5 Important Lessons From Berkshire Hathaway’s Annual General Meeting 2019

Every year, tens of thousands of investors flock to Omaha to attend Berkshire Hathaway’s Annual General Meeting (AGM). As Berkshire Hathaway (Berkshire) has started live-streaming the event in recent years, investors and non-investors alike can witness live, as Chairman and CEO Warren Buffett and his right-hand man Charlie Munger share their unscripted views on the company, the markets and the economy.

The chance to pick the minds of the Oracle of Omaha Warren Buffett is treated with sanctity by the investing community. After all, Buffett is perhaps the greatest known investor of our time. Words of Buffett are the gospel truth, period.

Despite his prestige, Buffett is also known to be generous for the timeless lessons he has provided. Not just does Buffett share his insights, he does so by explaining abstract ideas in plain simple words. Here are the five important lessons I learned watching the AGM2019 and post-AGM interviews.

On Making Mistakes

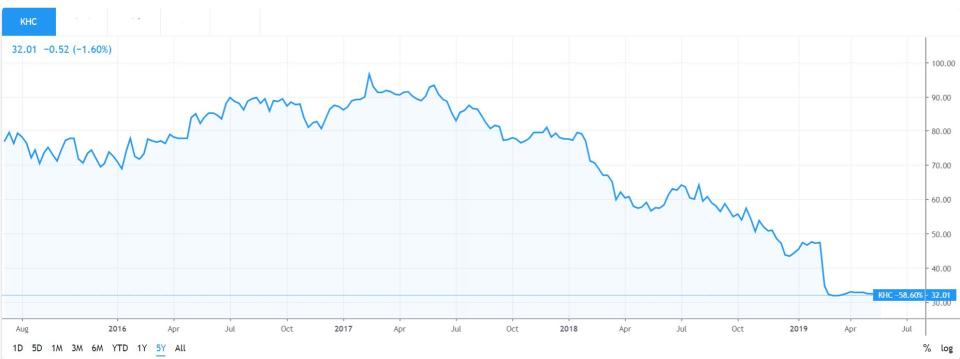

During the AGM, Buffett acknowledged that Berkshire made a mistake when it paid too much for the merger of the now-embattled Kraft Heinz. Shares of Kraft Heinz have plummeted more than 20 percent since the start of 2019 after a series of misadventures.

Kraft Heinz Woes

Source: Tradingview

In February, Kraft Heinz disclosed an SEC accounting investigation. Kraft Heinz also cut its dividend and took a US$15.4 billion writedown for its Kraft and Oscar Meyer brands. Despite the setback, Buffett maintained his loyalty to the company as he viewed that the core operations are still fundamentally strong.

Commenting on the mistake, Buffett said that “any investment can turn into a bad deal by paying too much”, but added that we cannot “turn any investment into a good deal by paying little.” In other words, Buffett knew overpaying will certainly undermine any investments, but it is still far better trying to pay a “fair” price for a quality company.

The Worst Mistake

Warren Buffett has often talked of his mistakes of omission. In fact, Buffett actually view the error as far costlier than mistakes of commission (like for Kraft Heinz). You see, Buffett thinks that investors could point to a mistake of making a bad investment and actually calculate a loss. However, when you commit a mistake of omission, there is no investment loss and you would only realise it much later in hindsight.

During the AGM, Buffett and Munger lamented that they “screwed up” for not identifying Google owner Alphabet Inc earlier. In fact, it was one of their biggest regrets as they saw how great search engine optimisation was used in Berkshire’s insurance unit GEICO. As it turned out, Google grew to be the world’s largest search engine platform as he and Buffett just “sat there to suck thumbs”.

At the end of the day, what Buffett and Munger were advocating is that good investors must be tolerant to risk, but great investors are risk taking. So always act on good information and do not regret not doing something you should have done.

See The Big Picture

As most investors should already know, Apple has become the largest stock holding in Berkshire’s portfolio in just the recent years. When asked about Berkshire’s investment in Apple and he described owning the stocks to a metaphor of owning a farm.

As Buffett explained, crops do not grow faster if you stare at it or heck, even cheer for it. Economic conditions are not within the control of businesses and some years will be bound to be better than others. What is important is that the farm is well tended to in terms of rotating crops and hopefully yields get better over the years.

The idea is to see the big picture as investors do not invest in stocks but rather in the underlying business itself. Eyeing the stock price like a hawk does not make it grow faster and losing sleep over your investments is simply not worth it. The takeaway is to buy into quality companies with great managers that care about enhancing shareholder value. Let them deliver the returns to you over the years.

Not Investing In IPOs

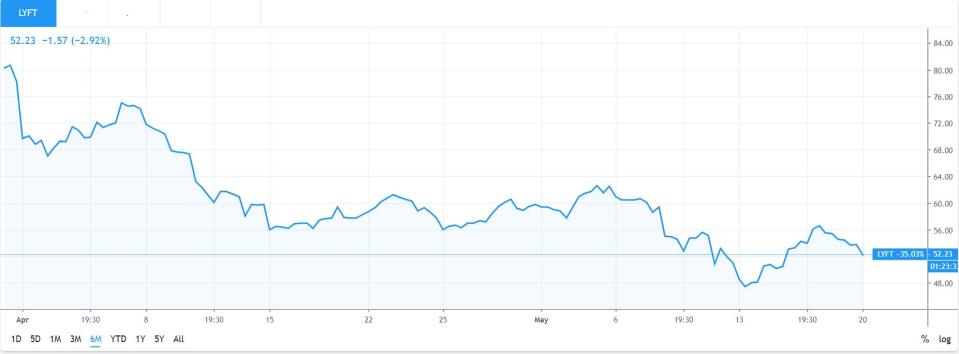

When asked about initial public offerings (IPO), Buffett has constantly advised investors to avoid IPOs, especially the hot ones. Buffett mentioned that “high-growth companies with no profits still have a lot to prove to investors.”

Despite a wave of hot IPOs the likes of Uber, Lyft, Pinterest and Beyond Meat in the US, Buffett has stayed clear from investing in any of the Silicon Valley’s “unicorns”. In fact, Buffett has never been a fan of investing in IPOs and the last he did was in the 1950s when he took part in Ford Motor’s debut. While acknowledging that his view on subject means that he stands to lose out on getting a piece of successful companies like Amazon when they are young, Buffett is skeptical of IPOs because of common sense.

Think about it, when a company debuts on the public markets, it is highly unlikely for the owners to ask for less than what he considers to be the intrinsic value. The IPO underwriters, that earn commission and fees, would also want to set a price that is at the high side of the spectrum.

Lyft: Classic post-IPO performance

Source: Tradingview

The selling incentives would contribute to overpricing issues. More importantly, both the owners and underwriters are privy to a lot more information about the company and hence it would be a silly thing to bet against the house.

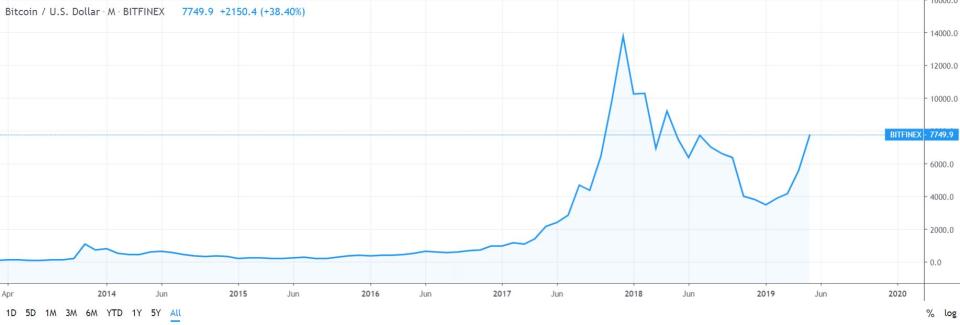

Hypes and Euphoria

As disciplined practitioners of the value investing philosophy, Buffett viewed Bitcoin as “rat poison” and “a delusion”. While acknowledging that the blockchain technology is indeed important, Buffett thinks that Bitcoin is not unique in any way in terms of its ability to work with the technology.

Will Bitcoin Recover?

Source: Tradingview

Munger, who has more openly shown his disdain for Bitcoin, went further and said that it is “immoral” to trade the cryptocurrency. Doubling down on his remark, Munger added that “the fact that it is clever computer science does not mean it should be widely used, and that respectable people should encourage other people to speculate on it”.

As Munger has explained before, society ascribes value to resources that are useful. For instance, fiat money has a utility value because they serve transactional purposes. On the other hand, the volatile fluctuations of Bitcoin’s value completely undermine the cryptocurrency’s ability to serve the purpose it promises to achieve.

So fellow investors, always question the soundness of the investment thesis. Never buy into hopes, dreams and promises. It is the easiest way to get burnt.

Yahoo Finance

Yahoo Finance