3 Chemical Specialty Stocks to Escape Industry Headwinds

The Zacks Chemicals Specialty industry is facing challenges from demand softness, largely due to the sluggishness in Europe and a slow economic recovery in China. Margins of companies in this space also remain under pressure due to the still-elevated input, supply chain and logistics costs.

Industry players like PPG Industries, Inc. PPG, Celanese Corporation CE and Axalta Coating Systems Ltd. AXTA are banking on strategic measures, including operating cost reductions, to tide over a persistently challenging environment.

About the Industry

The Zacks Chemicals Specialty industry consists of manufacturers of specialty chemical products for a host of end-use markets such as textile, paper, automotive, electronics, personal care, energy, construction, food & beverages and agriculture. These chemicals (including catalysts, surfactants, specialty polymers, coating additives, pesticides and oilfield chemicals) are used based on their performance and have a specific purpose. Specialty chemicals can be single molecules or a combination of molecules referred to as formulations, and they provide a vast range of effects upon which various industries rely. Their compositions significantly influence the performance of the finished products. Specialty chemicals have applications in the manufacturing process of a vast range of products, including paints and coatings, cosmetics, petroleum products, inks and plastics.

What's Shaping the Future of the Chemical Specialty Industry?

Headwinds From Demand Slowdown: Companies in the chemical specialty space are facing headwinds from customer de-stocking and softness in building and construction and industrial end markets, especially in Europe and China, due to the economic slowdown. Elevated borrowing costs and inflation have taken a bite out of the residential construction industry. Manufacturing activities have also weakened amid softer demand for goods and higher borrowing costs. A slower recovery in economic activities in China following the lifting of restrictions is hurting demand in that country. Moreover, the ongoing geopolitical tension, high inflation and elevated interest rates have dampened demand in Europe. While customer inventory de-stocking is nearing completion, some lingering impacts of the same are expected to continue over the near term. The demand slowdown is expected to weigh on volumes of chemical specialty companies.

Cost Pressure Still a Worry: Specialty chemical makers are facing headwinds from raw material cost inflation, and supply-chain and freight transportation disruptions. The closure of a large swath of factories to stem the spread of the COVID-19 outbreak disrupted the global supply chain. The Russia-Ukraine conflict and new lockdowns in China put further pressure on the global supply chain. These affected the availability of key raw materials for the chemical specialty industry. Some companies are also facing challenges from elevated logistics and labor costs. While raw material costs have moderated somewhat lately, driven by the easing of supply-chain disruptions, they remain higher than the pre-pandemic levels. The lingering impacts of inflationary pressures are expected to continue over the short haul and weigh on the margins of chemical specialty companies.

Self-Help Actions to Aid Results: The companies in this space are executing a raft of self-help measures — including cost-cutting and productivity improvement, expansion into high-growth markets, restructuring, operational efficiency improvement, and actions to strengthen the balance sheet and boost cash flows — in a bid to stay afloat amid the prevailing headwinds. Notably, the industry participants are aggressively implementing actions to cut costs. The measures are likely to help the companies sail through the ongoing challenges.

Zacks Industry Rank Indicates Downbeat Prospects

The Zacks Chemicals Specialty industry is part of the broader Zacks Basic Materials sector. It carries a Zacks Industry Rank #171, which places it in the bottom 32% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates a bleak near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Underperforms Sector and S&P 500

The Zacks Chemicals Specialty industry has underperformed both the Zacks S&P 500 composite and the broader Zacks Basic Materials sector over the past year.

The industry has lost 10.8% over this period compared with the S&P 500’s rise of 26.1% and the broader sector’s increase of 5.5%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing chemical stocks, the industry is currently trading at 18.16X, below the S&P 500’s 19.73X and above the sector’s 11.66X.

Over the past five years, the industry has traded as high as 18.8X, as low as 7.1X, with a median of 10.59X, as the chart below shows.

Enterprise Value/EBITDA (EV/EBITDA) Ratio

Enterprise Value/EBITDA (EV/EBITDA) Ratio

3 Chemical Specialty Stocks to Keep a Close Eye on

Axalta Coating Systems: Pennsylvania-based Axalta is a global coatings company engaged in the manufacturing, marketing and distribution of coatings solutions. AXTA is benefiting from the strength in refinish and light vehicle businesses, which is offsetting the weakness in industrial markets. The acquisition of CoverFlexx Group will enhance Axalta's refinish business by incorporating the extensive range of automotive refinish and aftermarket coatings, including primers, basecoats, clearcoats and various detailing products of the former. Axalta has also strategically expanded its portfolio by acquiring Andre Koch AG, a well-established Refinish distribution partner headquartered in Switzerland. Moreover, AXTA has raised its full-year 2024 earnings and free cash flow outlook based on strong first-quarter results and strategic actions to drive earnings.

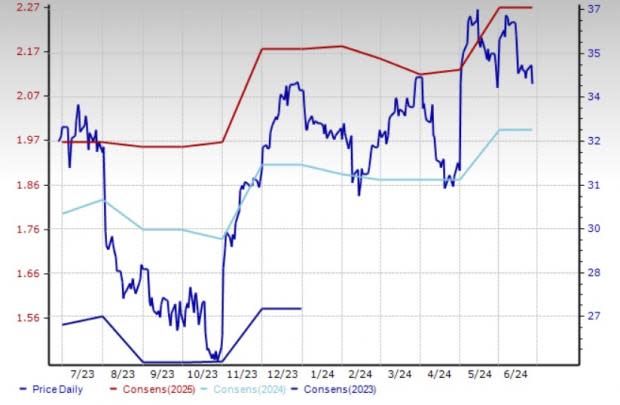

Axalta, carrying a Zacks Rank #1 (Strong Buy), has expected earnings growth of 26.8% for 2024. The Zacks Consensus Estimate for AXTA’s 2024 earnings has been revised upward by 5.9% over the last 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: AXTA

PPG Industries: Based in Pennsylvania, PPG Industries is a global supplier of paints, coatings and specialty materials. The company is benefiting from cost savings from restructuring activities, pricing actions and synergies of strategic acquisitions. It is implementing a cost-cutting and restructuring strategy and optimizing its working capital requirements. The cost savings generated by restructuring initiatives will act as a tailwind. The company is also undertaking measures to expand business inorganically through value-creating acquisitions. PPG also remains committed to maximizing shareholder returns.

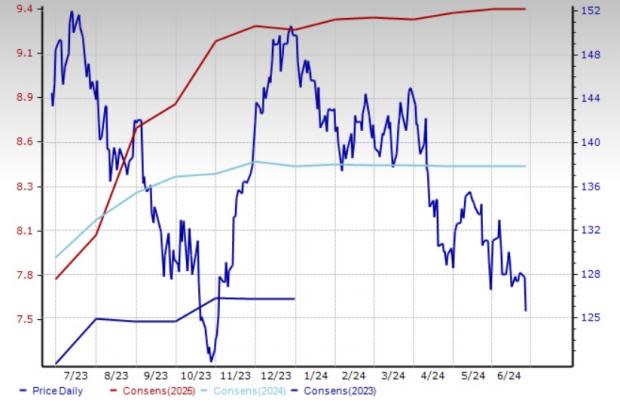

PPG Industries, carrying a Zacks Rank #3 (Hold), has an expected earnings growth rate of 10% for 2024. PPG’s earnings beat the Zacks Consensus Estimate in three of the last four quarters while matched once. In this time frame, it has delivered an earnings surprise of roughly 3.3%, on average.

Price and Consensus: PPG

Celanese: Texas-based Celanese is a leading producer of differentiated chemistry solutions and specialty materials used in most major industries and consumer applications. It is expected to benefit from its productivity measures, investments in high-return organic projects and strategic acquisitions. Celanese remains focused on executing its productivity programs, which include the implementation of a number of cost-reduction capital projects. CE also continues to actively pursue acquisitions, which are providing it with opportunities for additional growth, investment and synergies. The acquisition of the majority of DuPont’s Mobility & Materials business has allowed CE to enhance its growth in high-value applications.

Celanese, carrying a Zacks Rank #3, has expected earnings growth of 27.7% for 2024. The consensus estimate for CE’s 2024 earnings has been revised upward by 0.4% over the last 60 days.

Price and Consensus: CE

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance