3 Key Japanese Dividend Stocks Offering Up To 3.6% Yield

Amidst a backdrop of mixed weekly performances and dovish central bank policies, Japan's stock market presents a nuanced landscape for investors. As the Bank of Japan maintains its cautious approach towards monetary normalization, certain Japanese dividend stocks emerge as noteworthy considerations for those seeking steady income streams in a fluctuating economic environment.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.84% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

AiphoneLtd (TSE:6718) | 4.28% | ★★★★★★ |

Globeride (TSE:7990) | 3.70% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.56% | ★★★★★★ |

Kuriyama Holdings (TSE:3355) | 3.62% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 4.96% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.16% | ★★★★★★ |

Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 389 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

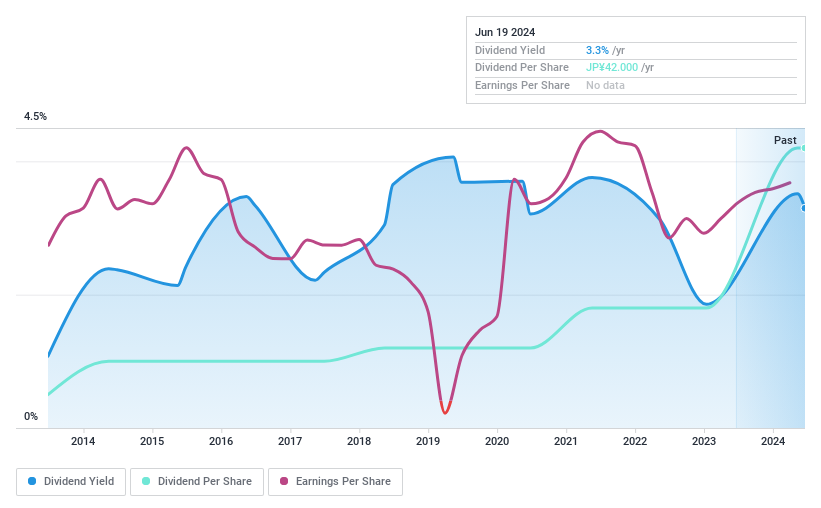

Toa Road

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toa Road Corporation, primarily involved in civil engineering within Japan, has a market capitalization of approximately ¥58.61 billion.

Operations: Toa Road Corporation generates revenue through its Construction Business, which earns ¥70.25 billion, and its Manufacturing and Sales, Environmental Business, etc., contributing ¥48.77 billion.

Dividend Yield: 3.3%

Toa Road has maintained stable and reliable dividend payments over the past decade, with a current yield of 3.3%. Although this yield is slightly below the top quartile for Japanese dividend stocks, its dividends are well-supported by both earnings and cash flows, with payout ratios of 52.5% and 28.3%, respectively. Recently, Toa Road completed a share repurchase program for ¥1.175 billion, signaling strong capital management aimed at enhancing shareholder value through improved capital efficiency and flexible financial policies.

Click here and access our complete dividend analysis report to understand the dynamics of Toa Road.

Our expertly prepared valuation report Toa Road implies its share price may be too high.

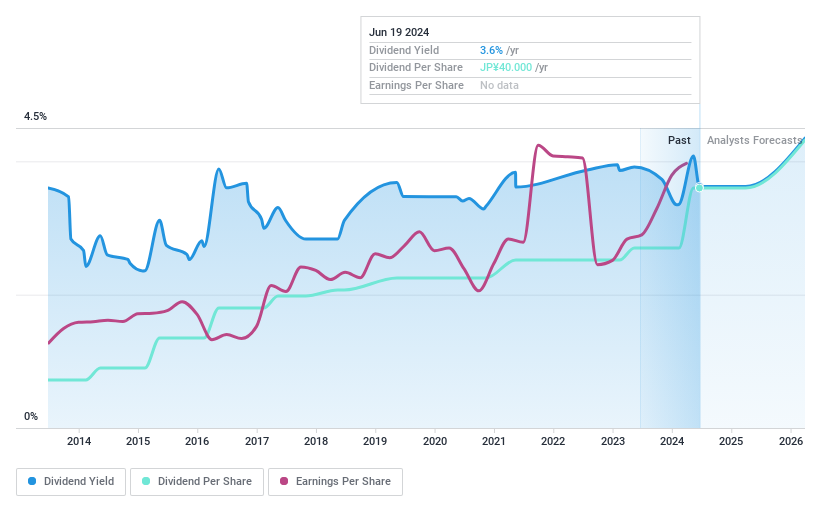

Nippon Air conditioning Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Air Conditioning Services Co., Ltd. operates in the HVAC services sector and has a market capitalization of approximately ¥37.94 billion.

Operations: Nippon Air Conditioning Services Co., Ltd. generates its revenue primarily from maintenance services and renewal construction, totaling approximately ¥58.23 billion.

Dividend Yield: 3.6%

Nippon Air Conditioning Services offers a dividend yield of 3.62%, ranking in the top 25% of Japanese dividend payers. Despite a stable decade-long history of dividends and recent growth in earnings by 40.5%, its dividends are not fully supported by cash flows, with a high cash payout ratio of 183%. Additionally, while trading at a significant discount to estimated fair value, concerns about its delisting due to inactive status could impact future reliability.

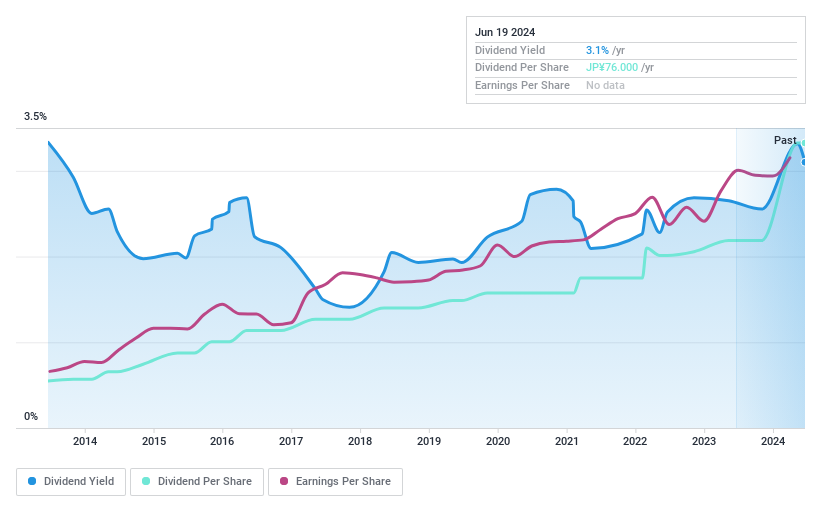

Cresco

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd. is a company based in Japan that offers information technology (IT) services and digital solutions, with a market capitalization of approximately ¥50.49 billion.

Operations: Cresco Ltd. generates revenue through its Digital Solution Business, which earned ¥3.85 billion, and its IT Service segments: Finance at ¥14.74 billion, Enterprise at ¥20.31 billion, and Manufacturing at ¥13.86 billion.

Dividend Yield: 3.1%

Cresco Ltd. maintains a modest dividend yield of 3.1%, slightly below the top quartile of Japanese dividend stocks, and shows a mixed history with unstable dividends over the past decade. While earnings have grown by 9.5% annually over five years, recent corporate actions include a 2-for-1 share split effective July 2024, potentially affecting per-share dividend figures. The company's forward-looking guidance suggests stable profitability, but dividends per share are forecasted to decrease from previous years' payouts.

Make It Happen

Click here to access our complete index of 389 Top Dividend Stocks.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:1882 TSE:4658 and TSE:4674.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance