Accumulate Bitcoin From a Long-Term Perspective: 5 Picks

The cryptocurrency market suffered a severe blow in April after a strong rally in the previous 15 months. The largest cryptocurrency — Bitcoin (BTC) — has been witnessing seesaw trading in the last couple of months. On Mar 14, Bitcoin recorded an all-time high of 73,750.07. However, it has fallen nearly 17% thereafter. Bitcoin gained more than 67% in first-quarter 2024 after jumping 157% in 2023.

One of the major reasons for the decline in Bitcoin price was the halving event that took place in April. Nevertheless, with the Bitcoin halving event now concluded, there is widespread speculation that the reduction in the supply of Bitcoins will result in a scarcity-driven price increase for the digital asset in the upcoming months.

Miners who validate and record transactions receive rewards from the Bitcoin network and transaction fees. Halving reduces the block reward by half, aiming to cap Bitcoin's global circulation at 21 million. Consequently, demand for new Bitcoins increases, driving up prices.

Moreover, since the launch of the first Bitcoin ETFs on Jan 11, the asset has surged more than 50%. The ETFs represent a landmark in Bitcoin’s journey, offering both retail and institutional investors a regulated and accessible means to invest in the cryptocurrency. This development not only enhances liquidity but also contributes to price stability.

Finally, on Jun 12, in his post-FOMC meeting statement, Fed Chairman Jerome Powell indicated just one cut of 25 basis points in the Fed fund rate in 2024. This is a significant reduction from three rate cuts for 2024, as hinted in the March FOMC meeting.

Meanwhile, a single 25 basis point rate cut this year was not bad news for Wall Street. A large section of economists and financial experts have already been pricing in no rate cut this year in stock market valuations. Moreover, the latest “dot-plot” of the FOMC hinted at a full 1% rate cut across 2025. As a result, the terminal rate of the Fed fund rate currently stands at 4.1% by the end of 2025.

At this stage, investors should think from a long-term perspective. The Fed is undoubtedly approaching the end of the higher rate regime. We may witness a rate cut at the end of this year if macro-economic data remains favorable.

A low interest rate is beneficial to high growth-oriented industries such as technology, consumer discretionary and cryptocurrency. Therefore, investors should accumulate bitcoin using a buy-on-the-dip strategy. Every dip in the bitcoin price will be a good purchasing point in order to gain handsomely once the Fed’s tighter monetary control comes to an end.

Our Top Picks

We have narrowed our search to five bitcoin-oriented stocks that have strong potential for the rest of 2024. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

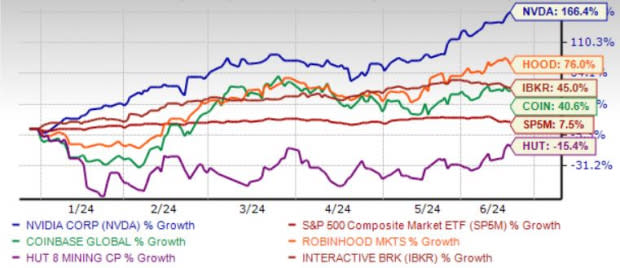

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Coinbase Global Inc. COIN provides financial infrastructure and technology for the crypto economy in the United States and internationally. COIN offers the primary financial account in the crypto space for consumers, a marketplace with a pool of liquidity for transacting in crypto assets for institutions; and technology and services that enable developers to build crypto-based applications and securely accept crypto assets as payment.

Zacks Rank #1 Coinbase Global has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

NVIDIA Corp. NVDA is a semiconductor industry giant and one of the biggest success stories of 2023. As a leading designer of graphic processing units (GPUs), the NVDA stock usually soars on a booming crypto market. This is because GPUs are pivotal to data centers, artificial intelligence, and the creation of crypto assets.

Zacks Rank #1 NVIDIA’s expected earnings growth rate for the current year is more than 100% (ending January 2025). The Zacks Consensus Estimate for its current-year earnings has improved 11.2% over the last 30 days.

Robinhood Markets Inc. HOOD operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Zacks Rank #2 Robinhood Markets has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the last 30 days.

Hut 8 Corp. HUT acquires, builds, manages, and operates data centers for digital assets mining, computing, and artificial intelligence in the United States. HUT mines Bitcoin. It merged with US Bitcoin Corp to increase its total hash rate substantially.

HUT aims to increase its total hash rate to 9.8 EH/s. HUT operates in four segments: Digital Assets Mining, Managed Services, High Performance Computing, Colocation and Cloud, and Other.

Zacks Rank #2 Hut 8 has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last seven days.

Interactive Brokers Group Inc. IBKR is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

Zacks Rank #2 Interactive Brokers Group has an expected earnings growth rate of 12.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Hut 8 Corp. (HUT) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance