3 High Performing Indian Dividend Stocks Yielding Up To 6.4%

The Indian market has shown robust performance recently, with a 1.7% increase in the last week and an impressive 45% climb over the past year. In this context of strong growth and positive earnings forecasts, dividend stocks can be particularly appealing for investors looking for both stability and income.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Bhansali Engineering Polymers (BSE:500052) | 4.22% | ★★★★★★ |

Castrol India (BSE:500870) | 3.95% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.82% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.19% | ★★★★★☆ |

D-Link (India) (NSEI:DLINKINDIA) | 3.15% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.29% | ★★★★★☆ |

Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.51% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.68% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.50% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.41% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bharat Petroleum

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited, operating in India, is engaged in refining crude oil and marketing petroleum products with a market capitalization of approximately ₹1.42 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue primarily through its Downstream Petroleum segment, which totaled ₹50.68 billion, and a smaller contribution from Exploration & Production of Hydrocarbons at ₹1.88 billion.

Dividend Yield: 6.4%

Bharat Petroleum Corporation Limited (BPCL) offers a dividend yield of 6.4%, ranking in the top 25% among Indian dividend payers, supported by a payout ratio of 33.3%. Despite this, BPCL's dividends have shown volatility over the past decade, and earnings are projected to decline significantly by an average of 42.6% annually over the next three years. Recently, BPCL proposed a final dividend of INR 10.5 per share, pending shareholder approval at the upcoming AGM.

Coal India

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coal India Limited, along with its subsidiaries, engages in the production and marketing of coal and coal products primarily in India, boasting a market capitalization of approximately ₹3.05 trillion.

Operations: Coal India Limited generates ₹13.03 billion from its primary segment, coal mining and services.

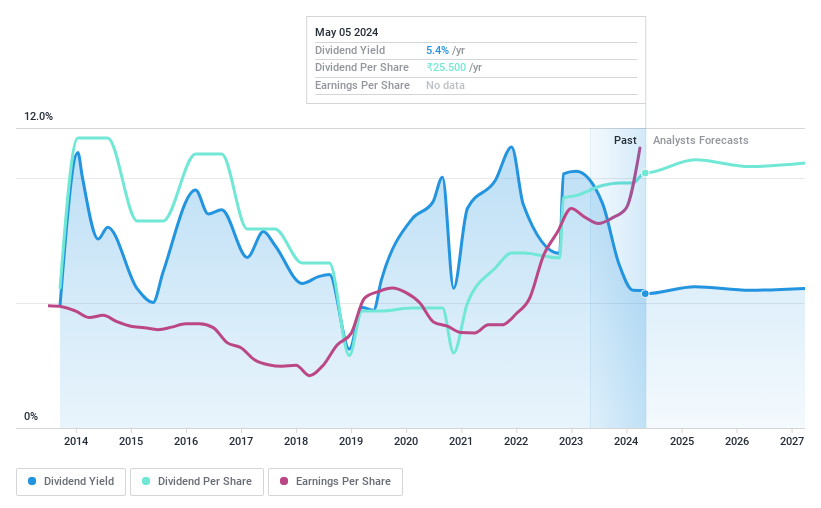

Dividend Yield: 5.2%

Coal India Limited, a significant player in the Indian energy sector, reported a robust increase in production and financial performance for FY 2024. The company's net income rose to INR 374.02 billion, with substantial growth in quarterly earnings as well. Despite this financial uptick, Coal India's dividend sustainability is under scrutiny due to a high cash payout ratio of 1226%, indicating potential stress on future dividend payments. The recent recommendation of a final dividend of INR 5 per share underscores ongoing efforts to maintain shareholder returns amidst these challenges.

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is engaged in manufacturing, marketing, and trading lubricants for the automotive and industrial sectors in India, with a market capitalization of approximately ₹48.42 billion.

Operations: Gulf Oil Lubricants India Limited generates its revenue primarily from the sale of lubricants tailored for both automotive and industrial applications.

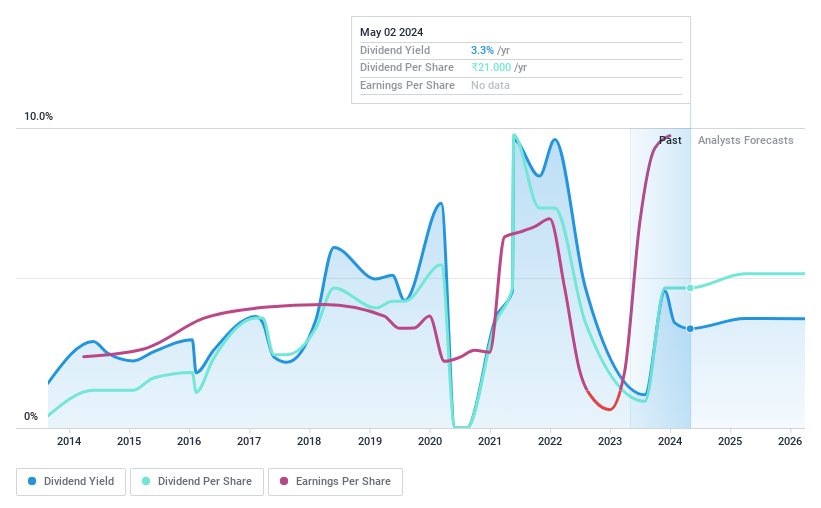

Dividend Yield: 3.3%

Gulf Oil Lubricants India, despite a volatile dividend history over the past decade, maintains a reasonable payout ratio of 71% and a cash payout ratio of 50.2%, ensuring dividends are well-covered by earnings and cash flows. The company's P/E ratio stands at 15.7x, favorable compared to the Indian market average of 31x, suggesting relative undervaluation. Recent financials show significant growth with net income rising to INR 3,079.61 million in FY2024 from INR 2,323.04 million in FY2023, supporting potential future dividend sustainability despite historical fluctuations.

Make It Happen

Click here to access our complete index of 22 Top Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCL NSEI:COALINDIANSEI:GULFOILLUB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance