ABN AMRO Bank And Two Other Euronext Amsterdam Dividend Stocks

As European markets show signs of resilience with indices like the STOXX Europe 600 Index on the rise, investors are increasingly looking for stable investment opportunities amidst fluctuating economic signals. In this context, dividend stocks such as those listed on Euronext Amsterdam can offer a compelling blend of potential income and relative security, making them attractive options in the current market environment.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.66% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.78% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.03% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 6.59% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.19% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.49% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

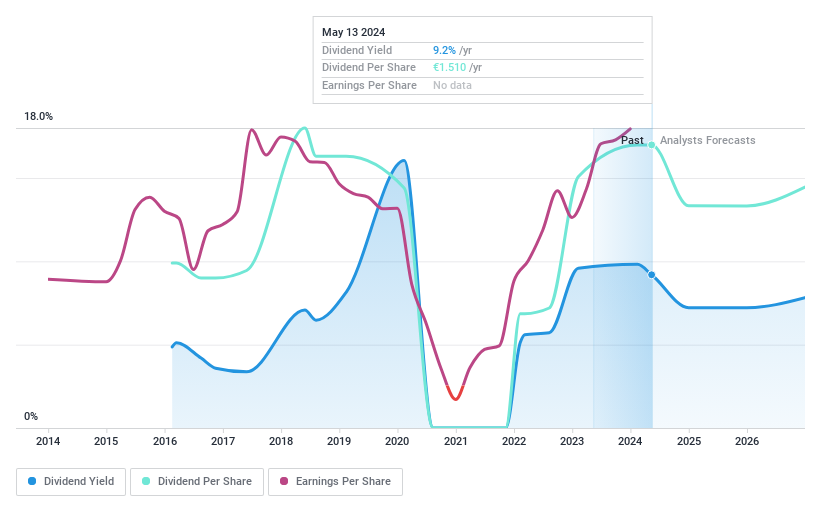

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €12.86 billion.

Operations: ABN AMRO Bank N.V. generates revenue primarily through three segments: Corporate Banking (€3.50 billion), Personal & Business Banking (€4.07 billion), and Wealth Management (€1.59 billion).

Dividend Yield: 9.8%

ABN AMRO Bank's recent strategic acquisitions, including the potential purchase of HSBC's German private bank, signify a robust expansion into wealth management, boosting assets by €26 billion. Despite this growth trajectory, ABN faces challenges with a forecasted earnings decline of 11.1% annually over the next three years and a history of volatile dividends. However, its current and projected dividend coverage remains strong with payout ratios under 50%, indicating sustainability amidst operational expansions.

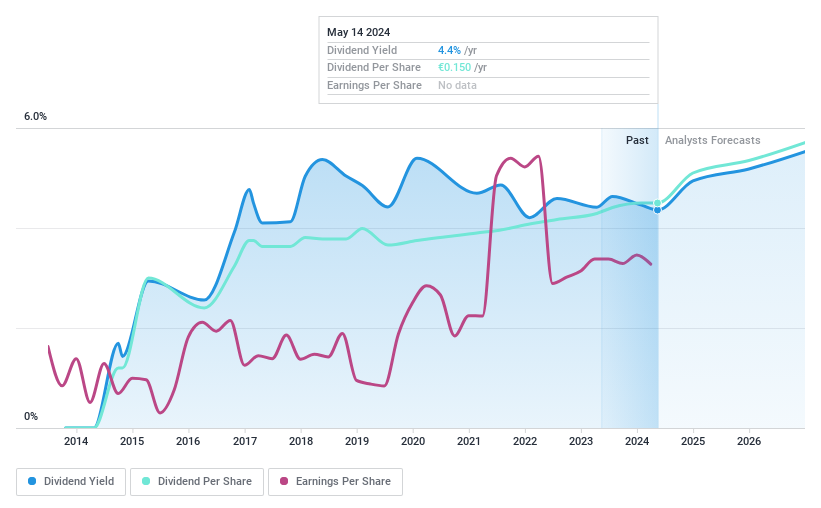

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a provider of telecommunications and information technology services in the Netherlands, with a market capitalization of approximately €14.08 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.2%

Koninklijke KPN's dividend yield at 4.19% trails behind the top Dutch payers, reflecting a modest appeal for high-yield seekers. Despite this, its dividends are well-supported by earnings and cash flows, with payout ratios at 78.4% and 59.6%, respectively, ensuring sustainability even amid financial commitments such as the recent €120 million investment in a tower venture with ABP to enhance its infrastructure assets. This strategic move aligns with KPN’s growth initiatives but also underscores the challenges of balancing expansion with shareholder returns given its substantial debt levels and past dividend volatility.

Get an in-depth perspective on Koninklijke KPN's performance by reading our dividend report here.

Our valuation report unveils the possibility Koninklijke KPN's shares may be trading at a discount.

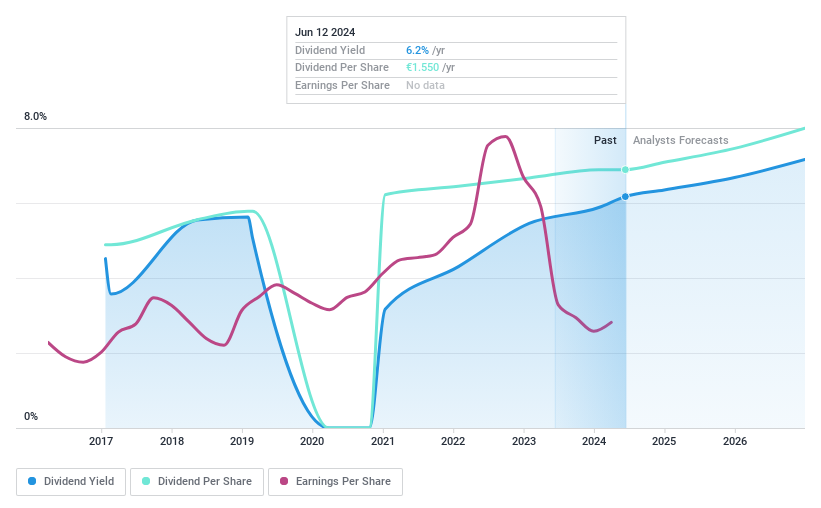

Signify

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. operates globally, offering a range of lighting products, systems, and services across Europe and the Americas, with a market capitalization of approximately €2.97 billion.

Operations: Signify N.V. generates revenue from conventional lighting products totaling €0.56 billion.

Dividend Yield: 6.6%

Signify's dividend yield stands at 6.59%, placing it among the higher echelons in the Dutch market, yet its dividend history shows instability with significant fluctuations over its 7-year payout period. Earnings are expected to grow by 16.95% annually, and both earnings (88.1% payout ratio) and cash flows (32.4% cash payout ratio) adequately cover dividends, suggesting a sustainable model if current conditions persist. However, profit margins have dipped from last year's 6.2% to 3.4%, indicating potential pressure on profitability despite recent share buybacks totaling €11 million aimed at supporting long-term incentive plans.

Next Steps

Access the full spectrum of 6 Top Euronext Amsterdam Dividend Stocks by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ABN ENXTAM:KPN and ENXTAM:LIGHT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance