.

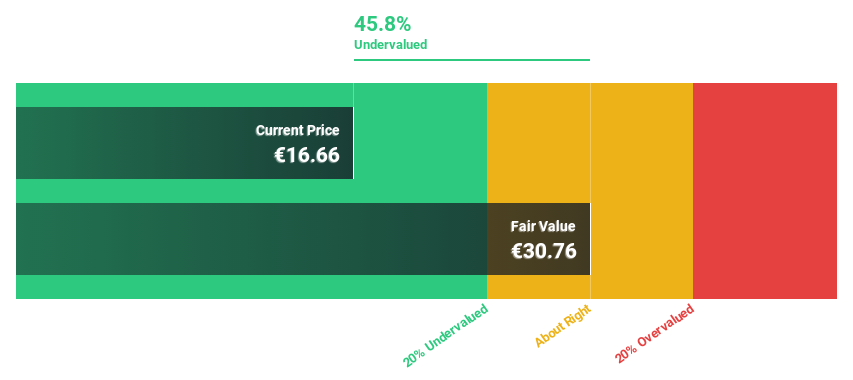

Estimated Discount To Fair Value: 45.4%

InPost, priced at €17, is considerably undervalued with a fair value estimate of €31.15 based on discounted cash flow analysis. Despite its high debt, the company's earnings are set to grow by 27.9% annually over the next three years, outpacing the Dutch market's 16.5%. Recent financials show a strong uptrend with Q1 sales rising to PLN 2.42 billion and net income doubling to PLN 254.8 million year-over-year, indicating robust operational performance and potential for sustained growth.

According our earnings growth report, there's an indication that InPost might be ready to expand.

Dive into the specifics of InPost here with our thorough financial health report.

Where To Now?

Unlock our comprehensive list of 7 Undervalued Euronext Amsterdam Stocks Based On Cash Flows by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ALFENENXTAM:ARCAD and ENXTAM:INPST

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance